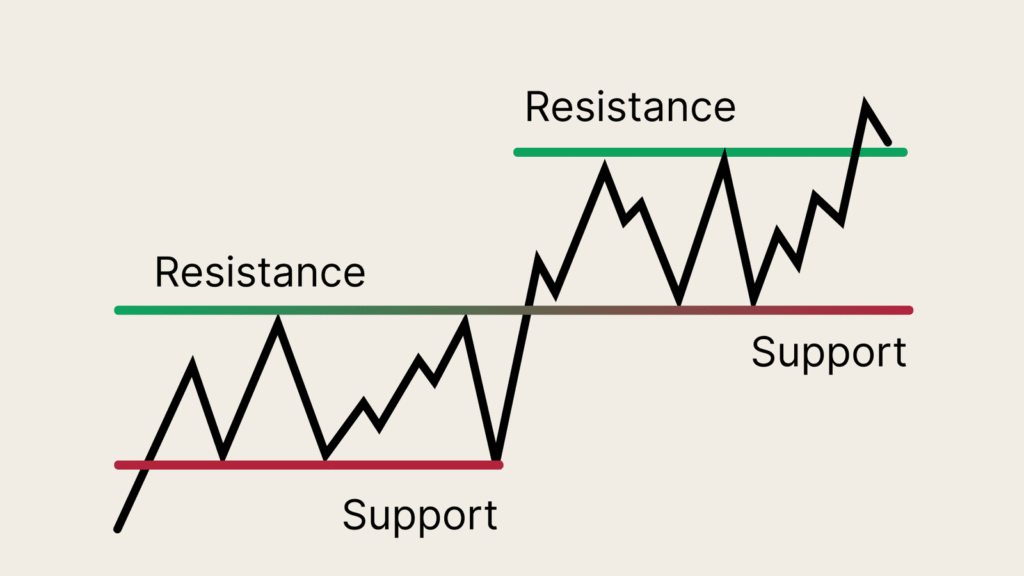

Support and resistance are levels used in technical analysis to interpret price movement in any stock or asset in the market. It is the point at which the price of assets or commodities stops rising or reverses its direction. It is essential to identify this level to make informed, better decisions about entry, exit, and risk management.

Definition

Support

This is the level at which the declining price of any stock stops falling and reverses its direction for upward price movement. This acts as the floor of price movement. It is essential for investors to find this point for investment and earning profits.

Resistance

It is a point at which the increasing price of any commodity or asset stops and starts declining. This acts as the roof of price movement. It is helpful for investors to sell their commodities or assets at that point to prevent further decline and losses.

Given below is the graph which illustrates both support and resistance levels:

Significance

Support and resistance are the elements that indicate the direction of trading and provide entry and exit points, as well as the psychological nature of investors. If the price graph touches the support or resistance level several times, then its significance becomes greater and helps to make informed decisions in the future. It also proves the fact of price reversal in a market that tends to follow a certain price wave.

Importance

To make a properly planned decision for Support and Resistance in trading, to find out the ideal place for entry and exit in the market.

Helps in risk management by finding an ideal stop loss.

Indication of breakout and breakdown that will lead to a new resistance and support level.

Practical Use

- To find out the entry point, that is, investing at the point where the price level is near the support level.

- To find out the exit point, that is, selling commodities or assets at the price level when it is near resistance.

- To analyse and prepare for breakout trading, when price movement breaks down from the support or resistance level.

- It acts as an approach to buying trades or assets at the time of trend reversal.

Example

Let’s assume the stock is named Bank Nifty and it is trading at 45000.

But when it reaches 46000, it sells down again and again; then 46000 is basically the resistance level.

And when it reaches 44000, it moves upward again and again; then 44000 is basically the support level.

Benefits

- It is easy to understand and effective for finding a better time for entry and exit.

- Can be used in any time frame for better analysis.

- Effective in preventing losses.

- Can be used for any market, such as the share market, crypto market, etc.

- Helps in risk management.

Disadvantages

- Several times it shows false breakouts that can again retrace to its normal pathway in the future.

- It has wider subjectivity; that is, different traders analyse the same chart with different perspectives and outcomes.

- In a volatile trading market, it is less effective.

- Basically, it depends on the history of price movement and therefore predicts the support level around the resistance level, so we cannot rely on it fully.

Conclusion

Support and resistance are trending and practical predictive tools. Proper utilisation of this tool, along with sound research and management, can lead to better profitability, but relying solely on it can also result in losses. Precautions are necessary while using this tool, and it can be integrated with other indicators for more effective decision-making.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.