To select the most preferable crypto exchanges, it is not only necessary to find the lowest trading rates. A platform influences your security, access to coins and fiat on-ramps, liquidity, and the ease of trading or investing. Crypto markets in 2026 are more controlled, competitive, and sophisticated than ever. Exchanges are catering to inexperienced traders and others with amateurs who are derivatives, API, and deep liquidity traders. The guide is a comparison of the top crypto exchanges based on clear criteria, fees, security, regulation, and features; hence, you can choose the platform that suits your purposes, whether you are a beginner to crypto or running sophisticated strategies.

- Exchange comparison

- How we tested and selected the best crypto exchanges

- Top crypto trading platforms

- Secure crypto exchanges: what to look for

- Cryptocurrency exchanges vs decentralized exchanges (DEXs)

- Crypto exchange platforms: fees, features, and advanced tools

- Best exchanges for beginners

- Best exchanges for new coins & altcoins

- Best exchanges for advanced traders & institutions

- How to choose the right exchange for your needs

- Common risks & how to mitigate them

- Deep dive: Fees, liquidity & execution quality (what actually impacts your results)

- Fiat on-ramps & off-ramps: the hidden friction

- Custody models explained (custodial vs self-custody)

- Security best practices for Exchange users (practical checklist)

- Advanced trading tools explained (for serious traders)

- Staking, Earn & yield products: risks vs rewards

- Regional availability matrix (who can use what in 2026)

- Performance during market stress (what breaks first)

- Real-world selection scenarios

- Future trends shaping crypto exchanges (2026–2027 outlook)

- FAQ

- Regulatory notes (US, EU, UK, India)

Exchange comparison

| Exchange | Best for | Fiat on-ramps | Spot fee (maker/taker) | Derivatives | Regulatory status (US/EU/Global) | Mobile app | Security notes |

| Binance | Liquidity | Yes (region) | ~0.10% / 0.10% | Yes | Restricted in some regions | Yes | Cold storage, SAFU |

| Coinbase | Beginners | Yes | Higher retail | Limited | Regulated US/EU | Yes | Insurance, cold storage |

| Kraken | Security | Yes | ~0.16% / 0.26% | Yes (region) | Regulated | Yes | Audits, cold storage |

| OKX | Pro tools | Yes (region) | Tiered | Yes | Global | Yes | Proof of reserves |

| Bybit | Derivatives | Partner | Low tiers | Yes | Restricted | Yes | Cold storage |

| Bitstamp | EU fiat | Yes | Tiered | No | EU/US | Yes | Long history |

| Crypto.com | Mobile | Yes | Tiered | Limited | Global | Yes | Insurance |

| Gemini | Compliance | Yes | Higher retail | No | US/EU | Yes | SOC audits |

| KuCoin | Altcoins | Partner | Low base | Yes | Restricted | Yes | Past incident disclosed |

How we tested and selected the best crypto exchanges

We have used an approach based on practical usability and safety:

Evaluation criteria

- Fees & pricing: maker/taker rates, deposit/withdrawal costs

- Liquidity: 24h volumes, depth of the order book (source: CoinGecko/CoinMarketCap, 2026-02)

- Security: cold storage, audits, breaches of the past.

- Fiat support: local fiat on-ramps and off-ramps

- User experience: mobile applications, onboarding, support, and reputation.

- Features: derivatives trading, spot trading, staking, margin, and API trading.

- Regulatory position: US/EU/UK/India and KYC/AML compliance.

- Transparency: disclosures, reserve proof.

Top crypto trading platforms

Our bestsellers by region and user type are listed below. All the profiles are structured in a uniform manner.

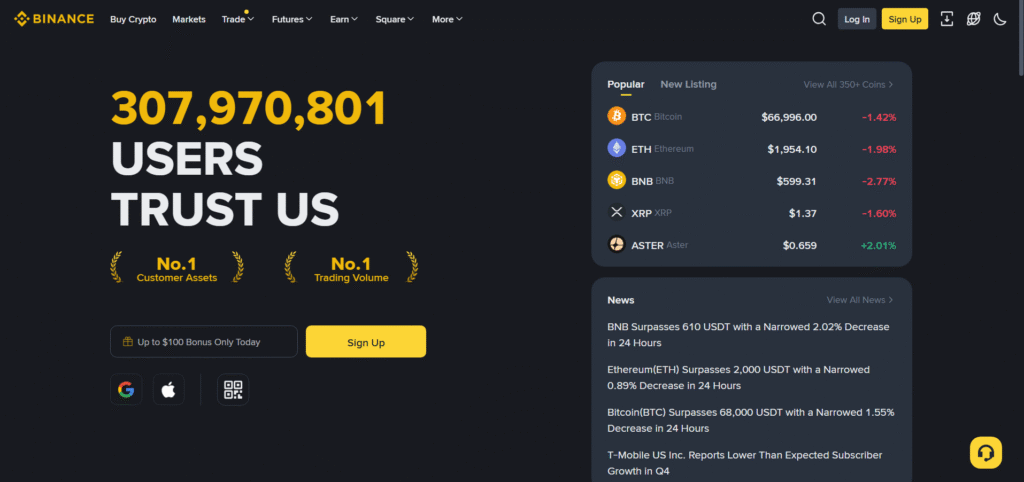

1. Binance

- Overview: Founded in 2017, with an international presence in the form of region-specific entities.

