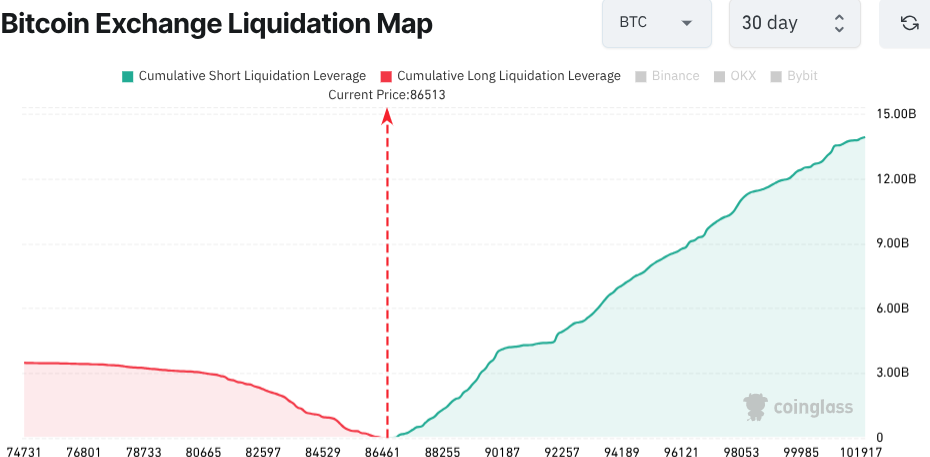

- Around $9.7 billion of cumulative shorts are on Bitcoin between $91.5k and $96k.

- A mild rally of 10% could wipe out almost $14 billion of these shorts, taking Bitcoin to $120k.

- Bitcoin is slowly recovering above $90k. It has gained 11% in the past 10 days.

- Further gain is expected on 10 Dec if the US Fed cuts rates.

Massive Short Squeeze is Building on Bitcoin’s Liquidation Charts

Bitcoin is seeing a massive short squeeze build on its charts, which could propel its price by 30% over the next 10 days.

On Bitcoin’s Exchange Liquidation Map, the charts show that between $91.5k and $96k, there are at least $14 billion worth of shorts. If any relief rally comes along in the near future, these shorts will quickly get squeezed, taking Bitcoin above $120k in no time.

A short squeeze is an event in which the price of an asset rises by double digits (e.g., 15%) in less than a day. This squeeze usually disrupts the short positions built during a bearish market. Short squeezes occur when the price of an asset falls sharply over a short period. For Bitcoin, its price fell by 40% between $126k and $82k.

The Possibility of a Rally is High

What makes the possibility of a rally particularly high is the convergence of technical signals and fundamentals.

Technically, Bitcoin is in an oversold zone, which is clearly shown by a bear market level RSI, a dip in fear and greed index, and a general sense of waryness in the markets.

Fundamentally, Bitcoin could get a decent rally if markets cut rates. Participants expect a very high likelihood of a cut at the Dec 9-10 Federal Reserve Meeting.

If the US Fed Cuts Rates, Bitcoin Could Cross $120k in No Time

Bitcoin heavily rests on a rate cut for a future rally. The reason for this dependency is that crypto markets have been starved of liquidity for almost a year now (since January 2025). Institutional liquidity, too, has dried up, with even large treasuries buying a handful of BTCs. In this scenario, there is no other source of liquidity except new US Dollars injected into the economy by a rate cut.

If the Federal Reserve cuts interest rates by at least 0.25%, which seems highly likely, it will force Bitcoin traders to cut their shorts, and Bitcoin might cross $120k in no time.

However, if the rate cuts fail to materialize, it might sink below $82k for a short period.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.