Attention to self-custody, robust security designs, and custom workflows that comply with U.S. tax and reporting facts to select crypto wallets in USA that users will trust in 2026. Hardware wallets (cold storage) are used to store long-term holdings offline, whereas software wallets ease daily use and access to DeFi. Other, more recent wallets employ MPC security to minimize the single-point key risk. The correct decision is based on the frequency of transactions, chains used, and the way you are going to make records to pay taxes. This guide will contrast the top choices, discuss the difference between the cold and hot wallets, and suggest how to set up a safe setup so that amateurs and intermediate users can decide on a wallet that suits their habits without compromising on security.

- How to choose the best crypto wallet in USA

- Secure crypto wallet in USA: hardware wallets (cold storage)

- US crypto wallet apps: software & DeFi wallets

- Bitcoin wallet USA: best options by use case

- IRS compatible crypto wallets: tax-friendly workflows

- Cold storage vs. hot wallets: which should U.S. users pick?

- How to set up a crypto wallet safely

- Risks & safety tips for U.S. users

- Best Crypto Wallets in USA at a Glance

- Mid-article reminder on crypto wallets USA

- Conclusion

How to choose the best crypto wallet in USA

In the assessment of the best crypto wallets in USA alternatives, it is important to focus on the following criteria:

- Security model: hardware (offline), software (hot), or MPC wallets.

- Type of custody: self-custody or assisted custody. Self-custody of private keys.

- Supported networks and assets: Multi-chain support will help minimize wallet sprawl.

- Platforms: Android/iOS/desktop/hardware

- Backups & recovery: seed phrase, backups, recovery flows, PINs on devices.

- UX & updates: easy installation, software/application updates, access to recovery procedures.

- U.S. usability: on-ramp/off-ramp accessibility, exports that are compliance-friendly, hand a history of transactions.

Take two wallets, one as a long-term cold storage wallet and one wallet as a daily use wallet.

Secure crypto wallet in USA: hardware wallets (cold storage)

Offline storage of the private keys in cold storage reduces the exposure to malware and phishing. In the case of U.S. users with nonzero balances, a hardware wallet and good seed phrase hygiene constitute the safest starting point.

1. Ledger Nano X

- What it is: Bluetooth mobile and desktop hardware wallet.

- Security model: hardware, secure element keys; passphrase options, PIN.

- Sustained assets and networks: Extensive support of L1s and tokens on major L1s.

- Best for: Stores long-term but gives it a mobile convenience.

- Key pros: mobile, large-scale asset coverage, and routine updates of the firmware.

- Limitations for U.S. users: Bluetooth convenience introduces an attack point where the hygiene of devices is compromised; certain features of apps may differ depending on the area.

https://www.ledger.com/

2. Trezor Safe 3

- What it is: Hardware wallet of modern security, entry-level.

- Security model: Hardware, secure boot, and open design philosophy; PIN.

- Sustained assets and networks: Good coverage on major chains and tokens.

- Best for: Cost-effective cold storage.

- Key pros: easy-to-use interface, open security policy, solid recovery procedures.

- Limitations for U.S. users: No Bluetooth, only mobile connection via cable.

