Key Insights

- Coinbase serves over 120 million people across 100 countries and handles billions in trades every single quarter.

- The platform now offers stocks, ETFs and its own blockchain.

- Trading fees can range from flat retail fees to tiered institutional rates, and users can choose between simple and advanced interfaces.

Coinbase has become far more than a simple place to buy Bitcoin. It has now become a massive financial titan on the NASDAQ, and people often call it the Everything Exchange because it connects crypto and stocks.

- Coinbase’s History

- Financial Services Offered by Coinbase

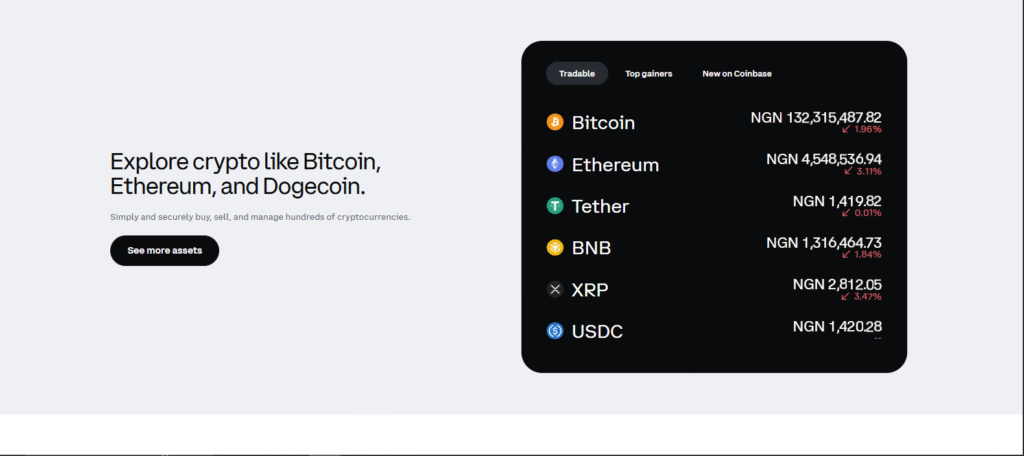

- Coinbase offers several financial services | source: Coinbase

- Retail Investing and Daily Use

- Institutional Support via Coinbase Prime

- The Developer Ecosystem

- Fees and Charges On Coinbase

- Unique Features of Coinbase

- How to Create a Coinbase Account

- The Strict KYC Requirements

- Common Questions About Using the Platform

Since its early days, the company has focused on being safe and easy to use. As of writing, it has now become a major part of how the world moves money.

Related: Coinbase Threatens To Oppose CLARITY Act Over Reward Rules

Coinbase’s History

The exchange’s founder, Brian Armstrong and Fred Ehrsam started the company in June 2012.

At the time, Armstrong worked at Airbnb while Ehrsam came from a background at Goldman Sachs. Both of these individuals wanted to make buying Bitcoin as simple as sending an email.

They joined the Y Combinator program and by 2014, the platform had nearly 2 million users.

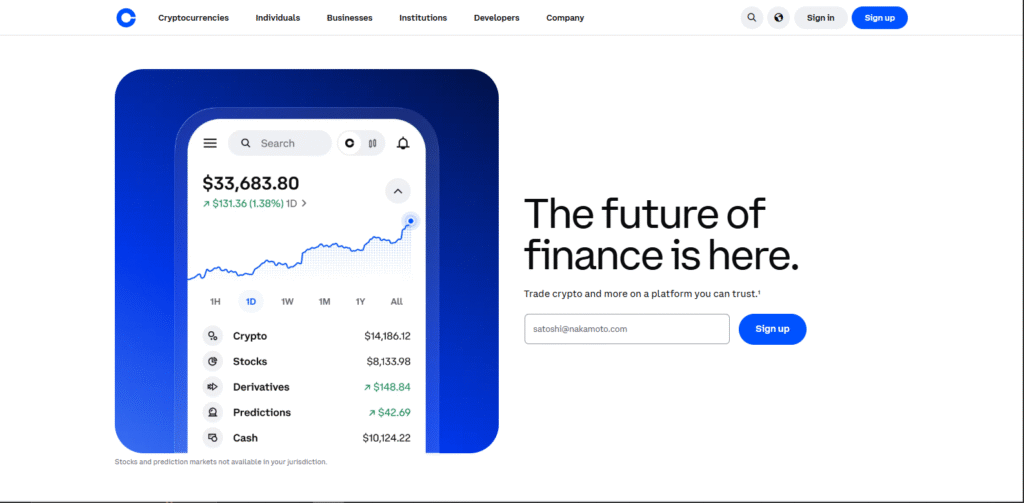

Coinbase’s homepage and services | source: Coinbase

It launched GDAX to help professional traders, which later turned into Coinbase Pro and then Coinbase Advanced. However, soon after in April 2021. The company went public on the NASDAQ.

It was the first major crypto exchange to do so and it debuted with a value of about $85 billion.

Between 2024 and now, the company has expanded its reach into areas like defi, with the Base network.

