Bitcoin is expected to cross its last ATH of $126k by Q2 of 2026 due to lower inflation, the US Federal Reserve’s rate cuts, and the possible end of the deindexing crisis affecting Bitcoin Treasuries.

What is Bitcoin?

Bitcoin is the largest and was the first cryptocurrency to solve the double-spending problem. It was created in 2008 by the mysterious cryptographer Satoshi Nakamoto, who is also assumed to hold over 1.1 million Bitcoins.

Fundamental Analysis

Bitcoin has shown an aggressive correction from its ATH of $126k on October 7, 2025, reaching a low of $82k on November 23, 2025. The correction was caused by the possibility that Bitcoin Treasuries might be removed from major indices in the USA, like the S&P 500. As a result, many investment firms holding Bitcoin Treasury shares and Bitcoin ETFs were forced to sell, bringing the crypto down by 40% from its last ATH. Further, Bitcoin’s ETFs also faced a major series of withdrawals, which catalyzed the correction.

However, the price of Bitcoin is not expected to slide further, at least fundamentally, because the US Federal Reserve is expected to lower its interest rates from the effective rate of 3.875% to below 2%, making credit cheaper again. Along with cheaper credit, there is also a clear sign that inflation will come down in the second half of the year, which could leave more to invest in the hands of retail investors.

Technical Charts

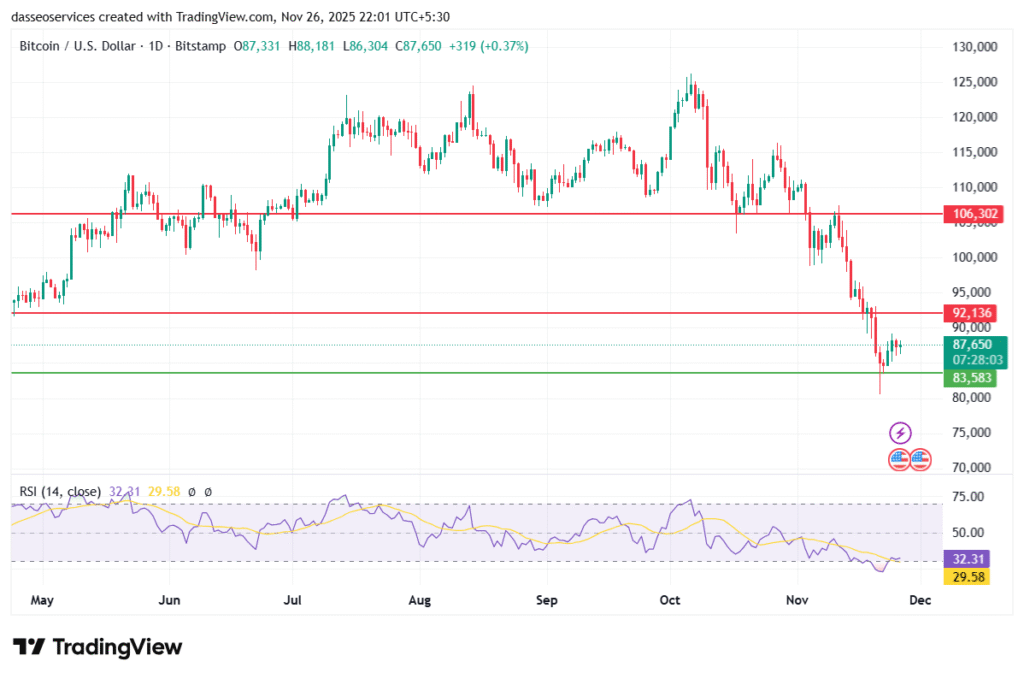

Bitcoin had entered a declining trend between October and November 2024, sliding down 40% in that period. However, that trend has come to an end with a trend reversal.

A strong support zone for Bitcoin lies at $83.5k. If Bitcoin sustains above these levels, the price recovery could sustain in the future.

Technical charts indicate at least two resistance levels for Bitcoin’s price at $92k and $106k, only above which Bitcoin is expected to cross its last ATH of $126k.

Further, technical indicators like RSI have also indicated the end of the declining trend. RSI on 1D charts has reversed since the October 7 fall, after going below 30. By the third week of November, Bitcoin had entered a positive RSI trend after reaching oversold levels.

Price Analysis for 2026

If Bitcoin’s price sustains above $83.5k, along with an interest rate cut in Dec 2025, Bitcoin could cross $100k by the last week of 2025.

However, if there is no rate cut by the US Fed, we could see Bitcoin slide below $82k, possibly reaching the next support zone of $74k.

In any case, the Fed is expected to revise its interest rate towards the downside, and inflation is expected to ease before that. Both these cases indicate that Bitcoin will cross $126k, supported by strong corporate and retail buying.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.