https://trezor.io/

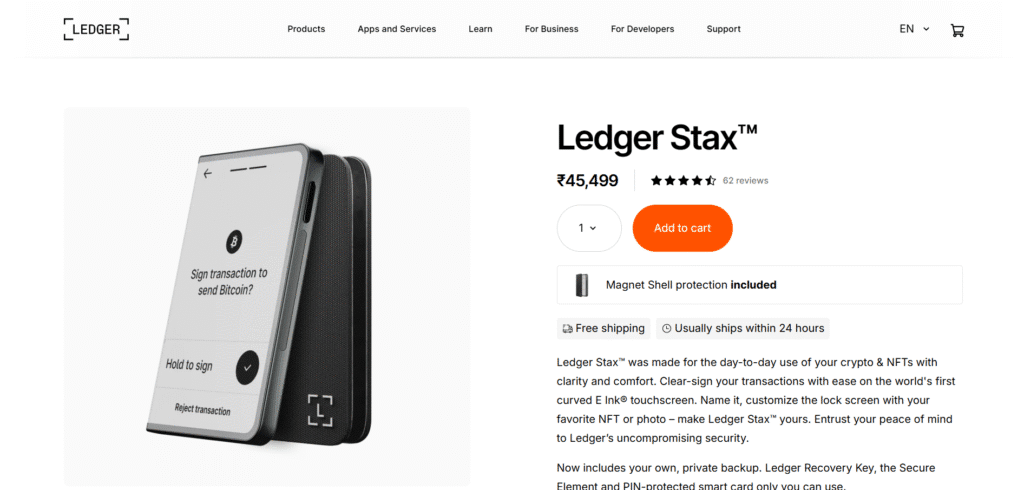

3. Ledger Stax

- What it is: A high-end touchscreen hardware wallet with a curved E-Ink display.

- Security model: Secured element hardware; offline key storage.

- Supported assets and networks: Multi-chain is similar to the ecosystem of Ledger.

- Best for: people interested in advanced UX and NFT on-screen display.

- Key pros: good readability, easy confirmations, and a good security model.

- Limitations for U.S. users: It is more expensive; its supply may change.

https://shop.ledger.com/products/ledger-stax

4. Trezor Model T

- What it is: Advanced user touchscreen hardware wallet.

- Security model: Hardware; PIN/passphrase on-device; open-source firmware.

- Supported assets and networks: Major network broad support.

- Best for: Power users who like touchscreen confirmations.

- Key pros: established history, good recovery solutions, and lack of Bluetooth.

- Limitations for U.S. users: Expensive entry models.

https://trezor.io/trezor-model-t

5. OneKey Pro

- What it is: A mobile-friendly, secure hardware wallet.

- Security model: Hardware, secure chip, and companion applications.

- Supported assets and networks: Multi-chain support of popular networks.

- Best for: Mobile-first users who require cold storage.

- Key pros: small size, simple installation, and decent multi-chain UX.

- Limitations for U.S. users: Ecosystem integrations are not as comprehensive as the best brands.

https://onekey.so/

US crypto wallet apps: software & DeFi wallets

US crypto wallet applications are hot wallets that are used on a daily basis, swaps, NFTs, and DeFi. They sacrifice part of the security for speed and convenience. Combine one with a hardware wallet to have serious balances.

1. MetaMask

- What it is: A browser and mobile wallet that is commonly used in DeFi.

- Security model: Software (self-custody); device encrypted keys.

- Supported assets & networks: Ethereum and EVM chains; token and NFT support.

- Best for: NFT interactions and Web3 applications.

- Key pros: big ecosystem, network switching, hardware wallet pairing.

- Limitations for U.S. users: phishing threat through counterfeit extensions; attention should be paid to approvals.

https://metamask.io/

2. Trust Wallet

- What it is: Multi-chain wallet, mobile-first.

- Security model: Software (self-custody).

- Supported assets & networks: Multi-chain support.

- Best for: Easy mobile self-ownership between chains.

- Key pros: easy UX, built-in browser, wide asset coverage.

- Limitations for U.S. users: Desktop support is restricted; users have to be cautious with approvals.

https://trustwallet.com/

3. Exodus

- What it is: Swapped built-in desktop and mobile wallets.

- Security model: Software (self-custody).

- Supported assets & networks: Multi-chain having a portfolio view.

- Best for: Desktop seekers aim to have clean UX.

- Key pros: Sleek design, welcome features, and hardware wallet integration.

- Limitations for U.S. users: Inbuilt swap costs may be increased; fewer sophisticated DeFi applications.

https://www.exodus.com/

4. Zengo

- What it is: MPC security Keyless wallet.

- Security model: MPC-based; seed none.

- Supported assets & networks: large chains and tokens.

- Best for: Suits novices who desire to have lower risk in seed phrases.

- Key pros: Biometric recovery, straightforward backups, powerful UX.

- Limitations for U.S. users: Advanced DeFi integrations are less restrictive than MetaMask.

https://zengo.com/

5. Coinbase Wallet

- What it is: a separate, non-exchange self-custody wallet.

- Security model: Software (self-custody).

- Supported assets & networks: Multichain with NFTs.

- Best for: those who are starting off with exchanges and moving to self-custody.

- Limitations for U.S. users: U.S. users will have a familiar UX, and it will be easy to gain access to dApps.

https://www.coinbase.com/en-in

Bitcoin wallet USA: best options by use case

The choice of a bitcoin wallet USA is based on BTC use:

- Long-term storage: Passphrase-protected and offline-backed hardware wallets (Ledger, Trezor).

