The money does not grow on its own. We need the right knowledge to make it work. It is the best investment books that give you exactly that. This teaches you how wealth is built & how smart investors think. They guide you when you are just starting out & they also guide you when you are already investing because the right book can change everything.

- Why Does Reading Finance Books for Investors Matter?

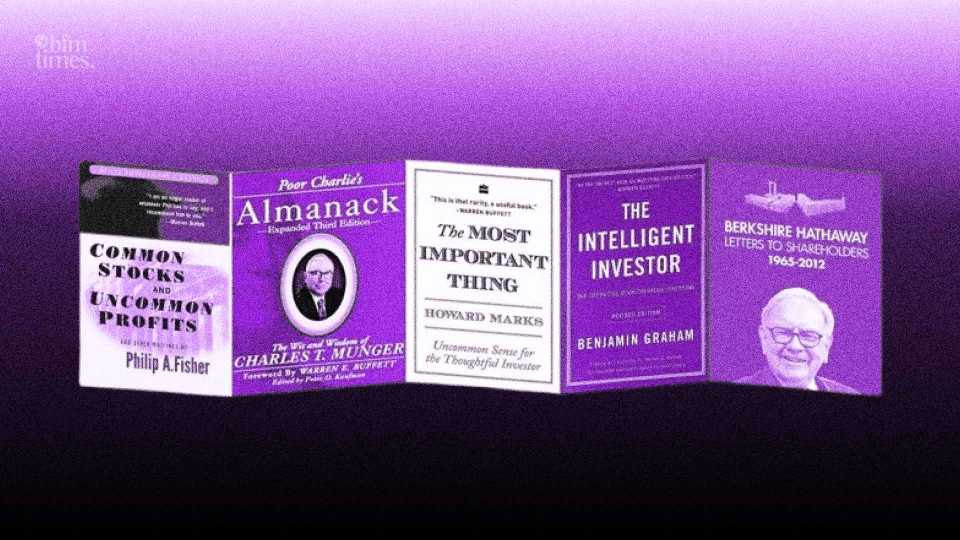

- What Are the Top Best Investment Books You Should Read Right Now?

- Quick Reference: Best Investment Books at a Glance

- How Do Wealth Building Books Transform Your Financial Life?

- Which Stock Market Books Help You Think Like a Pro?

- How Can You Get the Most Out of These Finance Books?

- Conclusion

Today in this article Users will understand about Best Investment Books Every Investor Should Read on BFM Times.

Why Does Reading Finance Books for Investors Matter?

People are never taught about money in school & this is a serious gap. We see that finance books for investors fill that gap perfectly. It explains key ideas like compound interest & risk control & portfolio building which are things that directly impact your financial future. This shifts your mindset when you read the right investing books. They help you stop thinking about money as something to spend & they help you start seeing it as a tool to build long term wealth. The best part is that you do not need a finance degree to understand these books because most are written in simple & clear language that anyone can follow.

What Are the Top Best Investment Books You Should Read Right Now?

The Intelligent Investor by Benjamin Graham

The book is known as the bible of investing. We know that Warren Buffett called it the best book on investing ever written. It focuses on value investing & long term thinking. This shows a core idea that is simple because you buy undervalued stocks & you hold them patiently. They also teach emotional discipline which is just as important as strategy.

Rich Dad Poor Dad by Robert Kiyosaki

The book is one of the most popular wealth building books of all time. We see that it compares two very different money mindsets. It shows that one chases a paycheck & the other builds assets. This makes it one of the best investing books for beginners because it is easy to read & highly motivating. They help you see your finances very differently after reading it.

A Random Walk Down Wall Street by Burton Malkiel

The book is a must read in stock market books. We see that it explains how financial markets work & why beating them again & again is so hard. It argues that index funds often perform better than actively managed ones. This is backed by solid research & real data which makes it strong. They make it a great pick for beginners & seasoned investors alike.

The Psychology of Money by Morgan Housel

The book is one of the most refreshing finance books for investors in recent years. We see that it does not focus on complex strategies or numbers. It explores how emotions & behavior shape financial decisions. This is filled with short & powerful stories. They teach a timeless lesson about wealth & human nature in each story. The patience & humility & consistency are the real keys to building wealth.

