The current state of decentralized finance is no longer experimental applications but an actual on-chain financial stack that directly executes trading, lending, staking, and yield strategies without using intermediaries. The modern DeFi platforms are composable, permissionless protocols that users and developers can mix and match in an effort to construct financial workflows between chains and layer-2 networks.

- What are DeFi platforms?

- Types of DeFi platforms & core use cases

- DEXs / AMMs

- DeFi lending platforms

- Staking & liquid staking

- Yield aggregators

- Derivatives & perpetuals

- Bridges & cross-chain liquidity

- How we selected the best DeFi platforms

- Top DeFi platforms to watch in 2026

- 1. Uniswap (DEX / AMM)

- 2. Aave (Lending/Borrowing)

- 3. MakerDAO (Stablecoin & Lending)

- 4. Curve Finance (Stable AMM)

- 5. Lido (Liquid Staking)

- 6. Balancer (AMM + Portfolio Pools)

- 7. Yearn Finance (Yield Aggregation)

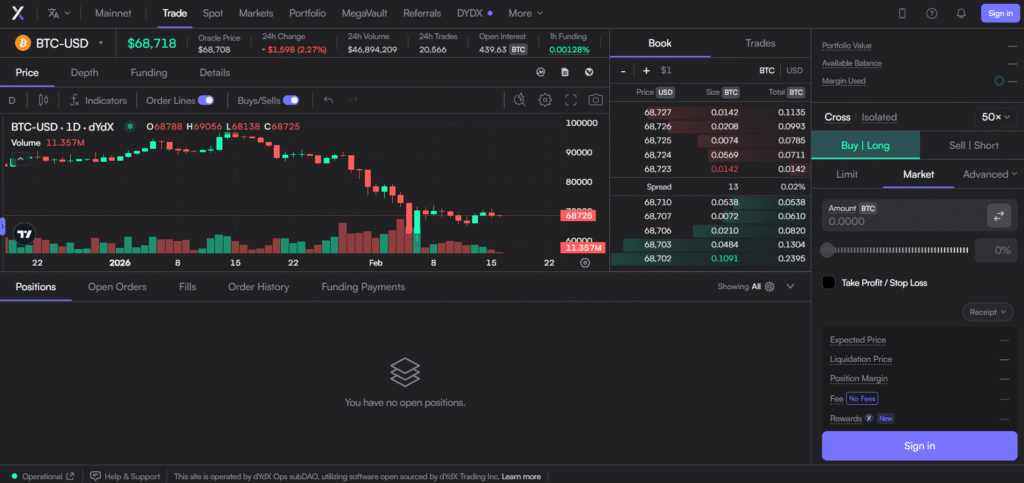

- 8. dYdX (Perpetuals)

- 9. THORChain (Cross-chain Liquidity)

- DeFi lending platforms: how they work & leading examples

- DeFi staking platforms & liquid staking

- Risk and safety checklist: how to vet a DeFi platform

- Practical tips for using DeFi platforms

- Quick comparison tables & key metrics

- Conclusion: choosing DeFi platforms responsibly

This guide describes the operation of decentralized finance platforms, the two primary types of platforms (DEXs, DeFi lending platforms, staking and liquid staking, yield aggregators, derivatives, and cross-chain liquidity), how to think about the safety and governance of such platforms, and which the most promising platforms currently are in 2026. The objective is applied knowledge: what each category entails, what the risks are, and how to perform due diligence of protocols before dealing with smart contracts.

What are DeFi platforms?

Decentralized finance platforms (also known as DeFi platforms) are smart contract-controlled on-chain applications. Their financial primitives include trading through automated market maker (AMM) pools, lending and borrowing, staking, derivatives, and cross-chain liquidity without centralized custody. Two ideas matter most:

- Permissionless access: everybody has a wallet.

- Composability: protocols integrate (e.g., a lending market acquires liquidity on a DEX pool).

This stackable system makes innovation fast but risky: an error or oracle breakage in one layer will be replicated throughout the integrated apps.

Types of DeFi platforms & core use cases

DEXs / AMMs

Liquidity pool and AMMs trading without custody. The major risks include slipperiness, irreversible loss, and MEV exposure.

DeFi lending platforms

Excessively secured lending/borrowing of on-chain liquidations and variable rates. Basic risks: Oracle crashes, cascading liquidation.