- Daily use: Small balance mobile software wallets only.

- DeFi/NFTs: Store wrapped in EVM wallets; store BTC cold.

Note: BTC cold storage should not be used together with experimental DeFi wallets.

IRS compatible crypto wallets: tax-friendly workflows

IRS compatible crypto wallets are not a tax is built in tax system; they are a matter of exporting clean transaction histories and being able to reconcile activity with tax tools.

Best practices for U.S. users:

- Use history or API-compatible in your wallet app.

- Label transfers (self-transfer vs. trade).

- A separate wallet to store long-term, as opposed to DeFi, should be kept to make records easier.

- Store times, charges, and chain identities.

- Always make backup records; never use just one piece of equipment.

Cold storage vs. hot wallets: which should U.S. users pick?

Cold storage (hardware):

- Pros: offline keys, the best security for long-term holding.

- Cons: Not as convenient to use on a day-to-day basis; it is expensive.

Hot wallets (apps):

- Pros: Speedy access, DeFi/NFT, swaps.

- Cons: Vulnerable to malware and phishing of the device.

Rule of thumb:

- Store 90%+ in cold storage.

- Carry balances in hot wallets.

- Use pair applications when hardware wallet connections are available.

How to set up a crypto wallet safely

- Purchase equipment through official stores (when using cold storage).

- Boot up offline; enter a solid PIN and optional passphrase.

- Print the seed phrase on paper or metal; save it in 2 different secure locations.

- Always update the software/applications and then deposit money.

- Firstly, send a small number of transactions.

- Turn on the security of the device (screen lock, malware protection, OS updates).

- Periodically check the wallet approvals and revoke inactive permissions.

Risks & safety tips for U.S. users

- Phishing/fake extensions: Install trusted apps/extensions.

- Approval drain: Review approvals regularly.

- Social engineering: There is no real support for requests for seed phrases.

- Backups: Recovery test with a little.

- Long-term storage: Think about geographically dispersed backups.

Best Crypto Wallets in USA at a Glance

| Wallet | Type | Custody | Platforms | Supported assets | Best for |

| Ledger Nano X | Hardware | Self-custody | iOS, Android, Desktop | Multi-chain | Long-term + mobile |

| Trezor Safe 3 | Hardware | Self-custody | Desktop, Mobile (cable) | Multi-chain | Budget cold storage |

| Ledger Stax | Hardware | Self-custody | iOS, Android, Desktop | Multi-chain | Premium UX |

| Trezor Model T | Hardware | Self-custody | Desktop, Mobile (cable) | Multi-chain | Power users |

| OneKey Pro | Hardware | Self-custody | iOS, Android, Desktop | Multi-chain | Mobile-first cold storage |

| MetaMask | Software | Self-custody | Browser, iOS, Android | EVM chains | DeFi/NFTs |

| Trust Wallet | Software | Self-custody | iOS, Android | Multi-chain | Mobile multi-chain |

| Exodus | Software | Self-custody | Desktop, iOS, Android | Multi-chain | Beginner UX |

| Zengo | MPC | Assisted self | iOS, Android | Multi-chain | Keyless security |

| Coinbase Wallet | Software | Self-custody | iOS, Android, Browser | Multi-chain | Beginners to self-custody |

Optional use-case matrix (summary):

- Long-term storage: Ledger, Trezor, OneKey

- Daily use: Trust Wallet, Coinbase Wallet

- DeFi/NFTs: MetaMask (+ hardware pairing)

- Beginner keyless: Zengo

Mid-article reminder on crypto wallets USA

The most secure system with crypto wallets in USA is two wallets, a cold one and a hot one, where one keeps their savings and spends daily, respectively. This helps in restricting exposure in case a phone or a browser extension is compromised.

Conclusion

The decision to use crypto wallets in USA that can be trusted in 2026 by the users of the USA is based on the concept of the levels of security, i.e., cold storage to store long-term holdings, hot wallets to spend money every day, and clean records to implement compliance workflows. The most secure are hardware wallets; the most convenient are software and MPC wallets. Choose tools that fit your habits, maintain balances separated, and have a disciplined backup.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.