Key Insights

- Fed interest rate decisions directly affect crypto prices because they change market liquidity.

- Higher rates drain liquidity and push investors away from volatile assets like crypto.

- Lower rates on the other hand, flood markets with cheap money and encourage investors to take more risks.

Crypto was once viewed as separate from traditional finance. Bitcoin was introduced after the 2008 financial crisis, as an alternative to central bank control.

Many believed that digital assets would remain immune to conventional monetary policy. However, the recent economic cycles have destroyed this narrative.

Interest rates and crypto now share a tight relationship, and no factor now influences prices more than Federal Reserve decisions.

How the Federal Reserve Controls Money Flow

One of how the Federal Reserve manages the US economy is through Interest Rates and Crypto.

How Does Raising Interest Rates Affect The Economy?

The Fed raises the Federal Funds Rate when the economy grows too quickly and inflation becomes an issue. This policy is known as a “hawkish” one, and the agency implements it to slow things down.

Higher rates mean banks pay more to borrow from each other. They can then pass these costs to consumers and businesses through higher mortgage rates, loan rates and credit card rates. At the end of it all, money becomes expensive (or harder to come by).

Quantitative tightening also comes alongside rate hikes. The Fed sells bonds to reduce the money supply, and this drains liquidity from financial markets. Less and less thus money circulates through the system.

When rates rise, risk-free assets like US Treasury bonds become attractive when rates rise. Investors tend to go for bonds in these scenarios because they can earn solid returns without needing to take chances.

The opportunity cost of holding non-yielding assets like Bitcoin also increases and creates a risk-off sentiment. Investors move money away from volatile investments and Crypto prices suffer during these periods.

Lowering Interest Rates Stimulates Growth

The Fed cuts the Federal Funds Rate when the economy slows and needs stimulus. This policy is known as a “dovish” one, and it encourages borrowing and spending.

Put simply, lower rates make loans cheaper for everyone. Businesses invest more and consumers spend more. As this happens, economic activity picks up across the board.

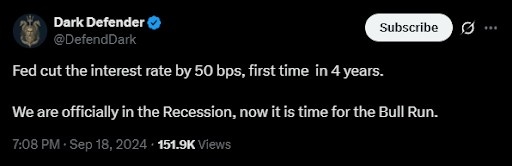

The market generally expects prices to soar when interest rates are cut | source: X

Quantitative easing also floods markets with liquidity. The Fed buys bonds and injects cash into the financial system. Money then becomes cheaper and easier to come by.

In conditions like these, risk-free assets offer poor returns and investors tend to seek higher yields elsewhere. They move capital into riskier asset classes like technology stocks and cryptocurrencies and this demand pushes prices upward.

The pattern is straightforward from here. When the Fed drains liquidity, crypto struggles and vice versa.

The Digital Gold Narrative Meets Reality

Bitcoin supporters initially marketed it as “digital gold.” The fixed supply of 21 million coins was believed to be able to protect holders from inflation caused by the central bank’s money printing.

This narrative was based on the assumption that Bitcoin would rise when inflation soared.

What Actually Happened

The 2021-2022 inflation period tested this theory. Early on, mone flowed into crypto as inflation fears grew and the digital gold narrative seemed to hold. However, everything changed when the Fed started aggressively raising rates.

The market crashed even further when the FED started to hike interest rates | source: TradingView

Bitcoin and other cryptocurrencies crashed heavily and started to behave more like tech stocks and other high-risk growth investments. Crypto was nothing like the inflation hedge it claimed to be.

As of writing, major cryptocurrencies now work more like high-beta risk assets and are more volatile than traditional equities. They also sometimes mimic the S&P 500, the Nasdaq-100 and some other tech-heavy indices.

The crypto market is showing stock correlation, and analysts are raising alarms | source: X

Understanding the New Reality

Crypto independence seems to be weaker nowadays than it used to be. Bitcoin’s technology and decentralised structure are still unique, but market prices now work like forex and stocks.

Crypto asset valuations now track the monetary policy cycle predictably and the relationship works like this:

When inflation rises and the Fed raises rates, liquidity drains from markets. Risk-off sentiment dominates and crypto prices fall as capital flees to safer assets.

When inflation finally gets controlled or the economy slows, the Fed cuts rates to stimulate growth. Liquidity floods back into markets and risk-on sentiment returns.

Crypto prices then rise as speculation increases.

This cycle has repeated multiple times so far, and each iteration reinforces the pattern. This said, traders should not ignore macroeconomic conditions when making decisions.

Why This Matters for Investors

Smart crypto investors now watch Fed meetings as well as any stock trader does. Interest rate announcements can move markets immediately.

Buying crypto during aggressive rate hikes is like a fight against powerful headwinds. This said, buying during rate cuts or accommodative policy is like riding a tailwinds.

Investors should note that timing matters now more than understanding the environment. Rate hiking cycles typically last 12 to 18 months and patient investors can wait for conditions to improve rather than catching falling knives.

Planning Your Strategy Around Interest Rates and Crypto

The relationship between interest rates and crypto is a great way to make informed decisions. You don’t need to predict exact price targets, and can get by with a strong understanding of market cycles.

During hawkish periods when rates are rising, expect volatility and downward pressure. The same applies in reverse.

So far, interest rates and crypto will continue to be interconnected. This means that in the crypto market, macro factors drive prices just like they do for stocks and bonds.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.