Staking & liquid staking

Base-layer assets (e.g., ETH) by being a stakeholder in a protocol; liquid stake tokens (LSTs) are protocol-composable but expose de-pegging risk.

Yield aggregators

Yield farming is automated by the use of vaults in pools and incentives. Strategy complexities and smart-contract risks are some of the risks.

Derivatives & perpetuals

Funding rate on-chain perps and liquidation engines. Risks: Oracle latency, liquidity fragmentation.

Bridges & cross-chain liquidity

Cross-chain and route liquidity. Oldest most impactful exploit surfaced in DeFi.

How we selected the best DeFi platforms

The short list of platforms that we selected consists of platforms that have persistent liquidity, an established security stance, and active governance:

- TVL and liquidity depth (protocol TVL, primary chains pool depth)

- Security posture (independent audits, bug bounties, timelocks, incident history)

- Decentralization & governance (on-chain governance, multisig controls, upgrade processes)

- UX/charges (L2 support, gas efficiency, documentation)

- Stability (integrations across the stack)

- Multi-chain support (Ethernet + layer-2s; chosen L1s)

- Community & developer activity (governance cadence, releases)

Top DeFi platforms to watch in 2026

(Includes leaders who are usually mentioned as the best DeFi platforms and the best DeFi apps 2026.)

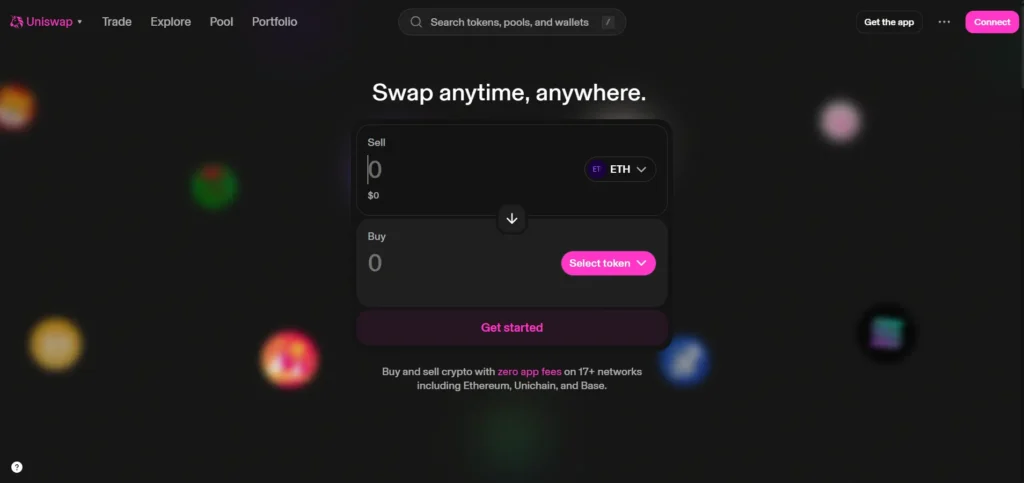

1. Uniswap (DEX / AMM)

- Positioning: Spot trading and liquidity provisioning, flagship AMM.

- Core features: liquidity pools, routing, and L2 rollouts.

- TVL & chains: approximately $5.8B on the Ethereum mainnet and large L2s.

- Security audits: Various third-party audits and a continuing bug bounty.

- Governance: on-chain proposal-based UNI governance; fee switches.

- UX Notes: State-of-the-art routing; L2s cut costs.

- Main risks: impermanent loss, MEV, and governance capture risk.

- Best use case: L2s’ high liquidity spot swaps and L2’s LP strategies.

Explore everything straight from the source on their website: https://app.uniswap.org/

