- Quick Price Prediction Summary

- Current Market Overview

- What Is Arbitrum (ARB)?

- Factors Affecting Arbitrum (ARB) Price

- Arbitrum Price Prediction by Timeframe

- Short-Term Price Prediction (Next 3-6 Months)

- Medium-Term Price Prediction (2026-2027)

- Long-Term Price Prediction (2030 & Beyond)

- Bullish vs Bearish Scenarios

- Is Arbitrum a Good Investment?

- FAQs

- Can Arbitrum reach $10?

- Is Arbitrum safe?

- Where can I buy ARB?

- What affects the ARB price the most?

- Is ARB better than Optimism (OP)?

- Final Thoughts

Key Insights

- Arbitrum has been under selling pressure for years. However, the heavy monthly token unlocks for team members and investors will finish by March 2027.

- This could end this hurdle for Arbitrum and lead to price surges between 2027 and 2030.

- Major players like BlackRock are already using Arbitrum for tokenised funds, which could be great for its price too.

Arbitrum has made a name for itself among Ethereum scaling solutions because of its fast and cheap transactions.

The new year is in already, and investors are wondering what comes next for the native $ARB cryptocurrency between now and 2030.

Could the network’s massive usage eventually reflect in the token price? What are some of the most objective views on Arbitrum from analysts?

Related: Chainlink (LINK) Price Prediction (2026-2030)

Quick Price Prediction Summary

| Period | Estimated Price Range | Market Outlook |

| Current Price (Feb 2026) | $0.15 – $0.18 | Bearish-Neutral / Accumulation |

| Short-Term (Next 6 Months) | $0.20 – $0.45 | Recovery Attempt |

| Mid-Term (2026-2027) | $0.70 – $2.80 | Structural Breakout |

| Long-Term (2030+) | $4.50 – $7.00 | Mature Ecosystem Standard |

Current Market Overview

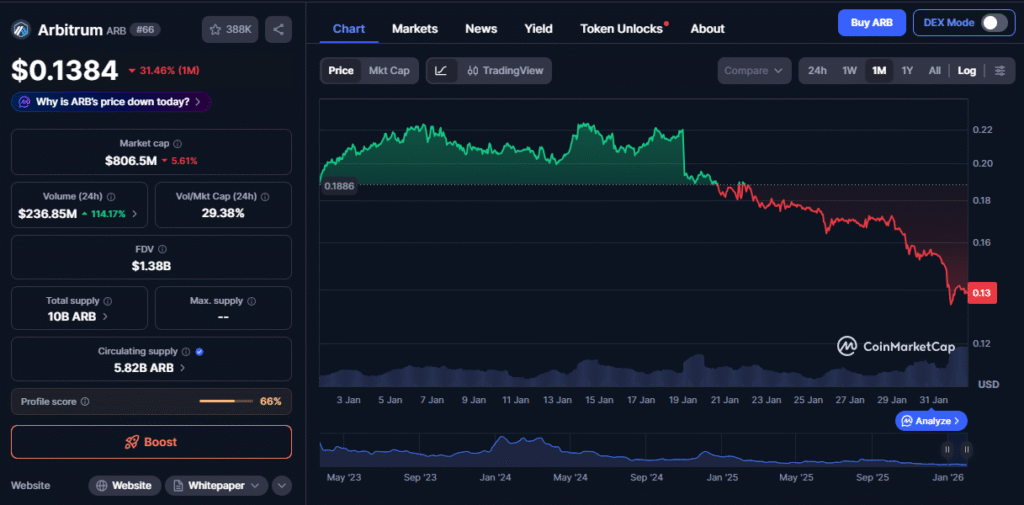

As of early February, Arbitrum (ARB) is under heavy selling pressure.

The token currently trades at approximately $0.15 and has faced a lot of downward pressure over the last year. The market cap now sits at roughly $820 million, and there are about 5.8 billion ARB tokens currently in circulation.

