- Quick Price Prediction Summary

- Current Market Overview

- What Is Toncoin (TON)?

- Factors Affecting Toncoin (TON) Price

- Toncoin (TON) Price Prediction by Timeframe

- Technical Analysis Overview

- Bullish vs Bearish Scenarios

- Is Toncoin (TON) a Good Investment?

- FAQs

- Can Toncoin reach $10?

- Is Toncoin safe?

- Where can I buy Toncoin?

- What affects the price the most?

- Is Toncoin better than Solana?

- Does Toncoin have a maximum supply?

- Final Thoughts

Key Insights

- Toncoin’s direct integration with Telegram’s 950 million users provides an advantage that most Layer-1 blockchains cannot match.

- The ongoing rollout of the TON Teleport Bridge and TON Storage could turn the network into a hub for Bitcoin liquidity.

- Recent multi-million dollar deals for GPU AI tools are promising signs that the network is moving toward high demand.

Related: Shiba Inu (SHIB) Price Prediction (2026-2030)

Toncoin has moved away over the years, from being a Telegram-led concept to a massive community-driven blockchain.

The project is now focusing on turning its huge social reach into actual financial use cases, and here is a price prediction that shows how the asset might perform between now and the next five years.

Could the incoming technical upgrades and user growth drive the price of the TON token up over the next several years?

Quick Price Prediction Summary

| Period | Estimated Price Range | Market Sentiment |

| Current Price (Feb 2026) | $1.30 – $1.45 | Bearish-Neutral |

| Short-Term (3-6 Months) | $1.20 – $2.50 | Accumulation / Consolidation |

| Mid-Term (2026-2027) | $4.50 – $14.50 | Ecosystem Expansion |

| Long-Term (2030+) | $16.00 – $49.00 | Mature Social Web3 |

Current Market Overview

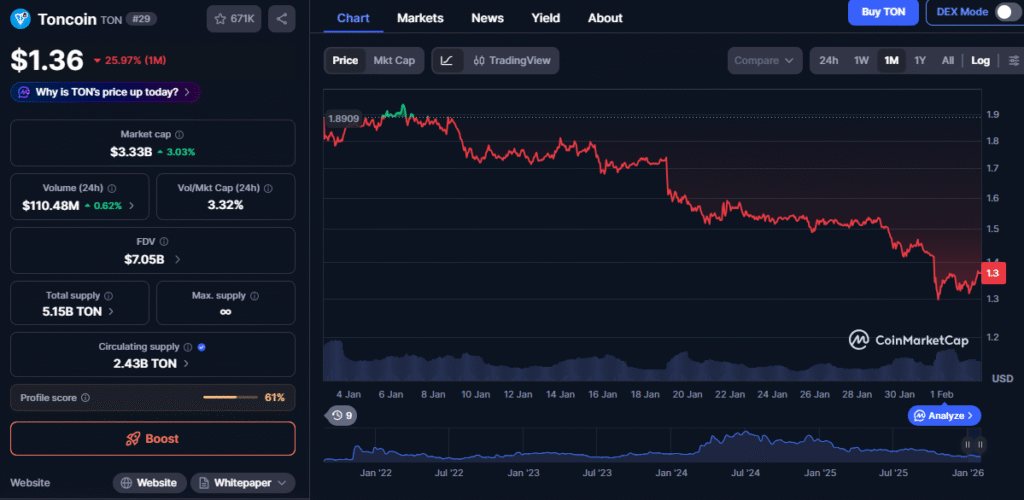

As of writing i early February, Toncoin is in the middle of stress from the general market.

The token currently trades at approximately $1.34, and this price tag shows just how far the asset has fallen from its highs in 2024. The total market capitalisation for Toncoin is roughly $3.27 billion as of writing, and the cryptocurrency has a circulating supply of approximately 2.44 billion TON.

Toncoin has been under heavy price pressure over the last few years | source: CoinMarketCap

Recent price movement has been dragged down by the world’s macroeconomics lately, and many investors have moved capital back into Bitcoin, which currently dominates the market.

However, the network itself is showing no signs of slowing down because its daily transactions are currently above 1 million according to data from Santiment.

Toncoin is also eyeing a recent $46 million deal for GPU AI infrastructure, which shows that developers are still building for the long term. While the price is low, the technical foundation of the network is growing stronger every month.

What Is Toncoin (TON)?

Toncoin is the native currency of The Open Network, which is a high-speed Layer-1 blockchain. It was originally designed by the team at Telegram to handle massive amounts of traffic.

The network uses a special architecture that splits the blockchain into smaller pieces called shards. This allows it to process millions of transactions every second.

Toncoin has become so popular so far, because it makes using crypto as simple as sending a chat message. Toncoin connects nearly a billion social media users to one another, and as such, it is more of a bridge between the messaging app and the defi space.

Factors Affecting Toncoin (TON) Price

The most important factor for Toncoin from here, will be how many Telegram users start using the wallet between now and 2030.

Toncoin could perform very well if millions of people adopt the “Mini Apps” and games within the app. Demand will rise, and prices are expected to follow. Moreover, the success of viral games like Hamster Kombat between 2024 and last year have shown just how much is possible with $TON.