One Up On Wall Street by Peter Lynch

The author ran one of the most successful investment funds in history. We see that he shares his approach in a very practical way. It shows that everyday people have a real edge over Wall Street professionals. This explains that they can spot great investment opportunities before the experts do. They make it one of the best stock market books for learning how to pick winning stocks.

Think and Grow Rich by Napoleon Hill

The classic belongs on every investor shelf. We see that it is not just about money but about the mindset required to achieve wealth. It shows that the author studied hundreds of successful people to find common habits & traits. This proves that the lessons are timeless. They apply to wealth building in any era & any market.

The Little Book of Common Sense Investing by John C. Bogle

The author founded Vanguard & created index funds. We see that in this book he makes a strong case for simple & low cost investing. It shows why chasing hot stocks or complex strategies often backfires. This explains that steady & consistent index fund investing beats most alternatives over time. They make it one of the top wealth building books for passive investors.

Quick Reference: Best Investment Books at a Glance

| Book Title | Author | Best For | Key Focus |

| The Intelligent Investor | Benjamin Graham | All Investors | Value Investing |

| Rich Dad Poor Dad | Robert Kiyosaki | Beginners | Mindset & Assets |

| A Random Walk Down Wall Street | Burton Malkiel | All Investors | Index Investing |

| The Psychology of Money | Morgan Housel | All Investors | Behavioral Finance |

| One Up On Wall Street | Peter Lynch | Stock Pickers | Stock Selection |

| Think and Grow Rich | Napoleon Hill | Beginners | Wealth Mindset |

| The Little Book of Common Sense Investing | John C. Bogle | Passive Investors | Index Funds |

| Security Analysis | Graham & Dodd | Advanced Investors | Deep Analysis |

How Do Wealth Building Books Transform Your Financial Life?

The reading of wealth building books is itself a powerful investment. We see that the knowledge you gain helps you avoid costly mistakes & it also helps you spot opportunities that others miss entirely. It shows that many of the world’s most successful investors are committed readers. This proves that Warren Buffett reportedly reads five to six hours every day & Bill Gates reads around fifty books per year. They both credit continuous learning as a major driver of their success. The truth is that you do not need to read hours each day. We see that even thirty minutes a day can make a massive difference over time. It is wise to start with one book & build the habit from there.

Which Stock Market Books Help You Think Like a Pro?

The stock market can feel overwhelming at first. We see that there is endless news & complex jargon & thousands of options. It shows that the right stock market books cut through all that noise & they give you a clear plan for making smart investment decisions. This explains that books like One Up On Wall Street & A Random Walk Down Wall Street offer different but complementary views. They show that Lynch focuses on finding hidden opportunities through personal observation & Malkiel makes the case for passive index investing. The result is that reading both gives you a balanced & well rounded view of the market. We see that the goal is not to memorize theories. It is to develop a clear investment philosophy that works for you. These are reasons why the best investment books help you do exactly that.

How Can You Get the Most Out of These Finance Books?

Reading alone is not enough. We see that you need to apply what you learn. It is helpful to take notes as you read each book & write down the key ideas & revisit them often because this reinforces the lessons & keeps them fresh in your mind. This also shows that talking about what you read with others can help. They suggest that joining an investing group or online community can speed up your learning & expose you to new points of view. The most important step is to take action. We see that opening an investment account & starting small if you need to make every lesson real in a way that reading alone cannot.

Conclusion

At last, we can conclude that the best investment books are some of the most powerful tools available to any investor. We see that they provide knowledge & proven strategies & the mindset needed to succeed financially. It shows that you can be just getting started or you can be looking to sharpen your edge because there is a book on this list for you. This means you should start with one that speaks to you. They encourage you to apply the lessons & then move on to the next. The result is that over time your knowledge will grow & your confidence & your portfolio will also grow. We see that every great investor started somewhere. It is true that the best investment books were often the very first step for them. This is your turn to pick up a book today & start building the financial future you deserve.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.