SUI is expected to cross $3 in 2025 due to an increasing market share, while in the long term, i.e., by 2030, it may cross $5.

Positive factors for SUI include a fast blockchain and affordable transaction costs, which are ready for next-generation applications like RWA, P2P, blockchain gaming, and several other applications. However, there are also negative factors, including an altcoin bear market, declining altcoin adoption, competition with the TON chain, and a rapid price decline.

What is SUI?

SUI is a fast layer-1 blockchain that can process roughly 270k transactions per second, far higher than Ethereum (current TPS at 32k) and Solana (current TPS at 65k). Its fast processing speed gives it an edge in low-cost, high-frequency applications, such as on-chain trading, small p2p payments, education, gaming, low-cost investments, bot trading, etc.

For More, Read: SUI Blockchain Explained

Fundamental Analysis

SUI has outranked many other high-speed blockchains, including Solana, BNB, and Ethereum Layer-2s, thanks to its ultra-high speed, a feature that helped it rank 21 by market cap, despite being a new blockchain.

Further adoption of SUI is expected as blockchain technology expands into traditional markets. SUI can become the blockchain of choice for applications where costs must remain low, but transactions must execute quickly. Some applications are:

- education grade and points tracking

- gamification

- mobile gaming

- p2p payments

Technical Charts

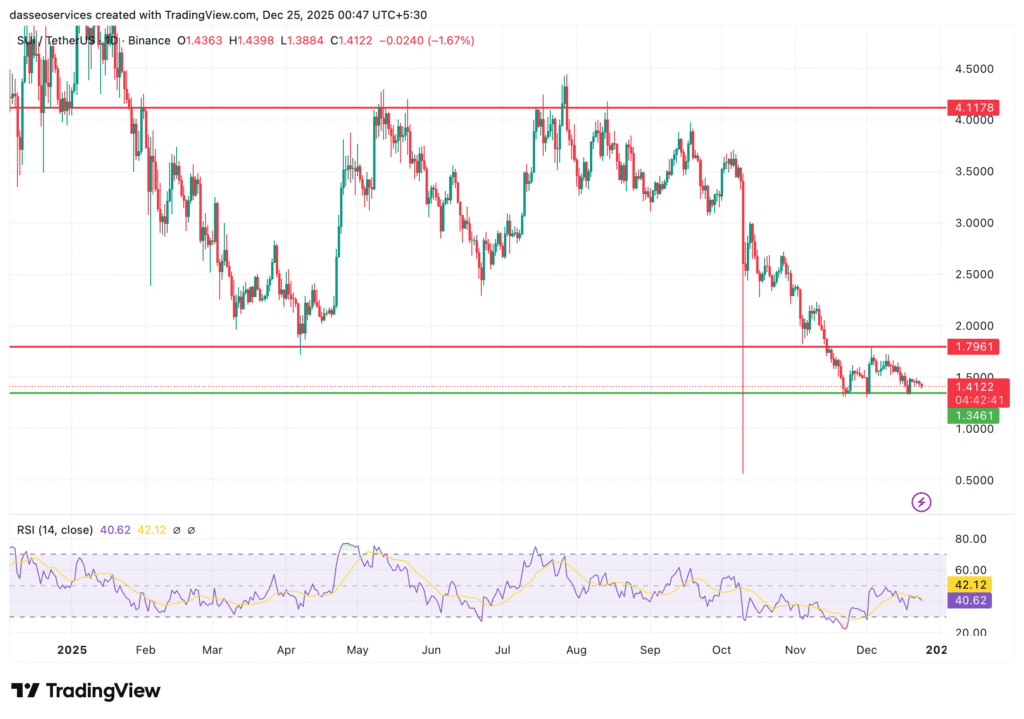

SUI saw a sharp price decline in October 2025 following a market scare that even saw Bitcoin fall from $126k to $82k. SUI fell from $3.6 to $0.5 briefly but soon recovered above its support zone of $1.3.

However, the fall has resulted in a sharp downtrend that engulfed SUI in November.

Surprisingly, SUI saw some relief in December as the price stabilized following a market recovery.

Price Analysis for 2026

For 2026, we expect SUI to remain under its October 2025 levels, i.e., $3.6, because the markets have been in a correction mode due to high inflation in the US, trade wars, global supply disruption, and high Federal Reserve interest rates.

If the markets see any relief in inflation, rates, or trade, we could see SUI swing towards $2, followed by a rally towards $3.6.

Long-Term Price Analysis

In the long term, we expect SUI to grow due to its highly scalable blockchain and to attract new users seeking a cheap yet fast blockchain. This adoption could help SUI cross $5 mark, potentially rising to $10.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.