According to data sources like TradingView, Arbitrum has converted the $0.14 level into active support.

The heavy token unlocks continue to weigh on ARB | source: CoinMarketCap

According to analysts, Arbitrum’s sluggishness is mostly due to “unlock fatigue”, where every 30 days, about 100 million new tokens are released to the team and early investors.

This is one of the factors that adds constant selling pressure to the market.

However, the network itself is thriving. Arbitrum One has over $17 billion in total value locked (TVL), and its partnerships with giants like Robinhood and BlackRock show that big institutions are still onboard.

What Is Arbitrum (ARB)?

Arbitrum runs on a special type of technology called an Optimistic Rollup.

This so-called “optimistic rollup” allows the chain to handle more transactions on the Ethereum network’s behalf.

As such, using Ethereum is up to 100 times cheaper and much faster. Additionally, users get the speed they want while staying within the Ethereum network’s security.

Arbitrum is likely to remain relevant because it is one of the engines keeping modern defi afloat.

It also hosts very popular trading platforms like GMX, and it is usually the first place people go when they want to use Ethereum without the high gas fees.

Factors Affecting Arbitrum (ARB) Price

The most important factor for Arbitrum from here is the token release schedule.

Between now and early 2027, Arbitrum will introduce more tokens into the market every month, and this will likely make it hard for the price to rise. However, once these releases stop, the supply will stabilise.

If demand continues to grow, the price could even break out of its current lows.

New technology, like Stylus will also be a major part of this. Stylus allows developers to build apps using common computer languages, and this could open the door for many more builders to join the network.

Institutional adoption is another major driver. If global banks keep choosing Arbitrum for tokenised real estate or bonds, the demand for network governance will increase.

Arbitrum Price Prediction by Timeframe

Short-Term Price Prediction (Next 3-6 Months)

The short-term outlook for $ARB is a bit mixed. The asset is currently in a zone where many people are buying for the long term.

However, the constant monthly unlocks are keeping the price from jumping too high. Because of this, analysts expect a range between $0.20 and $0.45.

Still, if the price can stay above $0.30, it might even be able to register a small rally. However, this would only happen if the overall crypto market starts to recover.

Medium-Term Price Prediction (2026-2027)

This is a very important window for the token because the major vesting cycles will end in March 2027. Once the market stops worrying about millions of new tokens, the price can move more naturally.

Additionally, analysts expect a range of $0.70 to $2.80 with the growth of the “Orbit” chain.

Long-Term Price Prediction (2030 & Beyond)

By 2030, only a few Layer-2 networks will likely remain dominant.

If Arbitrum keeps its lead in DeFi and continues attracting big business deals, it will likely become a major part of the world’s finances. Plus, if the DAO adds ways for the token to capture value from network fees, the price could reach $4.50 to $7.00.

