Key Insights

- Ethereum already leads the real-world asset (RWA) tokenisation market with a market share of more than 66%.

- The Fusaka upgrade from late last year, and the planned 2026 Glamsterdam fork could push network speeds to 10,000 TPS.

- Aggressive fee-burning mechanisms and a staking rate climbing toward 40%, mean that Ethereum has a strong foundation.

Ethereum has been the top smart contract platform for years, and the time between now and 2030 could be when Ethereum moves towards total maturity.

- Quick Price Prediction Summary

- Current Market Overview

- What Is Ethereum?

- Major Factors Affecting Ethereum Price

- Ethereum Price Prediction by Timeframe

- Short-Term Price Prediction (Next 3-6 Months)

- Medium-Term Price Prediction (2026-2027)

- Long-Term Price Prediction (2030 and Beyond)

- Technical Analysis Overview

- Bullish vs Bearish Scenarios

- Is Ethereum a Good Investment?

- Can Ethereum reach $10,000?

- Is Ethereum safe?

- Where can I buy Ethereum?

- What affects the price the most?

- Will Ethereum flip Bitcoin?

- Final Thoughts

The network has moved beyond being the go-to for early tech adopters. Instead, it is now the main engine for the world’s defi and RWA tokenisation.

Here’s a quick look at what Ethereum could be worth in terms of price over the next few years.

Related: Ethereum Price Analysis 2026

Quick Price Prediction Summary

Here is an overview of what analysts expect Ethereum to be worth within certain time intervals.

| Timeframe | Price Range |

| Current Price (Jan 2026) | $2,850 – $3,050 |

| Short-term (3–6 Months) | $3,400- $4,800 |

| Mid-term (2026–2027) | $6,500 – $11,000 |

| Long-term (2030 & Beyond) | $25,000 – $40,000 |

Current Market Overview

As of writing, Ethereum currently holds a market cap of around $362 billion. This makes it the second-largest digital asset in the world, and its current circulating supply is roughly 120.7 million ETH.

Recent price action shows that the asset is now trading near the $3,000 mark. This is interesting, considering the cryptocurrency’s shaky start to the year.

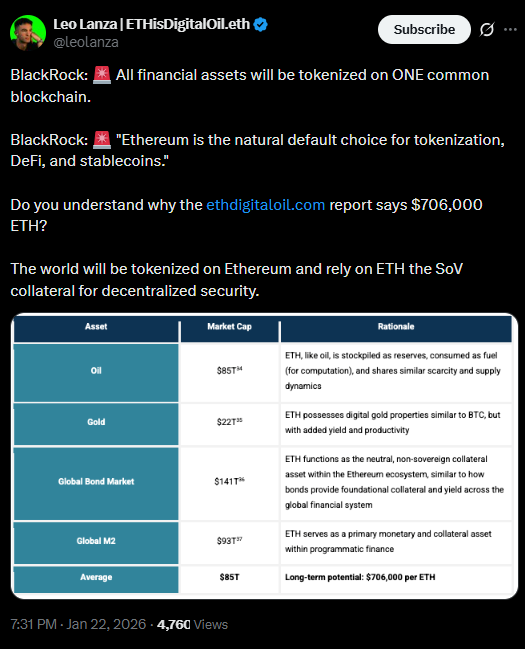

Ethereum has been holding its ground despite the general market | source: X

Institutional activity has also been a major sentiment driver so far. BlackRock recently reported that Ethereum holds a 66% share of the tokenised asset market.

This means that the network is far ahead of competitors like BNB Chain and Solana.

Furthermore, firms like BitMine have also continued to accumulate millions in ETH despite its shaky price action lately.

In all, this level of heavy buying by major firms indicates that major holders are optimistic, despite the recent outflows.

What Is Ethereum?

Put simply, Ethereum is a decentralised, open-source blockchain. It is known as the first chain to introduce smart contracts to the world.

Think of smart contracts as self-executing agreements that are written directly into the blockchain. These small computer programs are what power every decentralised protocol or application on the market.

It is also the reason why, while Bitcoin acts as digital gold, Ethereum works as a programmable computer.

In addition to this, ETH, its native token, acts as the gas that the network uses to power transactions. It also verifies transactions through a Proof of Stake model and node operators known as validators.

Ethereum is so important because it hosts the majority of the world’s DeFi protocols and NFTs. Not only this, its major use cases have also expanded over the years.

Ethereum has now become the main layer for tokenisation and other use cases.

Investors are now pulling trillions of dollars in traditional assets onto this network, and Ethereum’s transition from being a mere speculative asset into what it currently is, is why analysts are so bullish.

Major Factors Affecting Ethereum Price

Several major factors are expected to control the network’s valuation over the next few years.

- Institutional Inflows

Spot Ethereum ETFs managed by firms like BlackRock and Fidelity already provide steady demand for ETH. This is because these products allow traditional investors to access the asset easily.

BlackRock is bullish on Ethereum | source: X

- The Burn Mechanism

A portion of every transaction fee is destroyed under EIP-1559. This creates deflationary pressure when network activity is high, and could be bullish for price.

