Key Insights:

- Investors must understand how a token’s supply schedule affects scarcity and value.

- It is also necessary to check the vesting plan to spot any risks of insider sell-offs.

- Be sure to look for real and lasting use cases that make the token a useful one.

The real strength of any crypto project goes far beyond a flashy whitepaper or hype-filled marketing.

What truly defines its future value is the design of its economy, or its tokenomics. This term describes how a project creates, distributes and manages its native token. In simpler terms, it’s the engine that determines whether the token can hold or grow in value over time.

Every serious investor should study a project’s tokenomics before putting money into it.

Doing this helps reveal how sustainable the project is and whether its design supports growth.

How Scarcity and Dilution Shape Value

The structure of a token’s supply determines how rare it is and how much its value can be diluted as new tokens enter circulation. When reviewing a project, always examine the three main supply figures and how they change over time.

Maximum Supply

This is the total number of tokens that will ever exist. A fixed limit, like Bitcoin’s 21 million cap, shows scarcity. Unlimited supplies, like Dogecoin, mean constant inflation. This usually lowers the token’s long-term value.

Total Supply

This includes all tokens that have been created, even those not yet released to the public. These might be locked for future use in staking rewards, treasury funds or vesting contracts.

Circulating Supply

These are the tokens already available for trading. It’s the figure used to calculate the project’s market cap by multiplying the current price by this supply.

When the maximum supply is much higher than the circulating supply, there’s a high chance of dilution in the future. This means more tokens will flood the market later and will drag prices down.

This said, investors should compare the current market cap with the fully diluted valuation (FDV), which shows what the project’s market cap would be if all tokens were released.

Studying the Release Schedule

A project’s emission or release schedule shows when locked tokens will be unlocked and made tradable. Constant emission rates can make a token inflationary, while projects that burn tokens or limit new issuance can create deflationary pressure.

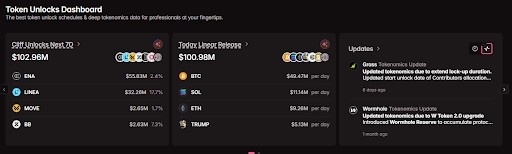

Healthy designs often balance both, and you can check platforms like Tokenomist.ai for upcoming or past unlocks.

Platforms like tokenomist.ai can be a great resource for checking vesting schedules | source: tokenomist.ai

They offer staking rewards but also include token burns to maintain scarcity. If too many tokens are released too quickly, the price may struggle to hold.

Vesting Schedules And Insider Incentives

Vesting is how projects release tokens to founders, developers, early investors and advisors over time. It prevents insiders from dumping large amounts of tokens right after launch.

A well-designed vesting plan keeps the team committed and protects the community from massive price drops.

How Vesting Works

Most projects use a cliff period, usually between 6 and 12 months. During this time, insiders can’t sell any tokens. After the cliff ends, their tokens are gradually released over two to four years.

For example, if a project sets a one-year cliff followed by a three-year release, team members will only receive portions each month after that first year.

What Investors Should Watch

- Team Allocation: If the team receives more than 25-30% of the total supply and their tokens unlock too quickly, that is a red flag. It shows that the founders might be focused on profit rather than longevity.

- Unlock Events: Be sure to track major unlock dates. When a big batch of tokens is set to be released, expect price changes or even sell pressure.

- Fair Timing: Gradual releases over several years tend to build confidence. On the other hand, sudden or large unlocks can indicate short-term focus.

Token Utility And Why It Needs to Exist

Supply defines scarcity, but a token’s use case defines its demand. Even if a token has a well-managed supply, it will fail if it doesn’t serve a clear purpose. A good token should be important to the project’s function, not just seen as a fundraising tool.

Asking the Right Questions

- Does the project really need a token?

Many tokens exist only to raise money. This being said, look for those that have built-in uses like paying fees, staking or securing the network. Tokens used for real transactions can create steady demand. - Does it offer governance rights?

Some projects use tokens to give holders a vote in decision-making. If the project generates real revenue, governance tokens can be powerful. - Does activity increase demand for the token?

In strong projects, growth naturally powers demand. For instance, if using a platform requires holding or burning tokens, more users lead to higher demand and less supply.

What Smart Investors Focus On

Successful crypto investors look past the initial hype and focus on structure. They analyze numbers, schedules and use cases before buying.

- Be sure to compare the current market cap with the fully diluted value to measure the dilution risk.

- Study the release calendar for any token unlocks that could affect price.

- Find and assess vesting schedules to confirm how involved insiders are.

- Ask whether the token has a meaningful use case.

A solid token design combines a controlled supply, fair distribution and clear purpose. Anything other than this should be avoided.