In the fast-paced world of digital finance, Centralized Exchanges (CEXs) provide convenience and stability, but they come with the typical risks of centralization. From regulatory bans to overnight shutdowns, the security of CEXs is very important to their users. So what happens to your crypto when an exchange is banned?

The Immediate Impact: Withdrawal Freezes

In the event of a ban, one of the first things to expect is withdrawal freezes. To prevent a bank run, this is what a regulatory body would do when it bans the exchange. The practical effect of this is that users will be able to see their account balance but will be unable to carry out any transactions. Sometimes, users may also lose all technical access to the exchange’s app, losing their view of their holdings.

The Legal and Bankruptcy Maze

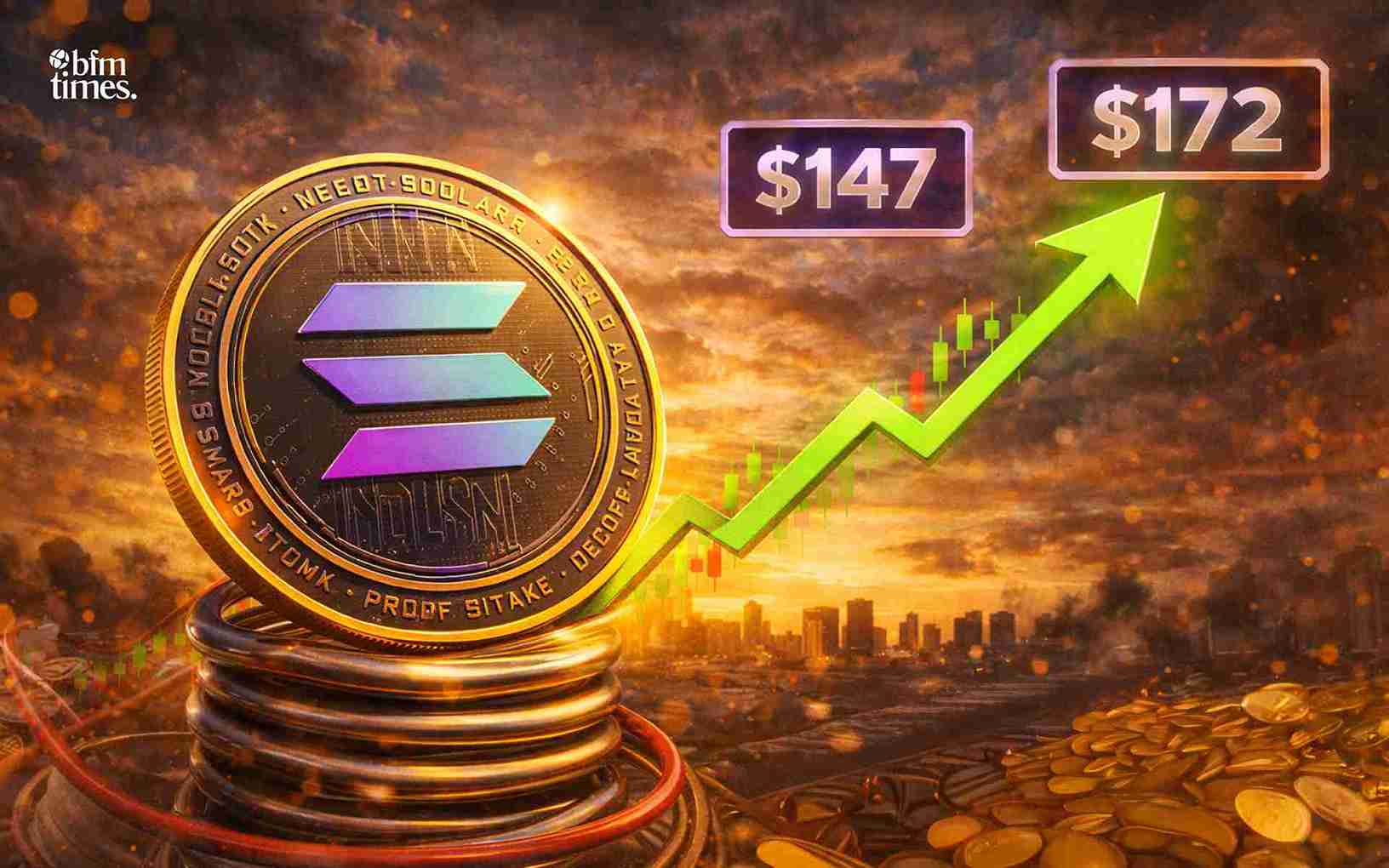

Usually, in the case of a ban, a legal proceeding follows, and this often takes years of protracted deliberations. Due to the largely unregulated nature of the crypto market, asset recovery in these cases is very rare. Investors are often classified as unsecured creditors and have to rely on the government to find and claw back assets to provide liquidity to pay them back. Historical cases like FTX and MT. Gox has seen a limited recovery of funds after years of legal proceedings and a crash in the market value of the digital assets.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.