- Best for: Active traders, international users, and wide access to coins.

- Key features: The most important features include spot trading, derivatives trading, margin, staking, Earn, API trading, and mobile applications.

- Fees: Maker/taker is usually around 0.10%/0.10% (volume/BUSD/BNB discounts).

- Assets & fiat: 350 and up assets; fiat on-ramps are regional.

- Security: Cold storage, SAFU fund, and historical incidents that were reported with reimbursements.

- UX & support: Powerful apps; support is divided on Trustpilot (depends on the region).

- Limitations: US/UK/EU regulatory limitations on certain services.

- It’s ideal if you can get it in your country, and it’s the best in terms of liquidity.

For all the details, hit up their official website: https://www.binance.com/en-IN

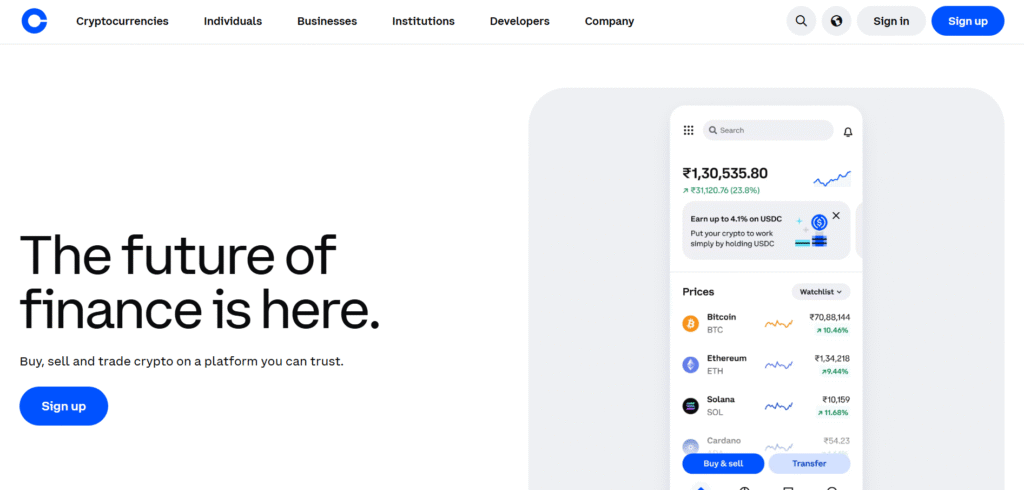

2. Coinbase

- Overview: Exchange, listed in the US; high compliance footprint.

- Best for: Average users, US/EU users, and fiat on-ramps.

- Key features: spot trading, staking, custody, mobile applications, and API trading.

- Fees: Increased retail charge; superior exchange reduced maker/taker.

Assets & fiat: good USD/EUR backing. - Security: Custodial asset insurance; cold storage.

- UX & support: Great UX; good education.

- Limitations: More expensive; reduced small-cap listing.

- Easiest complying entrance.

For all the details, hit up their official website: https://www.coinbase.com/en-in

3. Kraken

- Overview: Founded in 2011; high security reputation.

- Best for: Security-first users, pro traders.

- Key features: spot trading, margin, derivatives (where permitted), staking, and API trading.

- Fees: Maker/taker, 0.16 percent / 0.26 percent.

- Assets & fiat: USD, EUR, and GBP support.

- Security: Cold storage, security audits, no breaches in the past.

- UX & support: Pro UI; responsive support.

- Limitations: a smaller number of altcoins in comparison with Binance.

- Good security and pro feature balance.