It also began offering traditional stocks for trading, which eventually turned the app intoa an “everything exchange” for investors.

Financial Services Offered by Coinbase

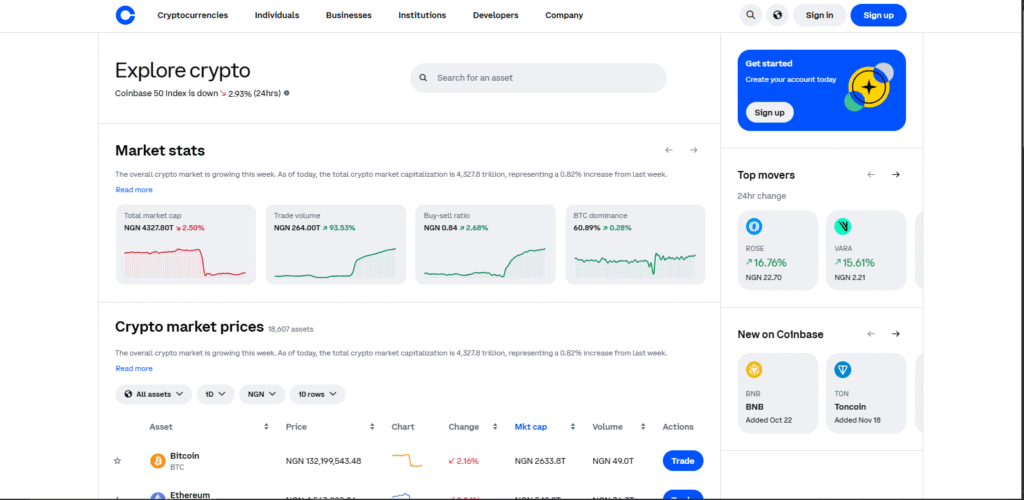

Coinbase offers hundreds of services to its customers, which include regular people, big companies and tech developers. In particular, most people use the main app for its simplicity.

Coinbase offers several financial services | source: Coinbase

Retail Investing and Daily Use

Regular users can trade over 300 different digital assets, whether Bitcoin, Ethereum or newer coins.

Staking on Coinbase is also is a huge draw for many. The exchange lets users earn rewards for holding certain coins and usually takes a commission of 25% to 35% on these earnings.

Coinbase is also a popular choice for active users, because it costs around $29.99 each month. This subscription gives you zero trading fees on many orders, while providing better support and more staking rewards.

The Coinbase Visa Card is another useful tool, because it allows users to spend their crypto on any store that takes Visa.

The biggest development from Coinbase over the last few months was its stock trading feature, which allows US users to buy thousands of stocks and ETFs from one app.

The app also allows users to manage their Apple or Tesla shares right next to their Bitcoin. Moreover, the platform has prediction markets available through a partnership with Kalshi.

In other words, users can bet on things like election results or sports games.

Institutional Support via Coinbase Prime

Big funds and rich individuals also use Coinbase Prime as a pro brokerage service.

This is because it offers a feature called Custody. This service keeps $400 billion in assets safe and most of this money stays in cold storage, which means that it is offline.

Prime also uses Smart Order Routing, which searches for the best prices across many markets. It helps big players trade millions without moving the price of said asset (whether Bitcoin or Ethereum) too much.

Even more, users can get loans using their crypto as collateral.

The Developer Ecosystem

Coinbase launched Base in 2023 as a layer 2 network built on Ethereum.

Base has been popular because it makes transactions very fast and very cheap and developers use it to build new apps for the decentralised web.

The Coinbase Wallet is another part of this arrangement, because it is a self-custody wallet and allows users to hold their own secret keys. In other words, you use it to browse the web3 space and own NFTs.

Finally, Coinbase Cloud gives tech firms the tools to build their own blockchain services.

Fees and Charges On Coinbase

The cost of using the platform depends on how you trade. It is important to note here that simple trades on the main app are different from professional ones.

Simple Trades and Spreads

If you use the basic “Buy” button, this means that you have to pay a spread and a transaction fee. This spread is usually around 0.50% of the price, and transaction fees can cost around $0.99 for small trades.

Meanwhile, larger ones are a percentage that can reach nearly 4% and the exact cost depends on whether you use a bank account or a debit card.

Coinbase offers a wide fee range for users | source: Coinbase

Advanced Trading Model

Experienced traders use the maker-taker model, which happens on the Coinbase Advanced interface. In this model, your fee drops as you trade more volume over 30 days.

Here is a table explaining this

| 30 Day Volume | Taker Fee | Maker Fee |

| Under $10k | 0.60% | 0.40% |

| $10k to $50k | 0.40% | 0.25% |

| $50k to $100k | 0.25% | 0.15% |

| Over $400M | 0.05% | 0.00% |

As shown, maker fees are lower because these orders add liquidity to the book. On the other hand, taker fees apply when you buy or sell at the current market price.

Extra Costs to Watch Out For

There are a few other charges to keep in mind. To start with, sending crypto to an outside wallet costs a network fee. This is the gas fee paid to the blockchain and Coinbase does not keep this money.

