Key Insights

- Solana has grown towards institutional circles lately, and its spot ETFs alongside partnerships with firms like Western Union have been major growth drivers.

- The rollout of the Firedancer validator client could also solve past reliability issues and boost its speed.

- Analysts expect a range of $600 to $1,200 by 2030 as the network matures.

It has quickly become one of the market’s leaders because of its high speeds and low costs.

- Quick Solana Price Prediction

- Current Market Overview

- What Is Solana?

- Major Factors Affecting Solana (2026-2030)

- Solana Price Prediction by Timeframe

- Short-Term Price Prediction (Next 3-6 Months)

- Medium-Term Price Prediction (2026-2027)

- Long-Term Price Prediction (2030 & Beyond)

- Technical Analysis Overview

- Bullish vs Bearish Scenarios

- Is Solana a Good Investment?

- FAQs

- Can Solana reach $500?

- Where can I buy SOL?

- What affects the SOL price the most?

- What is the Firedancer upgrade?

- Does Solana have a maximum supply?

- How does Solana compare to Ethereum?

- Final Thoughts

So far, the network has been moing more into maturity and analysts have high hopes for $SOL, its native cryptocurrency.

Here’s a look at what this asset could be worth between now and 2030 from a realistic perspective.

Related: Solana Price Analysis 2026

Quick Solana Price Prediction

| Period | Estimated Price Range | Market Sentiment |

| Current Price (Jan 2026) | $130 – $145 | Neutral-Bullish |

| Short-Term (3-6 Months) | $110 – $185 | Volatile |

| Mid-Term (2026-2027) | $220 – $450 | Bullish |

| Long-Term (2030+) | $600 – $1,200 | Mature |

Current Market Overview

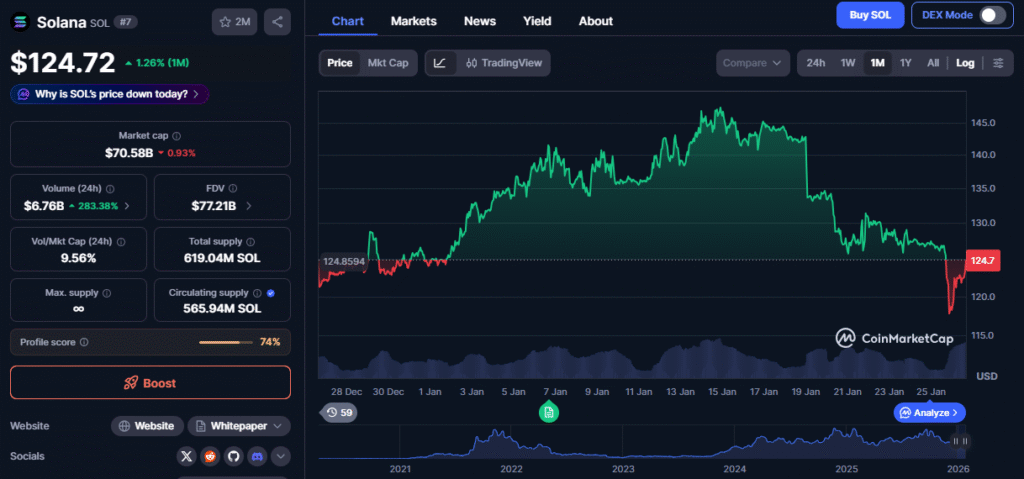

It currently sits as a top-five cryptocurrency by market size according to data from CoinMarketCap. Its market cap is around $75 billion and the circulating supply is roughly 565 million SOL tokens.

Its overview appears healthy so far | source: CoinMarketCap

Moreover, a high percentage of these tokens are currently staked, which means that about 70% of the supply is locked by holders who believe in the long term.

The price has stayed between $130 and $145 lately. This comes after a rocky end to 2025, when the entire market entered a downturn from Bitcoin’s lead.

Institutional interest now appears to be the main story behind Solana and big companies are filing more and more for spot ETFs.

This could bring a lot of new money into the ecosystem and because of this, It is showing a great deal of resilience on multiple timeframes.

What Is Solana?

It is a fast blockchain built for decentralised apps. It launched in 2020 to solve the slow speeds of older networks and uses a special system called Proof of History.

This allows the network to handle thousands of transactions every second, and makes it much faster than many of its rivals.

The SOL token has three main jobs. First, it is used to pay for transaction fees on the network. Second, users stake it to keep the blockchain secure and finally, it allows holders to vote on future changes.

It acts like a digital version of Visa because it provides the rails for modern finance and high-speed trading.

Major Factors Affecting Solana (2026-2030)

To start with, adoption is a major factor in the price. Large banks like Morgan Stanley are showing interest in this network, and Western Union is even testing stablecoins on it.

These partnerships have so far been moving Solana from being an experiment to being real infrastructure.

The Firedancer upgrade is another big deal. Analysts describe it as a new way for the network to process data because it makes the network more stable than it has been. The network also has aims to reach over 1 million transactions per second.

Tokenomics are another major part of this prediction. It does create new tokens over time, which makes inflationary (as opposed to Bitcoin).

However, to handle this, the network burns a part of every transaction fee, which helps balance the supply.

In other words, If more people use the network, the burn rate goes up.

Solana Price Prediction by Timeframe

Short-Term Price Prediction (Next 3-6 Months)

Solana has been bright so far, despite its current performance. The price has found support near $110 and analysts expect a trading range between $135 and $185.

Resistance at the $150 level also quite strong and if Bitcoin stays steady, Solana might be the one to lead a small market rally.

