The selection of the best long term investment platforms is not about searching for characteristics but rather about creating a low profile in the long term: low costs, tax-efficient accounts, uncomplicated automation, and reliable access to index funds and ETFs. To a buy-and-hold investor, the correct platform must enable an easy recurrent investment, automatic rebalancing (or at least make it simple), and cost minimization to allow compounding to do the heavy lifting. This guide demonstrates the best long term investment platforms that are most reliable in terms of fees, account types, passive tools, ease of use, and safety. You will receive a fast list of the five best, a comparison chart, and a checklist workaround to select the platform that suits your interests, and this could be taking a retirement, moderate saving, or lazy growth.

- What to look for in long term investing platforms

- How we picked the best platforms

- Top 5 best long-term investment platforms

- Vanguard: Best for ultra-low-cost index funds & long-term investors

- Fidelity: Best all-round broker with low-cost funds and robust retirement tools

- Charles Schwab: Best for beginner-friendly broker tools and commission-free ETFs

- Betterment: Best robo-advisor for automatic long-term portfolios & TLH

- Wealthfront: Best for automated planning, low minimums & tax-efficient features

- Investment platforms for beginners: features that matter

- Stock investing platforms vs robo/advisors for long-term investing

- Passive investing platforms & auto-investment features

- Top 5 platforms at a glance

- How to choose the right platform for your goals

- Conclusion

What to look for in long term investing platforms

In long term investing platforms, what is important to consider is the capability of reducing friction and cost over decades:

- Low fees & expense ratios: Platform charges and fund expense ratios are compounded. Minor distinctions do count.

- Account types: Taxable accounts with options of retirement (Traditional IRA, Roth IRA, 401k rollovers).

- Fractional shares: Invest set amounts at regular intervals, even in high-priced ETFs.

- Recurring investments: Fixed and forget purchases.

- Automatic rebalancing: Maintains the risk at your target allocation.

- Tax tools: Tax-loss harvesting (TLH) where necessary; placement of assets in tax-efficient assets.

- Education & research: Simple directions to amateurs, strong instruments to professionals.

- Safety & reputation: Good custodianship and years of operations.

How we picked the best platforms

Selection criteria

- Cost: brokerage fees or management fees; fund fees.

- Account options: Taxable & retirement accounts encouraged.

- Passive tools: index funds/ETFs, DRIPs, recurring purchases, automatic rebalancing.

- Security & reputation: Track record and investor protections where they exist.

- Ease of use: Cleared UX, mobile + web stability.

- Research & learning: Portfolio software, screening, novice advice.

In particular, we preferred platforms with minimal fees, passive workflows of investment, and automation to acquire-and-hold strategies.

Top 5 best long-term investment platforms

- Vanguard: Low-cost index funds: Long-term index funds with discipline.

- Fidelity: Powerful full-service brokerage, low-cost funds, and retirement products.

- Charles Schwab: Commission-free ETFs with commissions.

- Betterment: Tax-loss harvesting and an automated portfolio robo-advisor.

- Wealthfront: Tax-efficient, automated investment with low minimums.

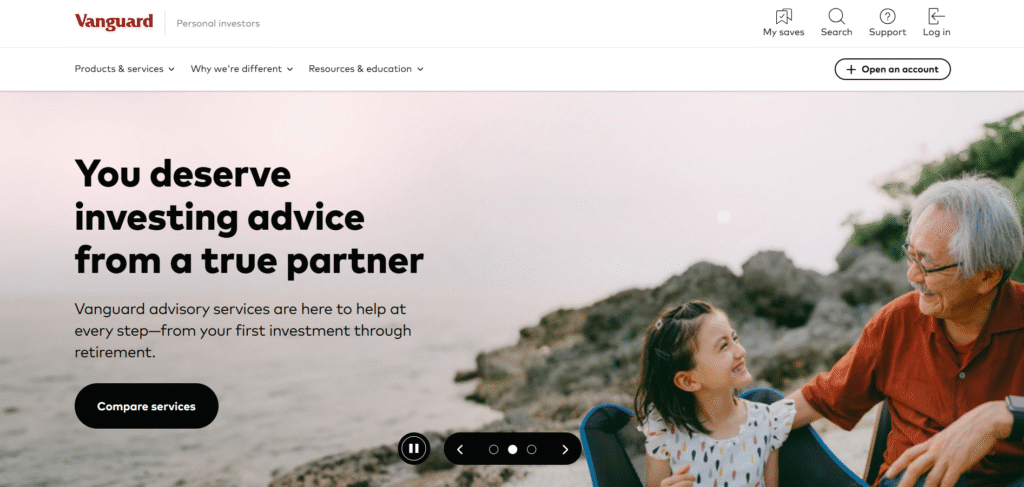

Vanguard: Best for ultra-low-cost index funds & long-term investors

- Positioning: Traditional index-fund purists.