Additionally, if you stake assets, the standard commission is 35%. However, Coinbase One members pay less and can pay as little as 25.25%. There is also a 5% fee for recovering tokens sent to the wrong address and this only applies if the amount is over $100.

To sum things up, Coinbase stays ahead by following strict rules and building new tech.

Over the years, it has grown from being just another crypto company into a bridge between the old and new worlds when it comes to finance.

Unique Features of Coinbase

Safety is the biggest reason people choose this platform. This is because Coinbase is a public company and it goes through regular audits to make sure that all of its operations are correct.

Coibase also does not hide its reserves because SEC rules force the company to be honest about its holdings.

Base is another reason the platform is popular.

Base is another popular Coinbase offering | source: Coinbase

As mentioned earlier, it is a layer two network, which means that it sits on top of Ethereum to make things faster. In other words, users can send assets to Base from the main app instantly.

Costs are also low and developers use it to build apps like social media platformsand AI agents. The company earns money from these network activities and all of this revenue helps them stay stable even when trading slows down.

Education is also another important part fo Coinbase’s services.

The Learn to Earn program gives users free crypto in exchange for watching short videos and answering questions.

How to Create a Coinbase Account

Coinbase, as mentioned, isknown for its simplicity. This means that setting up a profile is very simple, and anyone can use a phone or computer.

First, visit the website or download the app. Enter your full legal name and a valid email. Then pick a password that is hard to guess and remember to not use a VPN while signing up as the system will block you to follow local laws.

Second, verify your contact details via a code in your email. You will also need to link your phone number and set up two-factor authentication.

All of these processes are important for keeping hackers away from your money. If you can, avoid text message verifications and instead use a security app like Google Authenticator.

Third, pick the right account (note that most people need an individual account). However, if you are a business, you should choose the commercial option.

Fourth, fill out your financial profile. The law requires Coinbase to ask about your job, so be sure to fill in your details as well as you can. This helps Coinbase understand where the money is coming from, and whether you plan to invest or just shop around for crypto.

Finally, add a payment method. Note that you can link a bank account through Plaid. Debit cards and Apple Pay work too.

The Strict KYC Requirements

While Coinbase is known for being easy to use, it is also a very compliant exchange.

This means simply that you cannot skip the identity checks. If you do, you can only look at prices, and you will not be able to buy or sell anything.

You need a government photo ID, and a driver’s license or passport works best. If you are an international user, you can consider using a national ID card.

Note that the app will ask for a selfie and compare your face to the photo on your ID to make sure that you are the real owner of the account.

Some places require proof of address and while a utility bill or bank statement usually works, it must be less than three months old.

Tax rules have also changed so far this year, and US users must provide a Social Security Number to use Coinbase. The IRS now requires the 1099 DA form and Coinbase sends this to you every year.

This is a special document that shows exactly how much you made or lost, and it makes filing your taxes much simpler. It also gives the government a clear view of how much you made or lost.

Common Questions About Using the Platform

Q: Is my money on Coinbase insured?

- Cash: For US customers, USD balances are held in pooled accounts at FDIC-insured banks. In other words, your cash is protected up to $250,000.

- Crypto: Crypto is not FDIC-insured. However, Coinbase has a commercial crime insurance policy that protects part of its assets in case of theft or hacks.

Q: Can I use Coinbase if I live outside the United States?

Yes, Coinbase is available in over 100 countries including most of Europe, Canada, Singapore and parts of Latin America. However, some features (like the Coinbase Card or specific staking assets) can be different sometimes by region, or be based on local laws.

Q: What happens if I lose my phone?

Coinbase is a centralised exchange, which means that they can help you recover your account through their support team after you pass a series of verification checks.

This is different from a “self-custody” wallet (like Coinbase Wallet), where losing your recovery phrase means your funds are gone forever.

Q: Does Coinbase support NFTs?

Yes, Coinbase has an internal NFT marketplace where users can trade and showcase their digital collectables. You can also use your primary exchange balance to buy NFTs directly.

Here are more common questions users have when navigating the Coinbase platform in 2026. These cover account limits, transfer speeds, and security practices.

Q: How do I increase my buying and selling limits?

Your limits depend on your account age, location, the level of identity verification you have finished and other factors.

Coinbase automatically adjusts these over time, such that if you need higher limits immediately, go to your account settings and complete any remaining verification steps.

You might be asked for a fresh photo of your ID or to answer a few more security questions.

Q: How long does it take to move my money to a bank account?

The timing depends on the method you choose, because standard ACH transfers in the US usually take 3 to 5 business days.

However, if you are in a rush, you can use Instant Cashouts, which sends money to your debit card or a bank account that supports Real Time Payments (RTP).

Q: Can Coinbase recover my crypto if I send it to the wrong address?

Most crypto transactions are final and cannot be reversed. However, Coinbase recently added an Asset Recovery tool for certain unsupported tokens.

This means that if you accidentally sent a specific token to your Coinbase address that the exchange does not support, they might be able to get it back for you.

Keep in mind that they charge a 5% fee for this service on amounts over $100.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.