- Cryptocurrency and blockchain technology, which began with Bitcoin, were created to replace centralized control in finance.

- With ETFs, Corporate Treasuries, Governments, and now international institutions holding crypto, Bitcoin is becoming increasingly centralized.

- Without a tradeoff, most of Bitcoin will eventually be controlled by non-individuals, just the opposite of Satoshi Nakamoto’s dream.

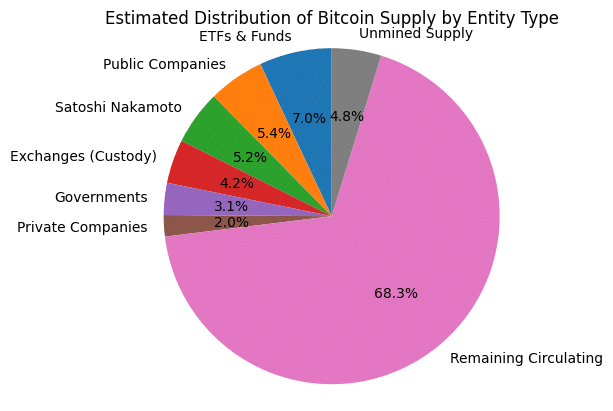

- However, still 68% of the total Bitcoin supply lies in the hands of individuals.

- Please take a look at the graph in the article for a much clearer perspective.

Where is Bitcoin Headed in 2026?

Cryptocurrencies and blockchain technology existed long before Satoshi Nakamoto. Nick Szabo created smart contracts way back in 1996, and Adam Back created Proof of Work in 1997. Yet, it was the genius of Satoshi Nakamoto who put everything together and created the most decentralized network ever in history.

Satoshi’s vision for Bitcoin, which was later replicated by every crypto project, was to create a network where no single entity has absolute control. Every network participant would be anonymous to protect their best interests, and the entire network was open to everyone.

However, by 2026, this dream seems to fade away as more companies try to buy Bitcoin amid global currency decay.

Closer to Centralization Than Ever, But Still Way More Decentralized

Right now, Strategy alone controls 714k BTC, roughly 3.4% of the entire Bitcoin supply of 21 million tokens. The scariest part is that at least 100 more companies are walking down the same path. All treasuries combined control roughly 1 million BTC or a total of

Looking at ETFs, we see at least 1.26 million BTC under their control, which makes it roughly 5.7%. Adding funds to it, we see another 1.1% of the Bitcoin supply, bringing the total to 6.8%.

Adding that to the last calculation, we get Treasuries and ETFs controlling almost 10.4% (4.7% Treasuries + 5.7% ETF) of the entire Bitcoin supply.

Satoshi Nakamoto, the mysterious founder of Bitcoin, is expected to hold 1 million BTC.

Governments worldwide control 646k Bitcoins.

Here’s a summary of all the data we collected.

| Entity Type | Estimated BTC Holdings | % of 21M Max Supply |

|---|---|---|

| ETFs & Funds | ~1,465,538 BTC | 6.98% |

| Public Companies | ~1,130,000 BTC | 5.38% |

| Satoshi Nakamoto | ~1,100,000 BTC | 5.24% |

| Exchanges (Custody) | ~884,675 BTC | 4.21% |

| Governments | ~646,685 BTC | 3.08% |

| Private Companies | ~431,260 BTC | 2.05% |

| Remaining Circulating | ~14,341,842 BTC | 68.30% |

| Unmined Supply | ~1,000,000 BTC | 4.76% |

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.