Medium-Term Price Prediction (2026-2027)

By 2027, the Alpenglow and Firedancer upgrades should be fully active and this will likely push the price higher. A realistic range for this period is $250 to $450, which matches the expected peak of the current market cycle.

While this happens, Solana will likely take more market share from other networks.

Long-Term Price Prediction (2030 & Beyond)

By 2030, Solana could have grown to become a global standard for payments and the “crypto” tag might not even matter anymore.

If Solana is able to handle massive traffic, the price could reach $800 to $1,200 (assuing it keeps its lead in speed). It also needs to capture a large share of the stablecoin market at the same time.

Technical Analysis Overview

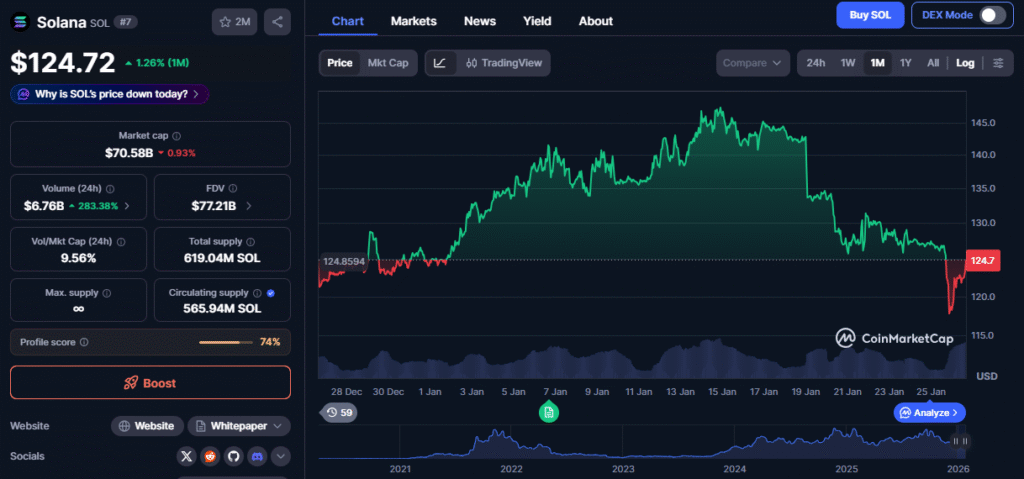

The current trend for Solana is neutral to bullish. The price is currently strong above the 200-day Moving Average, which is sign that the long-term path is still upward.

Support is strong at $130 and a deeper floor exists at $115. Over on the top side though the price still faces hurdles at $148 and $165.

Soolana’s RSI and MACD show that the bulls are in control, despite the crab walk | source: TradingView

The Relative Strength Index (RSI) is currently around 55, which means the asset is not too expensive or too cheap right now. Traders also tend to look at the RSI to see if a coin is “overbought” or “oversold.” This means that a reading of 55 shows healthy interest without the risk of a crash.

Furthermore, the Moving Average Convergence Divergence (MACD) is showing a slight upward curve.

This tends to happen before a new price jump and while short-term swings are common, the “Golden Cross” on the weekly chart is a major bullish signal. For context, this tends to occur when a short-term moving average crosses above a long-term one.

Bullish vs Bearish Scenarios

Bullish Case

A few things could happen and be bullish for Solana. For example, the US could approve a spot Solana ETF and the Firedancer upgrade could end all network downtime.

Moreover, DePIN (or Decentralised physical infrastructure) projects could grow on the network.

Finally, major payment processors like Visa could start to use Solana for settlements.

Bearish Case

On the flipside, Solana could tank hard if new laws label SOL as a security.

Technical bugs could also arise and cause the network to stop, or a new, faster competitor takes away users.

Ultimately, a global recession could hurt all high-risk assets as a whole, including Solana.

Is Solana a Good Investment?

Solana is a high-reward choice according to many experts and investors. Long-term investors see it as a bet on the future of the internet because tt offers deep liquidity for active traders.

This makes it good for buying and selling quickly.

However, before jumping in on Solana, you must remember the risks. Solana has had technical issues before and while the roadmap is great, things can still go wrong.

FAQs

Can Solana reach $500?

Yes, $500 is possible by 2027. However, this would need a market value of $280 billion (which is a big jump), but still puts Solana less than Ethereum’s peak.

For this to happen, more big companies have to jump onboard.

Is Solana safe?

No investment is totally safe. However, the network is much stronger now and has over 800 validators. The new Firedancer software will make it even more robust, so always be up to date on market risks.

Where can I buy SOL?

You can buy it on major exchanges like Kraken, Binance and others. You can also use the Phantom wallet to buy it directly.

What affects the SOL price the most?

Network usage is the biggest driver. This includes total fees and the value locked in apps.

Be sure to check news about ETFs, and note that Solana tends to follow the general path of Bitcoin.

What is the Firedancer upgrade?

Firedancer is a new piece of software for Solana validators. It was built by Jump Crypto to increase speed and reliability and it helps prevent the network outages that happened in the past.

Does Solana have a maximum supply?

No, Solana does not have a fixed cap like Bitcoin. It does have an annual inflation rate though, that decreases over time. Solana even burns a portion of every transaction fee to help control the supply.

How does Solana compare to Ethereum?

Solana is much faster and cheaper to use than Ethereum. It can handle thousands of transactions per second for a fraction of a cent. Ethereum on the other hand, is older and more decentralized. Still, it relies on “Layer 2” networks to stay competitive.

Final Thoughts

Solana has entered the new year as a strong and tested network. However, the road to 2030 will have many ups and downs.

Analysts generally agree that Solana’s core technology remains very impressive. Still, keep an eye on the Firedancer upgrade as this will be the true test for the network.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.