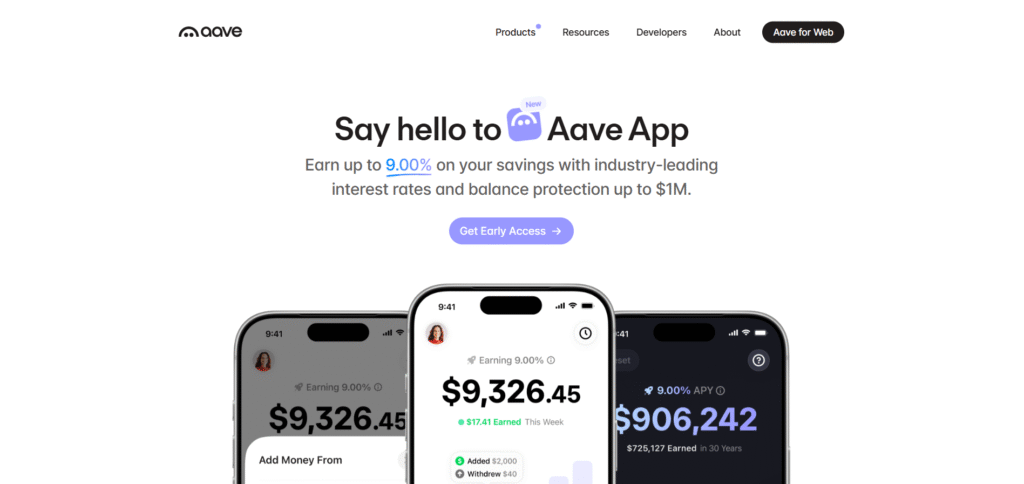

2. Aave (Lending/Borrowing)

- Positioning: Top credit delegation non-custodial lending market.

- Core features: variable/stable rates, isolation mode, and e-mode.

- TVL & chains: a total of about $9.6B in Ethereum + L2s and select L1s.

- Security audits: Repeat audits; bug bounty.

- Governance: AAVE token governance; risk parameters controlled by proposals.

- UX Notes: Intuitive dashboards; powerful L2 coverage of lower-cost borrows.

- Main risks: Oracle risk, liquidation cascades in volatility.

- Best use case: Efficient capital borrowing and reputable risk management.

Explore everything straight from the source on their website: https://aave.com/

3. MakerDAO (Stablecoin & Lending)

- Positioning: Issuer of DAI that is an on-chain collateralized debt position.

- Core features: Vaults, stability fees, and real-world asset integrations.

- TVL & chains: Approximately $7.4B on Ethereum.

- Security audits: lengthy audit history; risk-averse risk structure.

- Governance: Governance-based parameter updates and on-chain voting.

- UX Notes: More complicated UX compared to pure DEXs; integrations make it easier to get.

- Main risks: collateral risk, change of governance, and stress of peg stability.

- Best use case: Minting decentralized liquidity, which is stable, with crypto collateral.

Explore everything straight from the source on their website: https://makerdao.com/en/

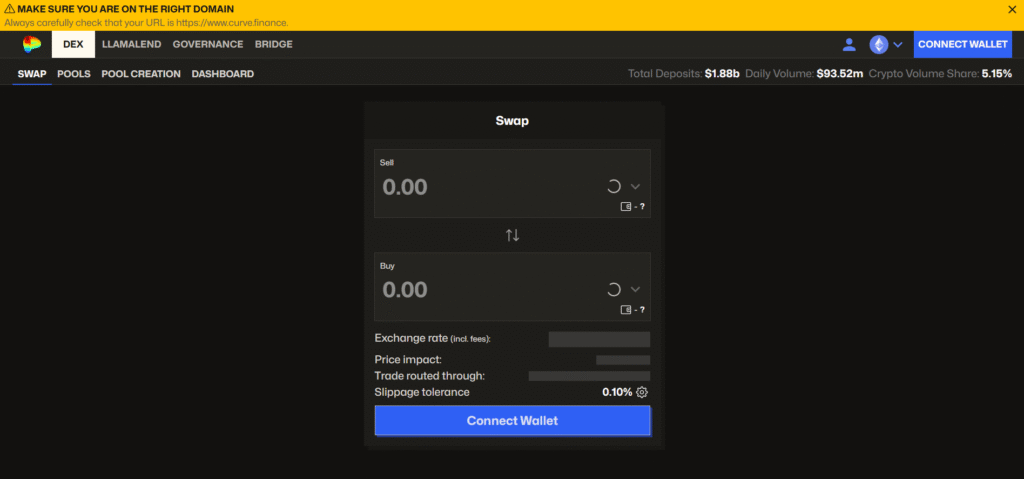

4. Curve Finance (Stable AMM)

- Positioning: Stable-asset and correlated-pair low-slippage swaps.

- Core features: Specialist AMM curves; profound stablecoin liquidity.

