Key Insights

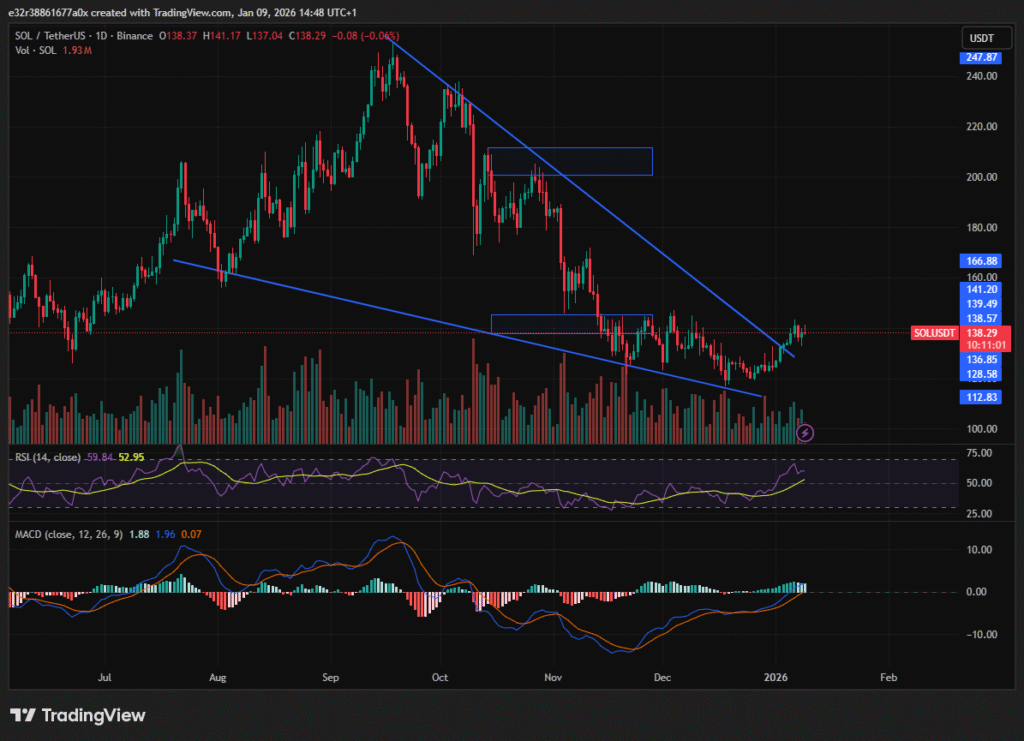

- Solana successfully recovered from a local bottom of $117 and registered an 11% price increase in under 48 hours.

- Technical analysts have identified the $147 mark as the next structural trigger that could unlock a rise toward $250.

- The network recently reached a milestone with the Firedancer validator client going live.

The opening weeks of the year have been a wild ride for the Solana ecosystem. After a tough end to last year, the asset finally found a lifeline this week.

On January 7, the price touched a local bottom of $117. This low point triggered a strong response from buyers who were waiting for a discount. By January 9, the price had stabilised around $138.

Read More: Solana Coils for $147 Breakout as Bulls Eye $172 Target

Protecting the Solana Support Floor

The bounce from $117.43 did not happen by accident. This specific price area is in line with a value zone where large investors historically step in to buy.

In essence, for the current recovery to last, the asset must stay above the $120 to $124 range. This is a must hold demand area that Solana needs to stay above.

Trading floors are currently calling this a repair phase. As long as the price stays above $120, the recent drop looks like a healthy correction. If this floor holds, the price action resembles a coiling spring ready to jump.

However, falling below $117 would change the story, and such a move would force the market to look for a new bottom near $90.

Reclaiming the $147 Trigger

While $117 is the floor, $147 is the ceiling that matters most. This level has capped every recovery attempt since the end of last year, and breaking above would be the trigger that flips the chart from bearish to bullish.

Once the price closes above this barrier, the path to higher targets opens up.

Analysts see three main goals if the bulls take control of the $147 level. The first target sits at $167, offering a 21% gain from today. The second zone is between $180 and $200, where many sellers might take profits.

The final target is $250, where reaching this height would represent a total 80% upside for the 2026 cycle.

Why the Solana Network is Healthier Now

The hope for an 80% move is not just based on lines on a chart. The underlying health of the blockchain itself is better than ever before, and several changes are giving investors confidence in a long-term rally.

The first is the long-awaited Firedancer validator client that went live on the mainnet in December. This validator client was developed by Jump Crypto and allows the network to handle up to 1 million transactions per second in tests.

Over 20% of validators already use this new tool, and this reduces the risk of the outages that happened in the past.

Secondly, big money is flowing into the ecosystem through regulated products. Assets in the Bitwise BSOL ETF recently passed $1.02 billion. In just one week, investors put nearly $800 million into these funds.

This has so far provided a steady stream of buying pressure.

Finally, real-world utility is on the rise. Active addresses grew to 3.78 million this year. Additionally, Total Value Locked (TVL) is now over $9.1 billion.

Most importantly, the stablecoin supply reached $14.8 billion. This shows that people are using the network for real payments and settlements.

The Overbought Trap

Despite the excitement, the market is still in a fragile state. The Relative Strength Index on the 4-hour chart currently sits near 67, and this indicates that the asset is approaching overbought territory in the short term. If buyers cannot push past $147 soon, the price might start to chop sideways.

A failure to break the ceiling could lead to a mean reversion trade.

In this scenario, the price would bounce between $117 and $147 for months. This sideways movement tends to exhaust smaller traders, and the smart money is likely waiting for a high volume break before entering new large positions.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.