- Quick Polygon Price Prediction

- Current Market Overview

- What Is Polygon?

- Factors Affecting Polygon’s Price

- Polygon Price Prediction by Timeframe

- Short-Term Price Prediction (Next 3-6 Months)

- Medium-Term Price Prediction (2026-2027)

- Long-Term Price Prediction (2030 & Beyond)

- Technical Analysis Overview

- Bullish vs Bearish Scenarios

- Is Polygon a Good Investment?

- FAQs

- Can Polygon reach $10?

- Is POL safe to hold?

- Where can I buy the POL token?

- What happened to the MATIC token?

- Final Thoughts

Key Insights

- Polygon conducts massive daily token burns that remove millions of POL from the supply.

- The AggLayer release could help connect different blockchains, making Polygon a central hub for the crypto space.

- Analysts expect a price range of $2.50 to $5.00 by 2030 as the ecosystem reaches full maturity.

Polygon has grown from being a simple scaling tool into a massive multi-chain giant.

So far, the Polygon project has replaced its old MATIC token with the more versatile POL asset, and analysts believe that the future is bright.

Here is a breakdown of how Polygon is expected to perform between now and the next five years.

Also Read: Ethereum Price Prediction (2026-2030)

Quick Polygon Price Prediction

| Period | Estimated Price Range | Market Outlook |

| Current Price (Jan 2026) | $0.12 – $0.14 | Neutral / Consolidating |

| Short-Term (Next 6 Months) | $0.10 – $0.22 | Volatile Recovery |

| Mid-Term (2026-2027) | $0.45 – $1.10 | Bullish Expansion |

| Long-Term (2030+) | $2.50 – $5.00 | Mature Ecosystem |

Current Market Overview

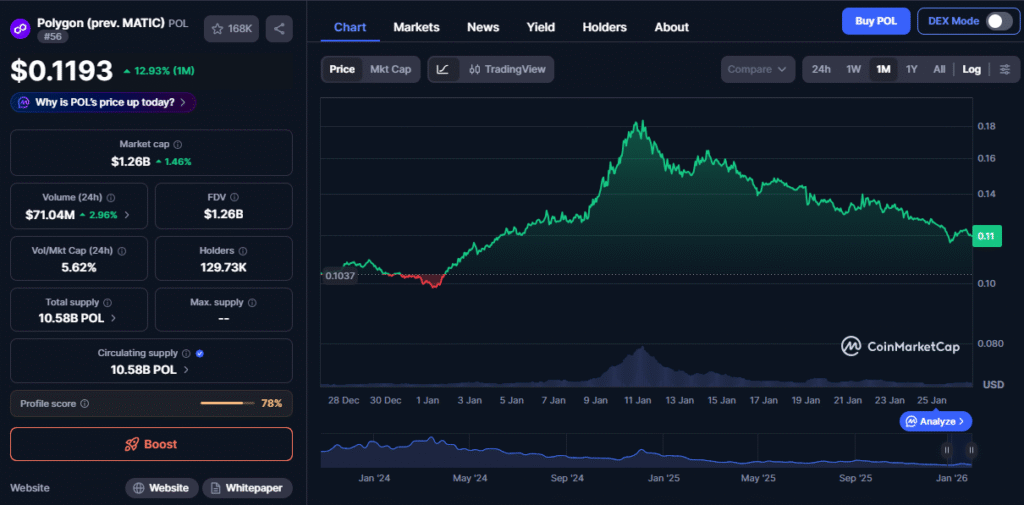

At the time of writing, Polygon is in the middle of a major transition phase. The migration from MATIC to the POL token is complete so far, and the project now holds a market cap of approximately $1.3 billion.

Polygon’s overview shows health across the sector | source: CoinMarketCap

This keeps it inside the top 100 digital assets globally with a circulating supply of around 10.6 billion POL.