- TVL & chains: ~$3.2B in Ethereum + L2s.

- Security audits: Security audits; bug bounty.

- Governance: The ve-token model harmonizes liquidity incentives.

- UX Notes: Power-user interface; routing is made easier by aggregators.

- Main risks: Pool imbalances; new-pool smart-contract risk.

- Best use case: Stablecoin trading and base liquidity of yield strategies.

Explore everything straight from the source on their website: https://www.curve.finance/dex/ethereum/swap

5. Lido (Liquid Staking)

- Positioning: Leading liquid staking provider of ETH.

- Core features: stETH LST, validator set management.

- TVL & chains: approximately $14.1B in the form of staked ETH.

- Security audits: Audited contracts, bug bounty, and validator diversification.

- Governance: DAO regulation of parameters and operators.

- UX Notes: Thumb minting and L2 integrations enhance composability.

- Main risks: LST de-peg risk; issues with validator concentration.

- Best use case: Investing in ETH and maintaining DeFi composability.

Explore everything straight from the source on their website: https://lido.fi/

6. Balancer (AMM + Portfolio Pools)

- Positioning: A flexible AMM of multi-asset pools and index-like strategies.

- Core features: Weighted pools and boosted pools that are overlaid with lending.

- TVL & chains: approximately 1.6B of Ethereum and L2s.

- Security audits: Audited, bug bounty, cautious pool onboarding.

- Governance: BAL control of parameters and emissions.

- UX Notes: Enhanced pool design; superior via integrator UIs.

- Main risks: Complexity of the pool design; IL in volatile baskets.

- Best use case: Portfolio-based liquidity and tailored AMM strategies.

Explore everything straight from the source on their website: https://balancer.fi/

7. Yearn Finance (Yield Aggregation)

- Positioning: Vault-based automated yield strategies.

- Core features: Strategy switching, risk-rated vaults.

- TVL & chains: Approximately $1.1B on Ethereum and L2s.

- Security audits: Strategy audits, a layered review process, and bug bounty.

- Governance: YFI governance; conservative risk controls.

- UX Notes: Strauss vault deposits; open-minded strategy notes.

- Main risks: complexity of strategy; integration risk with underlying protocols.

- Best use case: The most effective usage is passive yield aggregation to users who do not wish to maintain positions.

Explore everything straight from the source on their website: https://yearn.fi/

8. dYdX (Perpetuals)

- Positioning: Decentralized perpetual exchange with high liquidity.

- Core features: On-chain order books, perpetuals, and cross-margin.

- TVL & chains: App-chain stack protocol collateral of about $0.9B.

- Security audits: Audited codebase; live bounty program.

- Governance: Parameters and upgrades token governance.

- UX Notes: reduced charges on app-chain compared to mainnet.

- Main risks: Oracle latency; spike stress tests liquidation engine.

- Best use case: It is used when active derivatives traders are interested in non-custodial perps.

Explore everything straight from the source on their website: https://dydx.trade/trade/BTC-USD

9. THORChain (Cross-chain Liquidity)

- Positioning: Unwrapped assets, native cross-chain swaps.

- Core features: Liquidity pools of large L1 assets; cross-chain routing.

- TVL & chains: the order of $1.9B in supported L1s.

- Security audits: Re-audits after an incident; strengthened operational controls.

- Governance: Protocol parameter governance using nodes.

- UX Notes: Integrator wallets polished UX, increasing complexity in the engine.

- Main risks: surface area alongside a bridge; chain-level stalls.

- Best use case: Interchain swaps in the non-centralized bridges.

Explore everything straight from the source on their website: https://thorchain.org/

DeFi lending platforms: how they work & leading examples

DeFi lending platforms are based on the principle of over-collateralization: these platforms allow users to place collateral and borrow funds, and they are liquidated on-chain in case the specified health metrics drop below certain limits. Rates vary according to utilization; liquidators arbitrage under-collateralized trades. The most promising in 2026 are Aave and MakerDAO (minting stable liquidity), where risk management is based on price quality oracles, low LTV thresholds, and volatility circuit breakers.

DeFi staking platforms & liquid staking

With DeFi staking platforms, users are able to deposit their funds and get liquid staking tokens (LSTs) as a representation of staked positions. It has such benefits as composability across lending & AMMs and reduced opportunity cost compared to native staking. Risks are the concentration of validators, smart-contract risk in LST wrappers, and temporary de-pegs in the case of market stress. The implementation of Lido is still the reference; it is important to diversify with operators and chains.

