Key Insights

- Technical indicators are now showing that Solana is building strength for a breakout above $147.

- Institutional demand appears high with millions flowing into spot Solana ETFs from Bitwise and Fidelity.

- Real-World Asset tokenisation on the network has surged over 300% to hit new high.

The crypto market appears to be finding its footing in the new year, especially after a shaky end to the previous one, where most lost value.

Solana in particular, has been an investor favorite in this new year recovery.

The cryptocurrency is now trading at around $137 and traders are watching a specific pattern on the charts. This phase is known as “coiling”, and most analysts believe this is a sign of a coming price surge.

Read More: Can Solana Reach $1000 by 2030?

Solana Coils for $147 Breakout as Market Energy Builds

Price action over the first week of January shows that Solana and the general market are printing higher lows.

This indicates that the buyers are stepping in earlier each time the price dips. The range between buyers and sellers is also narrowing fast and this energy buildup usually leads to a fast price movement.

Several technical signals are lining up at once, too. For example, the 50-day Exponential Moving Average recently crossed above the 100-day average. Traders tend to see this as a signal for strength.

Solana is flashing strength with the 50 and 100-day EMAs | source: TradingView

Solana has also turned the $130 level into a strong support floor. For weeks, sellers pushed the price down every time it hit this mark.

Now, the asset is trading above that line with ease, and is eyeing the $147 resistance as the final hurdle. This level matches a major Fibonacci retracement point, where breaking through would prove that the bulls have full control.

On January 5, the network successfully defended the $135 mark and the Relative Strength Index now sits at 64. This means there is still room for the price to climb before it becomes overbought.

Institutional Inflows Provide Fuel for Solana

Retail traders are also feeling better about the market. However, big money is the real engine behind this move.

This year seems to be a major turning point for Solana investment products because institutional buyers are moving millions of dollars into the ecosystem.

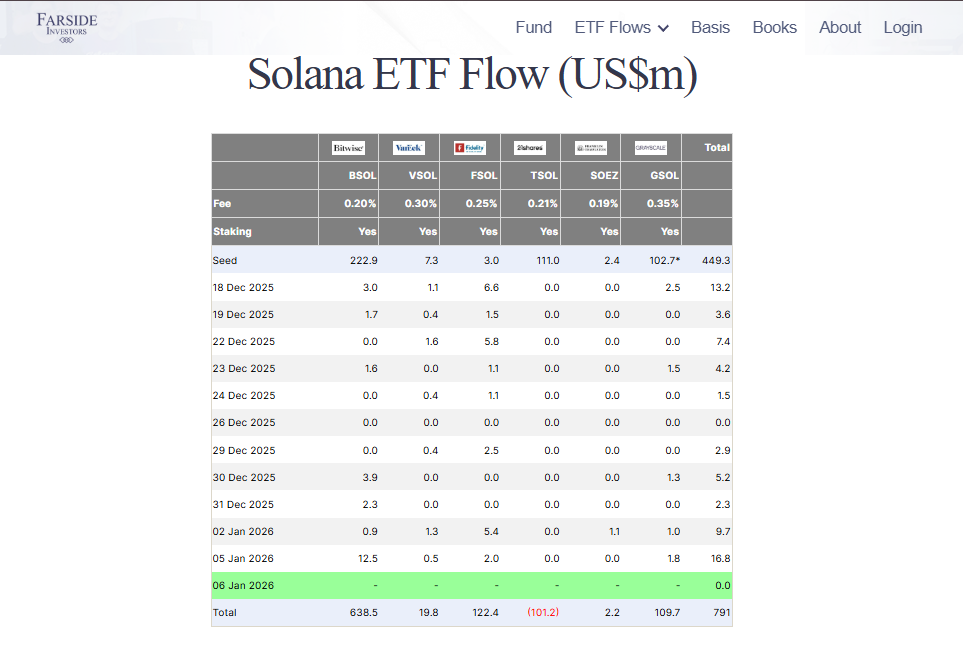

On January 5 alone, spot Solana ETFs saw a net inflow of $16.24 million. This shows that larger investors are taking positions over the long-term.

Institutional investors have been buying Solana via the ETFs | source: Farside

Bitwise also led the daily inflows with $12.47 million, while Fidelity followed with another $2.04 million in its FSOL product. 21Shares also saw steady growth after its launch on the CBOE late last year.

These inflows represent stable capital and unlike retail speculators, ETF providers must hold the underlying SOL to back their shares. This removes millions of dollars’ worth of supply from the open market and allows prices to move upwards naturally.

Real World Asset Growth Hits New Milestones

The case for a higher price is not just about charts. Fundamental metrics on the network have also reached all-time highs. Solana is now the third-largest blockchain for Real-World Assets.

These are tokenised versions of traditional financial products where US Treasuries and public equities are now moving onto the chain. In early January 2026, the value of these assets hit $873.3 million.

This is a massive 325% increase compared to last year.

The Bitcoin Factor and What Could Go Wrong

No market moves in a straight line forever, and Solana faces a few risks that could stall the rally.

The biggest factor is Bitcoin’s dominance. Bitcoin currently makes up 57% of the total crypto market. Which means that if the king of crypto crashes, the rest of the market follows.

The crypto heatmap shows strength, but Bitcoin could collapse | source: CoinMarketCap

For Solana, if Bitcoin caused a drop below $125, the current bullish thesis would collapse and prices might revisit the $110 level.

Short sellers are also putting up a fight. Data from CoinGlass shows that short positions make up over 52% of the open interest. These traders are betting that the price will fail to break $147.

If they successfully defend that level, it could trigger a wave of selling. However, if the price moves past them, these bears will be forced to buy back their positions. This creates a “short squeeze” that sends the price even higher.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.