For all the details, hit up their official website: https://www.kraken.com/

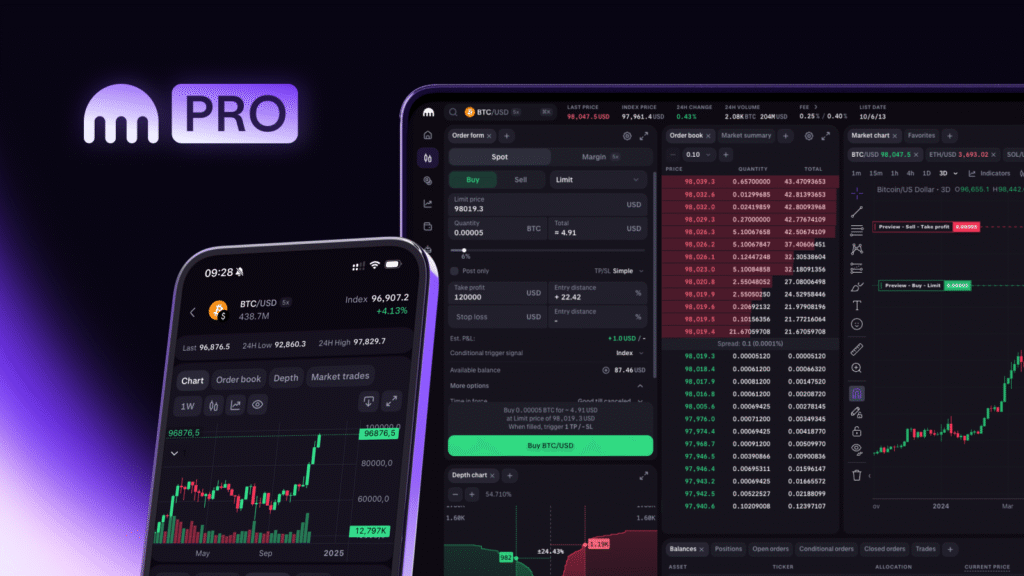

4. OKX

- Overview: International trading in derivatives and earning products.

- Best for: Experienced traders, derivatives.

- Key features: spot trading, derivatives trading, margin, staking, and API trading.

- Fees: competitive maker/taker fees.

- Assets & fiat: Large coverage of assets; fiat depends on the region.

- Security: Cold storage, disclosure of proof of reserves.

- Limitations: Not applicable in all jurisdictions.

- Full-bodied among professionals.

For all the details, hit up their official website: https://www.okx.com/

5. Bybit

- Overview: Derivatives and quick UX.

- Best for: Derivatives traders.

- Key features: spot trading, derivatives trading, margin, Earn, and API trading.

- Fees: Derivatives low maker/taker.

- Assets & fiat: wide crypto support; fiat through partners.

- Security: Cold storage; disclosure of incidents in the past.

- Limitations: Some countries are restricted by regulations.

- Awesome derivatives UX in practice.

For all the details, hit up their official website: https://www.bybit.com/

6. Bitstamp

- Overview: Established in 2011, it has a presence under the EU regulation.

Best for: EU users, fiat ramps. - Key features: spot trading, custody, and API trading.

- Fees: Scaling maker/taker.

- Assets & fiat: USD/EUR/GBP support.

- Security: Cold storage; long operating history.

- Limitations: Fewer features compared to Binance/OKX.

- Quality fiat gateway.

For all the details, hit up their official website: https://www.bitstamp.net/

7. Crypto.com

- Overview: Consumer-focused ecosystem

- Best for: Mobile-first users, staking.

- Key features: spot trade, staking, geographically specific cards, and earn.

- Fees: Trading fees depend on tiers.

- Assets & fiat: The broad coverage of assets and variances of fiat.

- Security: Cold storage; insurance disclosed.

- Limitations: App UX may be clogged.

- Powerful all-in-one app.

For all the details, hit up their official website: https://crypto.com/

8. Gemini

- Overview: US-based, compliance-oriented.

- Best for: Compliance-first users.

- Key features: spot trading, custody, and in some cases, staking and API trading.

- Fees: Greater retail; ActiveTrader is lower.

- Assets & fiat: USD support; guaranteed listings.

- Security: SOC audit, insurance.

- Limitations: Fewer altcoins.

- Breadth versus Trust and Compliance.