Risk and safety checklist: how to vet a DeFi platform

- Recency/Audits: a series of independent audits; scope and date of checks.

- Bug bounties: live shows with significant rewards.

- Admin keys & timelocks: time-gated upgrades; multisig requirements.

- Oracle design: circuit breakers; redundant feeds.

- Upgradeability: open governance and suspension.

- TVL concentration: do not rely on an individual pool or incentive.

- Incident History: Review and quality remediation.

- Insurance options: On-chain coverage where possible.

Practical tips for using DeFi platforms

- Use a well-known wallet and a hardware wallet.

- Start on layer-2 to reduce fees.

- Check the address of contracts through official documents.

- Set conservative slippage; do not have thin pools.

- Always start with a small amount.

- Monitor lending position health indicators and warnings.

- Approve tracks; revoke unused allowances.

Quick comparison tables & key metrics

Top DeFi Platforms Comparison

| Platform | Category | TVL (snapshot) | Chains supported | Main token | Best for |

| Uniswap | DEX / AMM | ~$5.8B | Ethereum, major L2s | UNI | Deep spot liquidity on L2s |

| Aave | Lending | ~$9.6B | Ethereum, L2s, select L1s | AAVE | Capital-efficient borrowing |

| MakerDAO | Stablecoin/Lending | ~$7.4B | Ethereum | MKR | Minting decentralized stable liquidity |

| Curve | Stable AMM | ~$3.2B | Ethereum, L2s | CRV | Low-slippage stable swaps |

| Lido | Liquid staking | ~$14.1B | Ethereum + integrations on L2s | LDO | Liquid ETH staking |

| Balancer | AMM / Portfolios | ~$1.6B | Ethereum, L2s | BAL | Custom pools & indices |

| Yearn | Yield aggregator | ~$1.1B | Ethereum, L2s | YFI | Passive yield strategies |

| dYdX | Perpetuals | ~$0.9B | App-chain + Ethereum bridges | DYDX | Non-custodial perps |

| THORChain | Cross-chain liquidity | ~$1.9B | Major L1s | RUNE | Native cross-chain swaps |

Major metrics & security snapshot

| Platform | Audit status (latest) | Admin keys / timelock | Bug bounty | Known incidents | Snapshot date |

| Uniswap | Multiple audits (2024–2025) | Yes (timelocked) | Yes | None material post-v3 | 2026-02-01 |

| Aave | Multiple audits (2024–2025) | Yes (timelocked) | Yes | None material | 2026-02-01 |

| MakerDAO | Ongoing audits (2024–2025) | Yes (governance) | Yes | Historical liquidations stress | 2026-02-01 |

| Curve | Audits per pool (2024–2025) | Mixed by pool | Yes | Pool-specific incidents (historical) | 2026-02-01 |

| Lido | Audits (2024–2025) | Yes (DAO + operators) | Yes | LST de-peg volatility episodes | 2026-02-01 |

| Balancer | Audits (2024–2025) | Yes (time-locked) | Yes | Isolated pool incidents (historical) | 2026-02-01 |

| Yearn | Strategy audits (2024–2025) | Yes (governance) | Yes | Strategy-level incidents (historical) | 2026-02-01 |

| dYdX | Audits (2024–2025) | Yes (governance) | Yes | Nonmaterial | 2026-02-01 |

| THORChain | Re-audits post-incidents | Protocol controls | Yes | Historical bridge-adjacent incidents | 2026-02-01 |

Protocol TVL and user safety can change quickly as incentives rotate and liquidity migrates across chains. Treat snapshots as directional, not guarantees.

Conclusion: choosing DeFi platforms responsibly

The DeFi stack will be sufficiently mature to be used daily, such as for trading on AMMs, borrowing on DeFi lending sites, staking in an LST, and automated yield, but risks are not trivial. Prefer audited protocols that have time-locked upgrades, diversified oracles, good governance, and bug bounties. Shop on layer-2s to manage fees and position size conservatively, and no smart-contract risk is zero. This is a summary of the DeFi platforms that is intended to assist you with the categories and shortlisting reputable ones, not to suggest a specific protocol.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.