Key Insights

- Monero has been the top investor choice for financial privacy for a long time, because it hides important details for every transaction.

- Major exchanges like Binance and OKX have removed XMR due to strict global rules like the FATF Travel Rule.

- Investors can still buy Monero through specific international exchanges, instant swap services, and decentralized P2P networks.

Related: Whales Accumulate ZCash (ZEC) Despite Market Strain, Pushing it Above $500

Intro

The crypto market has changed so much over the last few years that it is now harder to buy Monero for some reason. The year is already in full swing, and government oversight has reached a new peak. Now, many people want to keep their financial data private, yet mainstream platforms are closing their doors to privacy coins.

Here is a guide to finding and buying XMR, along with why it matters right now.

Read More: Dubai Bans Privacy Coins Amid New Digital Asset Rules

Where to Buy Monero on Centralised Exchanges?

Gone are the days when users could find XMR on every big app, because most domestic platforms have removed it to follow local laws. However, a few international names still offer trading pairs.

However, you will need to complete identity checks (KYC) to use these.

The first of these platforms is MEXC, which is currently one of the busiest spots to buy Monero. It supports pairs like XMR/USDT and XMR/USDC.

You can also still use Kraken for XMR in the United States and Canada. Sadly, they stopped supporting it in Europe and the UK. Finally, KuCoin serves many global users and is a good option for users who live outside of heavily restricted areas.

Fast Swaps and Non-Custodial Services

Users who already have assets like Bitcoin or Litecoin can also get some Monero. Even better, they do not need a full exchange account because instant swap services allow you to trade one coin for another.

These are great because certain services send XMR directly to user wallets in exchange for other mainstream cryptos.

Some popular examples include Changelly and ChangeNOW, which usually do not ask for a login.

However, traders should be aware that they might ask for ID if you try to swap a very large amount.

Using P2P and Decentralised Platforms to Buy Monero

Many users avoid big companies entirely, even before the bans. Instead, they prefer Peer-to-Peer (P2P) trading, which means that traders can buy directly from another person.

Haveno is a new leader in this space. It is a decentralised exchange (DEX) built specifically for Monero, and replaced older sites like LocalMonero. Since it has no central boss, it is very hard for governments to shut it down.

Bisq is another solid open-source choice in this niche.

Why The Exchange Bans In The First Place?

Related: Dubai Bans Privacy Coins Amid New Digital Asset Rules

Traders often wonder why so many exchanges stopped selling XMR.

The simple answer is that the coin is not broken or compromised. In fact, the problem is that it works too well.

Regulators want to see every transaction users make, but Monero prevents this.

Monero uses stealth addresses and ring signatures to hide these details, making the entire chain a black box where no one can see the history of coins.

Because exchanges cannot report these details, they often choose to remove XMR rather than face fines.

To top things off, just because an exchange stops selling a coin does not make it illegal. In most places, you can still own and mine XMR, and the rules mostly apply to the companies that sell it.

The Privacy Premium

The Privacy Premium

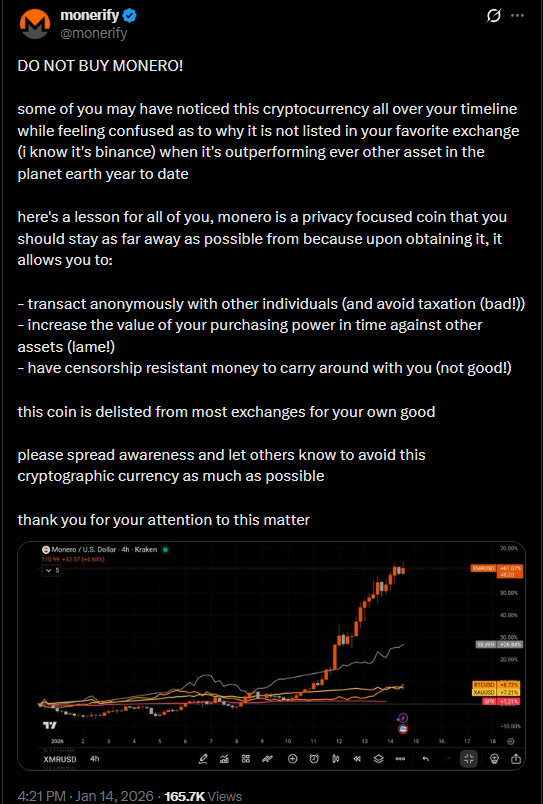

Something interesting is happening with the price because of these restrictions.

Because Monero is now harder to obtain, it often costs more on P2P sites than on big exchanges, a phenomenon known as a “privacy premium.” People are willing to pay extra for coins that cannot be tracked, and as DeFi surveillance grows around the world, the demand for “untraceable” wealth increases.

Many now see Monero as a shield against the new Central Bank Digital Currencies (CBDCs) that track every cent you spend. This privacy premium also reflects growing global concerns about financial freedom, personal data security, censorship resistance, cross-border transactions, and maintaining control over one’s digital assets in an increasingly monitored ecosystem.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.