Tokenomics and supply are massive parts of this equation as well. TON has a low annual inflation rate of about 0.60%, which pays the people who secure the network.

However, a few whale wallets hold more than 60% of the supply, which could turn out to be a problem. If these big holders decide to sell at once, it could cause the price to drop suddenly and investors must watch these wallet movements to predict what comes next.

Roadmap milestones are another factor. The launch of the TON Teleport Bridge later this year could allow for easier Bitcoin transfers, which could, in turn, bring a lot of new money into the TON ecosystem.

Regulatory news is also a factor because, since the project has close ties to Telegram, it is sensitive to changes in laws between the US, Russia and other global superpowers.

Toncoin (TON) Price Prediction by Timeframe

Short-Term Price Prediction (Next 3-6 Months)

The short-term technical view is currently leaning toward the bearish side. The price has fallen below the $1.40 mark, which is now a difficult ceiling to break. The charts show that the price could stay between $1.20 and $2.50 for the next few months. However, for a real recovery to happen, TON needs to break above $1.62 with high trading volume.

Medium-Term Price Prediction (2026-2027)

By late 2026, the network should see more use from its new cross-chain bridges. These tools will allow money to flow more easily between different blockchains, and if the general crypto market enters a new growth phase, TON could realistically trade between $4.50 and $14.50.

This growth would be fueled by new apps and payment services launched inside the Telegram ecosystem.

Long-Term Price Prediction (2030 & Beyond)

By 2030, Toncoin could become the main layer for the defi social web through Telegram.

If it stays in the top 10 cryptocurrencies, the price could eve reach a range of $16.00 to $49.00. However, reaching the higher end of this target would require the network to have hundreds of millions of active daily users.

It would also need to become a standard tool for payments around the world.

Technical Analysis Overview

Technically, Toncoin is currently in an oversold state, which means the price has dropped very far and very fast. This could be a good thing in the medium to long terms, because this event often leads to a bounce.

However, the overall trend is still pointing downward. The price is trading below its major moving averages, with a support level around $1.30.

Toncoin has its overall trend pointing downwards on the short to medium term | source: TradingView

The asset also has a strong price floor somewhere aroud $1.2, with immediate resistance around $1.41.

Its major resistance sits at around $1.62, with the RSI showing a reading of 32. This confirms that the market is in an oversold condition, and the MACD indicator supports this outlook because it is still in negative territory.

This indicates that the downward pressure has not fully disappeared yet, and investors should wait for the price to break above $1.60 before assuming the trend has changed.

Bullish vs Bearish Scenarios

Bullish Case

For Toncoin to be bullish over the next few years, the launch of the Telegram wallet should lead to 10 million new users later this year.

The new GPU infrastructure deal should also lead to high demand for TON-based computing, and large strategic companies should buy and hold massive amounts of the asset to reduce the supply.

Finally, it could be great for Toncoin if the Teleport Bridge becomes the most popular way to use Bitcoin in DeFi apps.

Bearish Case

On the other hand, it could be bad for Toncoin if large holders begin to sell their tokens and keep the price from rising.

New regulations in major countries could also limit how people can use in-app crypto wallets. Finally, major features like the TON Storage could also face long delays and cause users to lose interest.

Overall, a long-term decline in the price of Bitcoin could be what prevents TON from making its own gains.

Is Toncoin (TON) a Good Investment?

Toncoin is a special project because it is a “Social Blockchain.”

It is a good choice for those who believe that crypto will go mainstream through social media apps. It also offers high speed and a ready-made user base, which gives it an advantage over many other new networks.

However, there are risks to consider. For example, the concentration of tokens in whale wallets is a major issue.

Another one is the project’s history with regulators. Overall, the most neutral view for Toncoin is that it has a very clear road to success, save for the current market’s difficulty.

Toncoin is best held by long-term holders, rather than people looking for a quick flip.

FAQs

Can Toncoin reach $10?

Yes, it is a realistic target for the next few years. If the Telegram ecosystem keeps growing and the Bitcoin bridge attracts new money, reaching $10 is possible by 2027 or 2028.

Is Toncoin safe?

Toncoin uses a model that has been audited many times, which means that it is very secure. However, like all crypto, it is very volatile. The price has fallen more than 70% from its highest point in the past.

Where can I buy Toncoin?

You can buy it on big exchanges like OKX, Bybit and KuCoin. You can also buy it directly in Telegram using the @wallet bot with a bank card.

What affects the price the most?

The main things are user growth on Telegram, technical upgrades like sharding and how big “whale” wallets behave between now and 2030. General trends in Bitcoin could also affect the price.

Is Toncoin better than Solana?

Both are very fast. Solana has more apps and traders right now, but Toncoin has the advantage of being built directly into an app with nearly a billion users.

Does Toncoin have a maximum supply?

No, it has a small inflation rate to pay validators. However, it also burns a part of every transaction fee. This helps to lower the total supply over time.

Final Thoughts

Toncoin sits somewhat of a sweet spot between social media and defi. It is one of the few projects with a real-world use case for regular people and while the current year has started with a low price, the network’s growth tells a different story.

Investors should look past the daily charts and watch how many people are actually using the network apps.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.