Solana Price is expected to cross $135 on positive rate-cut news; however, should the rate cuts fail to materialize, we might see a breakdown to $106.

What is Solana?

Solana is one of the largest cryptocurrencies and one of the fastest Layer-1 blockchains, with an established presence among institutions, RWA projects, and several other blockchain applications. The network boasts a high transaction rate of 65,000 transactions per second, resulting in a very low cost per transaction.

Fundamental Analysis

Solana has one of the most mixed fundamentals in the current markets. Some of the aspects of the blockchain speak for their own while others still lag.

What’s Working for Solana

- The blockchain is close to achieving a near-instant finality with the latest Alpenglow Update.

- Transactions are occurring at a higher pace than in previous bull markets.

- Solana Price has a zero error run in 2025 (till date).

Where is Improvement Required?

- However, Solana Price is seeing a fall in adoption after memecoin mania faded away.

- Unfortunately, Solana Price is still behind Ethereum in several markets like RWA and DeFi.

Technical Charts

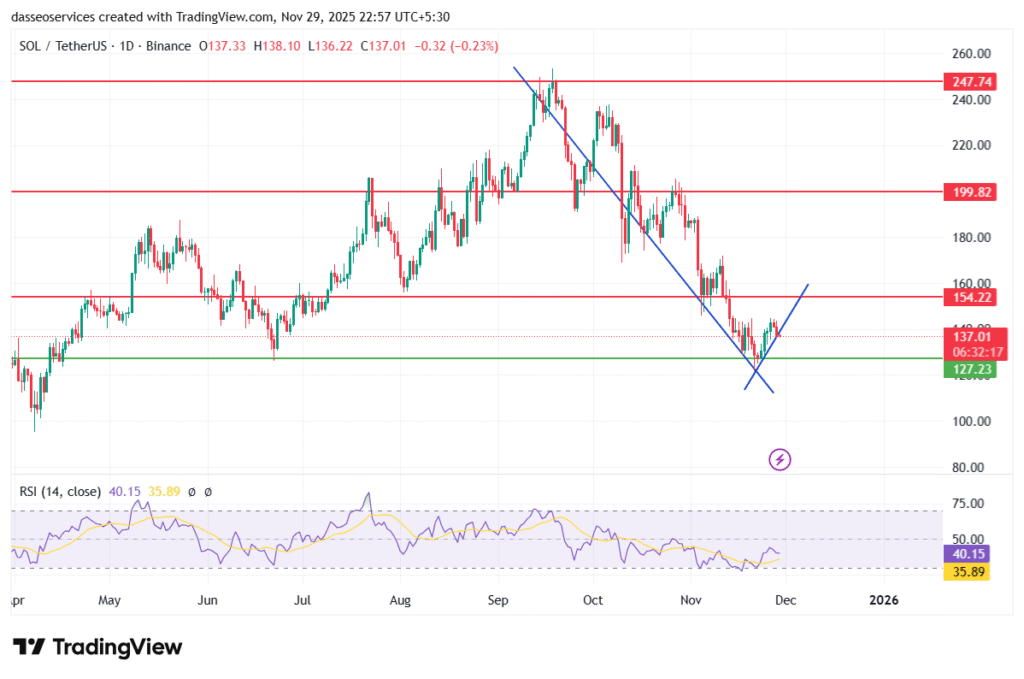

Solana has just broken a downtrend that it was following for the last two and a half months. The downtrend took Solana from $247 to $127, resulting in a 49% fall in SOL’s price. Had the downtrend continued a bit further, Solana would have crashed below $100 within the first week of December.

Despite the relief, Solana’s price seems to have met some resistance at $140 which stops it from entering a recovery rally.

Price Analysis for 2026

Solana’s price depends on the next US Federal Reserve meeting on Dec 9-10.

- If the Fed goes for a rate cut, it could lift Solana towards $200, above its current resistance.

- Without a rate cut, it could crash SOL toward $106 support zone.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.