Key Insights

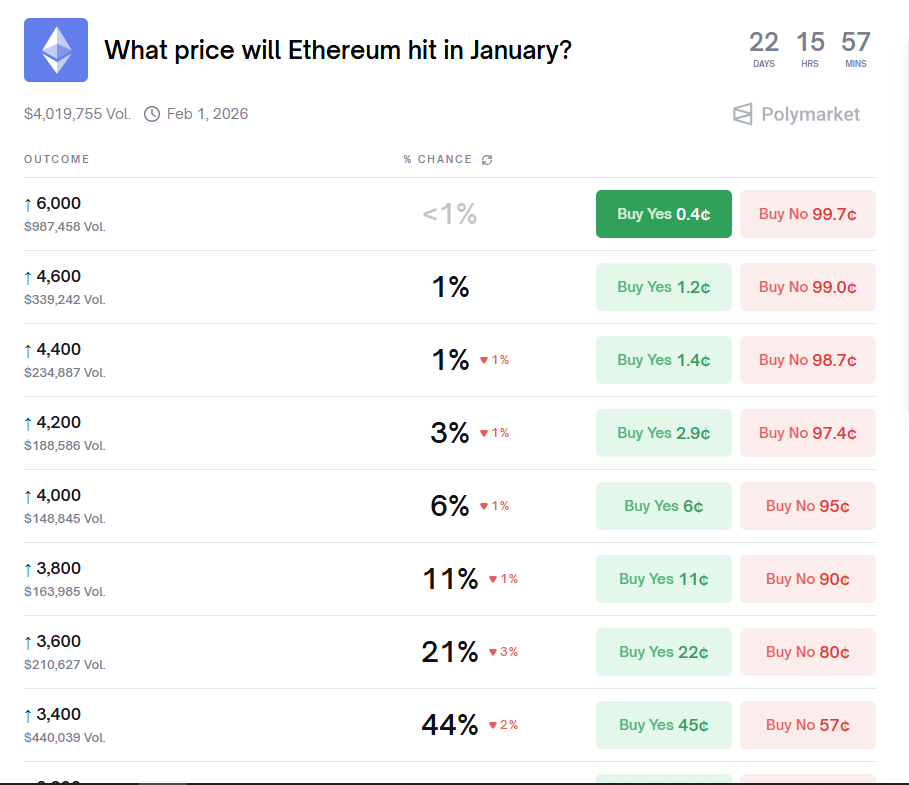

- Prediction platforms like Polymarket now show that most traders expect Ethereum to stay below $3,800 through early 2026.

- Technical upgrades like Glamsterdam and Hegota are set to improve the network’s efficiency and decentralisation this year.

- Meanwhile, exchange balances of ETH have hit record lows under 9%, creating a tight supply that could lead to a sudden price re-rating.

The start of the new year now has the world’s second-largest cryptocurrency at a crossroads.

On one side, decentralized prediction markets and institutional options show that investors expect a period of boring, sideways movement.

On the other side, the network is preparing for its biggest technical changes since the Merge.

Related: Ethereum Price Analysis 2026

Prediction Markets Signal Cautious Outlook for ETH

Currently, sentiment on platforms like Polymarket are showing a “wait-and-see” attitude among investors.

As of January 9, Ethereum trades near $3,212. While it has recovered somewhat from the slump of last year, it is still struggling to break through the $3,500 resistance level.

Most high-volume bets on prediction markets now show investor expectations that the price will remain range-bound for at least the first quarter.

Institutional data from options desks also supports this view. Many large players are using “sell-call” strategies, which is a common move when professionals expect an asset to stay stagnant.

Technical Upgrades Could Trigger a Big Move

While prediction markets are focued on short-term prices, developers are building for the long term.

According to the Ethereum foundation, two major upgrades are scheduled for this year, including Glamsterdam and Hegota. These are not just minor tweaks; they represent a fundamental redesign of how the blockchain operates.

Glamsterdam is expected in the first half of the year and will introduce the Enshrined Proposer-Builder Separation, or ePBS.

For context, this moves the auction of block space directly into the Ethereum protocol rather than using outside relays. This change improves decentralisation and makes the network more attractive to big institutions worried about censorship.

It also enables parallel block processing, which could greatly increase transaction speeds.

Supply Dynamics and the Hegota Upgrade

The second major event is the Hegota upgrade, which is planned for the latter half of the year. This upgrade aims to implement Verkle Trees, and this new data structure will reduce the amount of data a node needs to store by up to 90%.

This is a massive step toward “statelessness.” it would allow users to run a full Ethereum node on a basic smartphone or laptop.

These technical shifts happen while the supply of ETH is tightening. Data from Glassnode also shows that Ethereum balances on centralised exchanges are at their lowest levels ever.

Meanwhile, the amount of staked ETH has grown to over 41.8 million coins. This means that there is very little liquid supply left to meet any sudden surge in demand.

The Prediction Markets “Lag Effect”

History often shows a “lag effect” between network growth and price action. During the 2020-2021 cycle, Ethereum stayed flat for months while defi usage exploded.

Once the market finally noticed the fundamentals, the price quadrupled in a very short time. To put things simply, those betting on a flat market today might be ignoring this historical pattern.

The current market now seems to be pricing Ethereum like a “legacy” platform that is losing to faster rivals like Solana. However, this view overlooks the $76 billion in value currently locked in Ethereum’s DeFi ecosystem.

No other smart contract platform has the same level of regulated ETF infrastructure or institutional trust. In all, when the market finally “catches up” to these facts, the reaction is likely to be both violent and fast.

Meta Description: Prediction markets appear to be betting on a flat Ethereum for early 2026, but the Glamsterdam and Hegota upgrades could trigger a massive price move. Tags: Ethereum, ETH Price, Prediction Markets, Polymarket, Glamsterdam Upgrade, Hegota Upgrade, Crypto News 2026

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.