- Key features: broad index funds/ETFs, fractional shares, recurring purchases, DRIPs.

- Account types: Taxable, Traditional IRA, Roth IRA, 401k rollover.

- Fees & minimums: Low fund expense ratios; brokerage commissions $0; minimums Stand by funds (date-stamped in author note)

- Pros: Lowest costs in the industry; long history.

- Cons: less complex app/UI; fewer gamified tools.

- Best for: DIY ETF retirement investors.

You’ll find the full details on their official site: https://investor.vanguard.com/

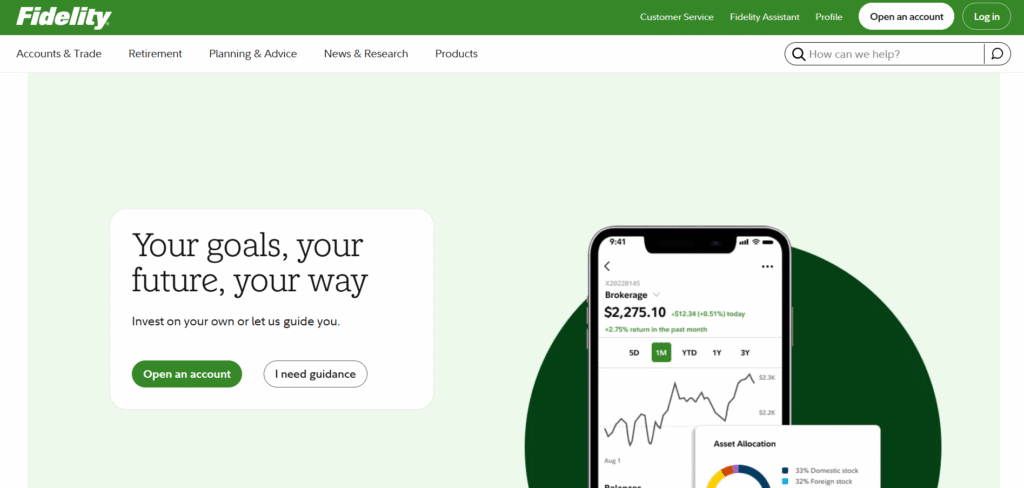

Fidelity: Best all-round broker with low-cost funds and robust retirement tools

- Positioning: A one-stop shop for long-term investors.

- Key features: No commission ETFs, fraction share or buy, monthly buys, good research.

- Account types: Taxable, Traditional IRA, Roth IRA, 401k rollover.

- Fees & minimums: $0 trades; no minimums on accounts to trade through a broker (date-stamped in author note)

- Pros: Good instruments + training; wide range of funds.

- Cons: The UI may be overwhelming to a beginner.

- Best for: Long-term savers desiring flexibility and richness.

You’ll find the full details on their official site: https://www.fidelity.com/

Charles Schwab: Best for beginner-friendly broker tools and commission-free ETFs

- Positioning: Clean entry into DIY investing

- Key features: There are commission-free ETFs, fractional shares, repeat purchases, and portfolio reviews.

- Account types: Taxable, Traditional IRA, Roth IRA, 401k rollover.

- Fees & minimums: No trades; low/none (date-stamped in author note) minimum.

- Pros: easy user experience; good customer service.

- Cons: Smaller number of native index funds as compared to Vanguard.

- Best for: New investors developing ETF portfolios.

You’ll find the full details on their official site: https://www.schwab.com/

Betterment: Best robo-advisor for automatic long-term portfolios & TLH

- Positioning: Hands-off investors who want automation.

- Key features: auto-rebalancing, TLH, recurring deposits, and goal-based portfolios.

- Account types: Taxable, Traditional IRA, Roth IRA, 401k rollover.

- Fees & minimums: Annual management fee on AUM; low minimums (date-stamped in author note)

- Pros: strontium tools; powerful tax tools.

- Cons: Continued management fee versus self-serve brokers.

- Best for: autopilot savings and retirement plans.

You’ll find the full details on their official site: https://www.betterment.com/

Wealthfront: Best for automated planning, low minimums & tax-efficient features

- Positioning: Financial planning + automation in one.