The asset’s recent price movement shows that the token has found a floor between $0.12 and $0.14. This stability is important, especially after the general market correction from the end of last year. So far, on-chain data looks very strong and the network even processed over 1.4 billion transactions last year.

Daily active addresses regularly hit the 1 million mark and the network burns the same amount of tokens every day due to high activity on prediction markets like Polymarket.

What Is Polygon?

Polygon is a decentralised platform that helps Ethereum handle more traffic.

It allows developers to build fast apps with very low fees and uses Zero-Knowledge technology to keep data secure. It used to be called the Matic Network, and has now pivoted towards Polygon, the “Value Layer of the Internet.”

Some of the main use cases of the POL token include paying gas fees for transactions on various Polygon-linked chains.

Other use cases include securing the network and earning rewards via staking, alongside governance.

Polygon has grown so powerful over the years because it fixes the heavy costs of transferring funds Ethereum. Polygon and many other L2 networks function more like a bridge for real-world uses.

While competitors use networks like Solana, developers interested in building on the Ethereum ecosystem choose Polygon for its speed.

Factors Affecting Polygon’s Price

Adoption is a major factor in how its price performs.

Polygon currently has partnerships with giants like Nike, Starbucks and Disney, and these brands use the network for loyalty programs and NFTs. The AggLayer technology also connects different blockchains, making it easier for money to move between networks.

The AggLayer technology is highly anticipated among investors | source: X

Tokenomics are also much better now as the new burn mechanism is linked directly to how much people use the chain. This means that if transaction counts stay high, the supply will shrink.

This creates a deflationary effect, and currently, 3.6 billion POL tokens are staked. This shows that many holders plan to stay for years.

Adding to the above, competition is the biggest hurdle for Polygon, because other networks like Arbitrum and Optimism want the same users.

This being said, olygon must keep its lead in ZK-proof technology to win. Regulation in the US is also a major factor in this arrangement, because if the government gives clear rules, more big banks might join the network.

Polygon Price Prediction by Timeframe

Short-Term Price Prediction (Next 3-6 Months)

Over the monthly timeframes, technical signals have been neutral so far. POL is also currently holding onto support levels from late last year, and analysts expect the price to stay between $0.10 and $0.22.

A jump above $0.17 would be a very bullish sign and this could happen if the AggLayer v1.0 goes fully live.

Medium-Term Price Prediction (2026-2027)

The “Gigagas” roadmap is aiming to push the network towards 100,000 transactions per second by 2027.

This would make Polygon as fast as traditional payment systems like Visa. As a result, analysts expect a price range of $0.45 to $1.10 during this growth stage.

Institutional interest in the zkEVM layer will also likely drive this move.

Long-Term Price Prediction (2030 & Beyond)

Success by 2030 means that Polygon is everywhere. Polygon could be used to power global gaming and RWA tokenisation by then. The price could also realistically move between $2.50 and $5.00.

However, this assumes that Polygon has become a hub for multi-chain activity. If this happens, POL would then be a staple in most digital portfolios.