- Network Upgrades

The recent Fusaka upgrade and the upcoming Glamsterdam fork are focused on scaling the network. These updates could help the network handle more users at lower costs.

- Tokenization Growth

As major banks like JPMorgan move money market funds onto the blockchain, demand for ETH is expected to increase.

- Supply Staking

Approximately 30% of all ETH is currently staked and locked. This reduces the amount of liquid supply available for sale on exchanges.

Ethereum Price Prediction by Timeframe

Short-Term Price Prediction (Next 3-6 Months)

Analysts’ technical sentiment for Ethereum is moving towards bullishness.

The asset has spent several weeks consolidating and analysts expect a breakout toward the $3,400 resistance level soon. If market risk appetite continues to be stable, a rally could push the price between $3,800 and $4,900.

This move would likely retest previous all-time highs by the middle of the year.

Medium-Term Price Prediction (2026-2027)

The “Supercycle” narrative is expected to gain traction between now and 2027.

Institutional tokenisation is expected to mature, and Ethereum will likely become the go-to settlement layer for Wall Street. Historical patterns even show a medium-term target range of $7,500 to $11,000.

However, this growth depends on the network holding on to its massive lead in the smart-contract space.

Long-Term Price Prediction (2030 and Beyond)

By 2030, Ethereum is projected to be the backbone of the “Internet of Value.”

Many financial institutions already see the token reaching $25,000 to $40,000 per unit and this outlook assumes that Ethereum captures a major percentage of the world’s “money moves”.

If this happens, the deflationary supply model will be fully mature and could even make the asset extremely scarce.

Technical Analysis Overview

According to charts from TradingView, Ethereum is currently trading on neutral ground on the daily charts. However, it is still bullish on loner timeframes like the weekly and monthly.

Ethereum is neutral on the daily charts, but bullish on higher timeframes | source: X

- Support & Resistance

The immediate support for the cryptocurrency sits at $2,880 and a drop below this could lead to a retest of $2,650. On the upside, however, $3,200 is the primary barrier and breaking this level would confirm a new uptrend.

- Indicators

The Relative Strength Index (RSI) is hovering near 50. This shows that there is a balance between buyers and sellers. However, the 200-day Moving Average is sloping upward. This could provide long-term structural support for the price.

- Market Structure

Volume concentration between $2,800 and $3,100 shows that long-term traders are accumulating. This means that they are building “support zones”, and this usually comes before a large move upwards.

Bullish vs Bearish Scenarios

Bullish Case

- Trillions in money market funds will move onto the mainnet.

- Monthly inflows into the spot ETFs will consistently stay above $1 billion.

- Millions of new users will join the network through low-cost Layer-2 networks.

- Staking rates will climb above 40%, leaving very little ETH for sale.

Bearish Case

- Technical setbacks could allow competitors to capture more market share.

- A global recession could lead to a general sell-off in risky assets.

- Unexpected legal challenges against top DeFi protocols can arise and be bearish for the market.

- Migration to L2s like Polygon and Optimism could reduce mainnet fees so much that burns slow down.

Is Ethereum a Good Investment?

Ethereum is generally considered a “blue-chip” asset in the crypto space.

Long-term holders favour the cryptocurrency because it is the ultimate exposure to the growth of Web3. It also attracts investors who are looking for yield through staking rewards.

However, all crypto investments come with high risk, and the price is still open to extreme volatility and external shocks.

All of the above being said, investors should consider diversifying and never investing more than they can afford to lose.

FAQs

Can Ethereum reach $10,000?

Yes, many analysts believe $10,000 is a realistic target for Ethereum between 2026 and 2028. However, this would require the market cap to reach roughly $1.2 trillion.

If this happens, Ethereum will be comparable to large tech companies if institutional buying continues.

Is Ethereum safe?

Technically, Ethereum is one of the most secure blockchains. It is protected by billions of dollars in staked capital and an army of validators.

However, “safe” does not mean that the price cannot drop during a market crash.

Where can I buy Ethereum?

You can buy ETH on almost every major exchange, including Binance, Coinbase and Kraken. It is also available through regulated ETF products in many countries.

You can track its performance on sites like CoinMarketCap or CoinGecko.

What affects the price the most?

The main movers of Ethereujm’s price include network utility, institutional investment flows (through ETFs), and the token burn rate.

When more people use the network, more tokens are burned. This reduces supply and usually puts upward pressure on the price.

Will Ethereum flip Bitcoin?

The “flippening” has been a hot debate topic for years. Ethereum clearly has more use cases than Bitcoin.

However, Bitcoin has a strong reputation as “digital gold”. Most analysts expect both to grow together, regardless of which one has a higher market cap.

Final Thoughts

Analysts generally have high hopes for Ethereum between 2026 and 2030. The network is moving from being a mere playground for tech enthusiasts to being an international powerhouse.

While there are still some risks to price like regulation and competition (from L2s and L1s alike), Ethereum has strong institutional backing and a shrinking supply.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.