- Key features: auto-rebalancing, TLH, goal planning, fractional investing.

- Account types: Taxable, Traditional IRA, Roth IRA, 401k rollover.

- Fees & minimums: Annual management fee on AUM; low minimums (date-stamped in author note)

- Pros: Good automation; clean goal tools.

- Cons: Less control for active DIY investors.

- Best for: busy people who prefer automation.

You’ll find the full details on their official site: https://www.wealthfront.com/

Investment platforms for beginners: features that matter

Beginners enjoy services that help to ease the difficulty in decision-making:

- Basic UI: Easy dashboards, onboarding.

- Guided portfolios: Risk-adjusted portfolio allocations.

- Low minimums: Begin with lows and establish a steady deal.

- Resources to learn: one-minute courses on ETFs, diversification, and rebalancing.

- Automation: Recurring purchases and auto-rebalancing to prevent time errors.

Stock investing platforms vs robo/advisors for long-term investing

When to select a stock investing platform (broker):

- You desire the power of ETF choice and distributions.

- And you are happy to rebalance once a year.

- You are looking to reduce the continuing management expenses.

When to choose a robo-advisor:

- You are more of an automation and tax-loss harvester.

- Goal-based portfolios that are not micromanaged.

- You would be happy to pay a little AUM fee to conveniently do so.

Have a broker manage your basic ETF portfolio, and a robo manage a specific objective (e.g., TLH taxable account).

Passive investing platforms & auto-investment features

Passive investment platforms are brightest when they eliminate friction:

- Index funds and ETFs: A wide market at minimal cost.

- Auto-invest: Monthly deposits are better than lump sums.

- DRIPs: Recurring dividends.

- Auto-rebalancing: Rebalances risk automatically.

- Tax-efficient design: TLH in taxable accounts; asset location across accounts.

The quality of automation is not the same, even in the best long term investment platforms. In the event that you appreciate hands-off compounding, then focus on platforms that have repeat purchases and consistent rebalancing rather than slickness.

Top 5 platforms at a glance

| Platform | Best for | Fees (management/brokerage) | Min deposit | Auto-invest & rebalancing | Tax tools (TLH) | Account types |

| Vanguard | Ultra-low-cost index investing | $0 trades; low fund ERs | Varies by fund | Recurring buys; manual rebalance | Limited TLH (via advisor tiers) | Taxable, Trad IRA, Roth IRA, 401k rollover |

| Fidelity | All-round long-term investing | $0 trades | $0 brokerage | Recurring buys; manual rebalance | Limited TLH tools | Taxable, Trad IRA, Roth IRA, 401k rollover |

| Charles Schwab | Beginner-friendly ETF building | $0 trades | Low/none | Recurring buys; portfolio tools | Limited TLH tools | Taxable, Trad IRA, Roth IRA, 401k rollover |

| Betterment | Automated portfolios + TLH | AUM management fee | Low | Auto-invest and auto-rebalance | TLH (taxable) | Taxable, Trad IRA, Roth IRA, 401k rollover |

| Wealthfront | Automation + planning | AUM management fee | Low | Auto-invest and auto-rebalance | TLH (taxable) | Taxable, Trad IRA, Roth IRA, 401k rollover |

How to choose the right platform for your goals

Quick checklist

- Retirement first? Select a platform that has high IRA support and low fund fees.

- Hands-off saver? Pick automation, rebalancing, + TLH.

- DIY ETF builder? Use a cheap broker and make monthly purchases.

- Tax efficiency? Prefer TLH and clean taxable-account workflows.

- Consistency tools? DRIPs and recurrent investments are negotiable.

Recommended picks by goal

- Retirement (low fees, DIY): Vanguard or Fidelity.

- Routine saving (plain ETFs): Charles Schwab or Fidelity.

- Tax-efficient, hands-off: Betterment or Wealthfront.

- Hybrid control + automation: Broker core ETFs + robo taxable TLH.

Conclusion

The best long term investment platforms are those that silently compound your money, which are low-cost, easily automated, tax-efficient accounts, and reliable access to index funds and ETFs, as required by buy-and-hold investors. A broker such as Vanguard, Fidelity, or Charles Schwab would suit you well should you desire complete control at minimal expense. When you prefer passive discipline with investment vehicles, Betterment or Wealthfront is the way to go. Make the platform fit your habits, automation is better than perfection, and check once a year. Do your own research, verify existing prices and options, and choose the system you will be able to use in the long term.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.