Technical Analysis Overview

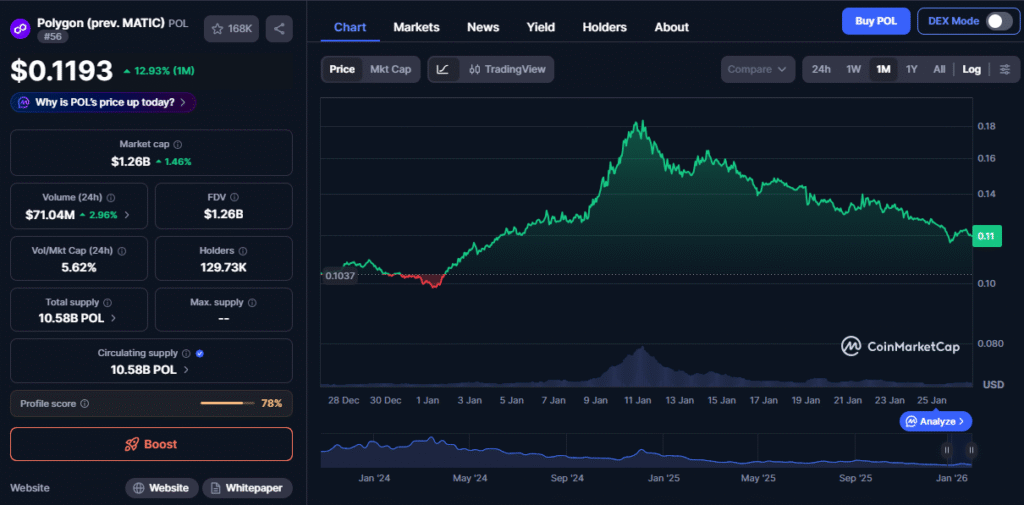

Polygon is currently consolidating after printing multiple lower lows. The price is trading below its 200-day Simple Moving Average, which is currently near $0.22 and breaking above it would indicate a major change in trend.

Polygon is showing a strong trend, and support seems solid around $0.11 | source: TradingView

Through it all, support is solid at $0.11 with a lower floor at $0.09. On the upside, $0.15 and $0.17 are the main obstacles and buyers need to clear these levels to gain speed.

Meanwhile, the Relative Strength Index is at 45, which shows the asset is not too expensive yet.

The MACD is showing a small bullish crossover and analysts believe that this means sellers are finally losing their grip. With this in mind, investors should watch the daily volume because high volume during a price break usually means that a trend will last.

Bullish vs Bearish Scenarios

Bullish Case

It would be a major win for Polygon if AggLayer successfully combines liquidity across dozens of chains.

Polygon could also explode if large banks use the Polygon CDK to launch their own private networks. If token burns exceed new token issuance, the supply could shrink too and affect the price.

Bearish Case

On the other hand, it would be bad for Polygon if users move to more centralised chains like Solana instead. US regulators could also label Layer 2 tokens as securities and damage Polygon’s standing (alongside others like Arbitrum and Optimism).

More issues could arise if a security flaw is found in the AggLayer bridge, of if network growth stalls while staking rewards continue to inflate supply.

Is Polygon a Good Investment?

Polygon is a strong choice for people who believe in the future of Ethereum.

It is one of the network’s most important pieces of infrastructure, and it is great for long-term holders who prefer utility over hype.

The token has deep liquidity on all major exchanges, which means that while its risks exist, they are lower.

The “Layer 2 space” is very competitive, which means that a rival could release a better technology tomorrow.

The crypto market is always volatile, so only invest money that you can afford to lose. Polygon has a “blue-chip” status, but it still follows the general market cycles.

FAQs

Can Polygon reach $10?

A $10 price would need a market cap over $100 billion. This is very high for the near future, and while it could happen in a hyper-bullish 2030, it is not a realistic short-term goal.

To be safe, a range of $3 to $5 is more grounded.

Is POL safe to hold?

Yes, Polygon is one of the most tested networks in the world. It has a massive team, and the technology is audited. No blockchain is perfectly safe, but Polygon is professionally managed.

Where can I buy the POL token?

You can find POL on any exchange like OKX, Binance, Coinbase, Kraken and MEXC. Most exchanges have already converted their old MATIC tokens to POL so if you hold tokens in a private wallet, you may need to use a migration tool.

What happened to the MATIC token?

MATIC was upgraded to POL to support a multi-chain vision. This new version allows for “restaking” and users can now earn rewards for securing many different chains at once.

Why is the burn rate so high?

Activity on prediction markets has surged between last year and now. These transactions generate fees, and a part of every fee is burned forever. This helps reduce the total supply of POL over time.

Final Thoughts

Polygon has a very ambitious roadmap, and by moving toward an aggregation layer, it is becoming a very important part of the web3 space.

Short-term prices may be quiet, but its growth is strong. As such, investors should watch out for technical updates and make sure to diversify their portfolios.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.