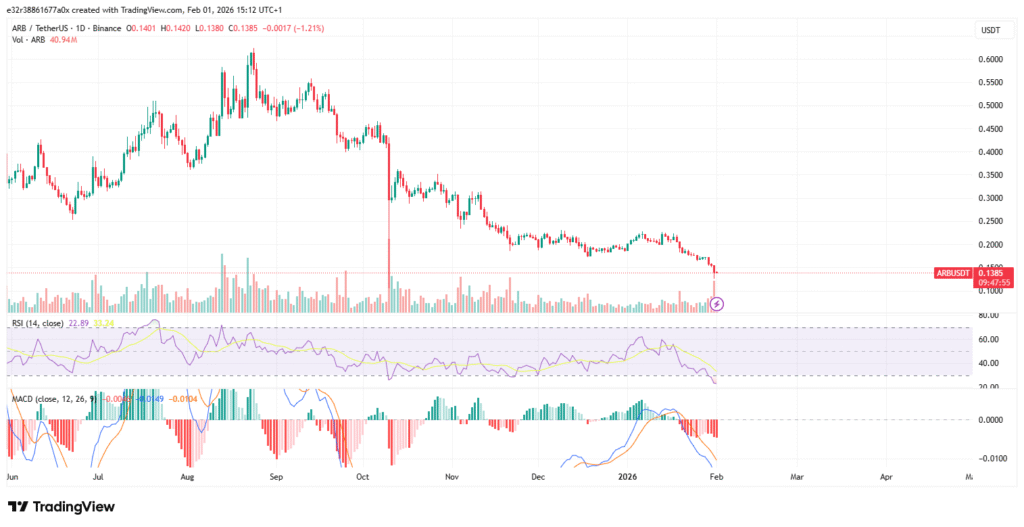

Technical Analysis Overview

Arbitrum is currently moving sideways on the charts. This shows that buyers and sellers are currently in a standoff at these low prices. The overall trend is still bearish, but analysts are starting to see signs that the bottom is near.

Major support levels currently sit at $0.14 and $0.11, which is an area where buyers have stepped in before. Resistance is waiting between $0.21 and $0.24, and the Relative Strength Index (RSI) is around 35.

This tells us that the asset is very close to being oversold.

Arbitrum is showing neutral to bearish conditions on the charts | source: TradingView

In all, traders are now waiting for a “Golden Cross” between the 200 and 50-day EMAs. If something like this happens in mid-2026, it would be a strong signal that a new uptrend has started.

Still, investors should DYOR before making any financial decisions.

Bullish vs Bearish Scenarios

Bullish Case

For Arbitrum to have the next of the next few years, the DAO would likely activate a plan to share network fees with people who stake ARB.

Hundreds of “Orbit” chains could also launch and create more utility for the main network.

Arbitrum could have a blast too if huge banks choose the network as the only place to launch their funds.

Bearish Case

On the other hand, it could be bad for Arbitrum if monthly token releases continue to push the price down faster than new users can buy.

Competitors like Base or newer ZK-rollups could also take away most of the network’s traffic.

Finally, new laws could make it harder for DAOs or certain networks to operate.

Is Arbitrum a Good Investment?

Arbitrum is currently a “value play.”

This means the network is doing very well, but the token price is low. It has more users and money than almost any other scaling solution and this could be great for long-term investors.

However, investors seeking fast profit should avoid $ARB. The monthly token releases make short-term trading very difficult and as it is with any crypto, caution is necessary.

FAQs

Can Arbitrum reach $10?

This is a maybe. To reach $10, Arbitrum would need a market cap of about $100 billion. This is a very high number and it would only happen in a massive bull market where Arbitrum runs most of the world’s finance.

To sum things up, it is possible by 2030, but not guaranteed.

Is Arbitrum safe?

Arbitrum is mostly seen as one of the most secure ways to scale Ethereum. It has moved through several stages of decentralisation and it even has a special council to protect the network during emergencies.

It uses the same security model as Ethereum itself, so yes, Arbitrum is safe.

Where can I buy ARB?

You can buy ARB on all the big exchanges like Binance, MEXC, Coinbase, OKX and Kraken. You can also buy it on decentralised exchanges like Uniswap if you already have a crypto wallet.

What affects the ARB price the most?

Some of the biggest factors affecting ARB are the monthly token releases and the growth of the DeFi apps on the network.

If the supply goes up faster than the demand, the price stays low. However, if more people start using the network, the demand could increase.

Is ARB better than Optimism (OP)?

Both are great projects. While Arbitrum currently has more money locked in its apps, Optimism is focused on building a “Superchain” with partners like Coinbase.

In sum, many people hold a little bit of both to stay covered in the Layer-2 sector.

Final Thoughts

The path for Arbitrum is about the token catching up to the network’s success. While the price has been low because of new tokens entering the market, the network is stronger than ever.

Once the releases finish in 2027, the price should grow to match the real utility of the system.

As always, be sure to do your own research before putting money into any crypto asset.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.