Key Insights

- The Indian women’s cricket team won their first ICC Women’s World Cup on November 2.

- Bitcoin and the Indian cricket team both faced early scepticism before gaining acceptance.

- Both movements prove that consistency can overcome doubt.

Indian women’s cricket made history on November 2 after winning their first ICC Women’s World Cup. The victory stands as more than just a sporting achievement.

It tells a story about proving critics wrong through sheer consistency.

Both started as underdogs. Both faced ridicule and dismissal, and yet both have achieved success by staying true to their vision.

Early Struggles and Building Foundations

Two decades ago, women’s cricket in India barely received any attention. Funding was limited and Media coverage was almost nonexistent. Young girls who wanted to play cricket faced obstacles at every turn.

They lacked proper infrastructure and coaching and Public enthusiasm for women’s cricket was nowhere near the support given to men’s teams. Yet a small group of players, coaches and administrators refused to give up.

These dedicated individuals worked quietly and practised hard. They improved their skills year after year despite limited resources and recognition.

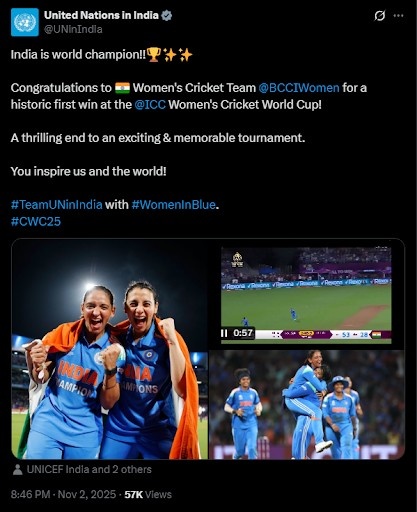

India’s women cricket team recently emerged victorious at the World Cup | source: X

Interestingly, Bitcoin’s early days followed a similar pattern. Satoshi Nakamoto launched Bitcoin in 2009 as a decentralised digital currency and the concept challenged everything traditional finance stood for.

Financial institutions viewed it with suspicion. Many called it a scam or a bubble that would soon burst. Economists predicted its collapse regularly and early adopters were seen as reckless gamblers betting on an unproven technology.

Yet those early believers understood something that others missed. They saw the value in a system that didn’t require banks or government control.

The Power of Persistence

Both movements survived because their supporters never wavered. They continued working even when success seemed far away, and they built their foundations one small step at a time.

Indian women’s cricketers and the Indian cricket team kept playing and improving, while Bitcoin’s network kept running and growing. The work happened away from the spotlight but it was happening nonetheless.

Breakthrough Moments That Changed Everything

Indian women’s cricket didn’t transform overnight. The change came gradually through strong performances. The Indian cricket team reached the World Cup finals in 2005 and 2017 and started changing public perception.

Players like Mithali Raj and Jhulan Goswami became household names. Their skill started to capture attention, and little by little, they proved that they belonged on the world stage.

Mithali Raj and Jhulan Goswami at the cricket world cup | Source: Circle of Cricket

As victories piled up, public interest grew and Media coverage increased. Corporate sponsors started paying attention and the 2025 World Cup win was the ultimate validation.

It transformed the Indian cricket team from underdogs into celebrated champions.

Bitcoin followed a similar path. Despite constant predictions of failure, the network kept functioning. Each market cycle brought more adoption and the technology behind it started attracting attention.

Major companies began taking Bitcoin seriously and now, MicroStrategy, Block (formerly Square) and Tesla currently have massive open investments.

Nowadays, payment processors have started accepting it and there are now regulated Bitcoin futures/ETFs.

So far, the narrative has moved from “Is this a scam?” to “How much should we invest?”

From Rejection to Acceptance by Institutions

The 2025 World Cup victory changed how institutions view women’s cricket in India.

The Board of Control for Cricket in India will likely increase funding by a great deal, and will invest more in training and domestic competitions.

Corporate sponsors are also lining up to associate with a winning Indian cricket team. The internet is now filled with coverage of Women’s cricket, and the sport has moved from the edges to the center stage.

This institutional shift is similar to what happened to Bitcoin. Major financial institutions that once dismissed it now offer crypto services, and investment banks that called it a Ponzi scheme now help clients invest in it.

Institutions that once dismissed Bitcoin are approaching | source: X

Pension funds are also considering allocations and university endowments are quietly adding digital assets.

The conversation has changed completely and holding Bitcoin is no longer seen as reckless.

Why Institutions Changed Their Minds?

Several factors drove this institutional acceptance of Bitcoin, and one of the biggest ones was the rise in public recognition.

Some are even calling it digital gold, especially during times of inflation.

Bitcoin’s performance over the past decade forced people to pay attention. It outperformed most traditional asset classes and regulatory clarity improved, making institutions more comfortable.

The fear of missing out certainly played a part, but the real change came from more and more people recognizing its value.

Looking Ahead to Future Success

The World Cup victory opens new doors for Indian cricket teams. The increased recognition will undoubtedly attract more talent. Competition will deepen and India will likely dominate women’s cricket for years to come.

The initial scepticism is gone and expectations have flipped completely. People now expect excellence from the Indian cricket team.

Meanwhile, Bitcoin’s story continues to unfold. Despite tremendous growth, it keeps growing and TradFi integration continues to deepen.

At the end of the day, these two stories teach us something important about change.

The best ideas and the most extraordinary talent face almost always face raised eyebrows at first. At the end of the day, what matters is the response to that doubt.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.