For all the details, hit up their official website: https://www.gemini.com/

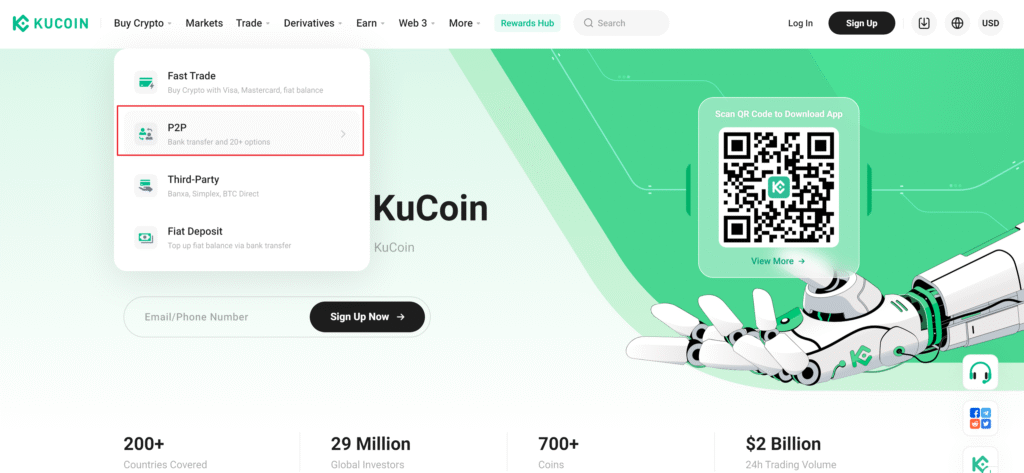

9. KuCoin

- Overview: Worldwide altcoin-intensive trade.

- Best for: New coin discovery.

- Key features: spot trading, derivatives trading, earnings, and API trading.

- Fees: Low base fees

Assets & fiat: Numerous little-cap assets; fiat through partners. - Security: Disclosure of past incidents; better controls.

- Limitations: Greater regulatory risk in certain areas.

- Availability of new coins has the added risk.

For all the details, hit up their official website: https://www.kucoin.com/

Secure crypto exchanges: what to look for

When considering a secure crypto exchange, make a priority:

- Cold storage: More than half offline.

- Audits/evidence of reserves: Periodic disclosure of transparency.

- Insurance: Custodial assets coverage (where applicable)

- Account security: 2FA, whitelist withdrawals.

- Incident history: Clear disclosures and user reimbursements.

- Custody model: Understand who controls private keys (custody vs. self-custody)

Cryptocurrency exchanges vs decentralized exchanges (DEXs)

Fiat on-ramps, customer service, and high liquidity (centralized) are provided by cryptocurrency exchanges; however, KYC/AML and custody trust are needed.

DEXs are self-custodial plus permissionless, do not have fiat on-ramps, can be more slippy, and subject users to smart-contract risk.

Entry, liquidity, and customer support are centralized platforms.

On-chain access and self-custody via DEXs, after learning risks.

Crypto exchange platforms: fees, features, and advanced tools

Contemporary crypto exchange platforms differ:

- Fees: maker/taker, VIP levels, withdrawals.

- Order types: limit, market, stop-limit, OCO.

- Advanced trading: margin, derivatives trading.

- APIs: algorithmic strategies.

- Yield: staking, Earn programs

- Compliance: KYC/AML, regional restrictions.

- Mobile trading apps: essential to active traders.

Best exchanges for beginners

- Coinbase: simplest fiat on-ramps, education.

- Gemini: compliance-first custody.

- Bitstamp: simple fiat rails

Find easy UX, low minimum deposits, and good support.

Best exchanges for new coins & altcoins

KuCoin, Gate.io (availability varies): broader listings

Risks: decreased liquidity, increased volatility, and listing risks. Limit use and use a small position size.

Best exchanges for advanced traders & institutions

Binance, OKX, Kraken, and Bybit: derivatives, deep liquidity, APIs, and OTC desks.

The more sophisticated users should focus on low-latency APIs, deep order books, and maker/taker discounts.

How to choose the right exchange for your needs

Checklist

- Is it regulated in your country?

- Does it support your fiat on-ramp?

- Do you have competitive fees for your volume?

- Are your pairs deep in liquidity?

- Does it have security best practices?

- Are you in need of derivatives trading, staking, or APIs?

- Do India/US/EU/UK have any country restrictions?

Common risks & how to mitigate them

- Custody risk: 2FA: use strong (considering self-custody on long-term holds).

- Hacks: Select cold storage and audit exchanges.

- Regulatory freezes: maintain off/on-ramps.

- Withdrawal limits: Check KYC levels prematurely.

- Privacy: Learn KYC/AML.

Deep dive: Fees, liquidity & execution quality (what actually impacts your results)

The execution quality and the liquidity tend to be more important than saving a few basis points on maker/taker fees to most users interested in headline trading fees.

Why liquidity matters more than you think

Liquidity is what makes a difference between your trade being executed near the price you are seeing on the screen or not. On low-liquidity pairs, you can experience:

- Slippage: You are fulfilling your order at a disadvantageous price.

- Thin order books: Larger orders drive the market.

- Wider spreads: You are, in effect, paying more per trade.

The best crypto exchanges have high-liquidity venues that reduce slippage in:

- Market orders

- Large trades

- Dynamic environments in the market.

Maker/taker fees vs real trading cost

Even the low-cost crypto exchange services may turn out to be costly in practice when spreads are wide. Example:

- Exchange A: 0.10 tight spread + taker.

- Exchange B: widespread, taker fee 0.05% exchange.

Exchange A may still be cheaper overall in that your execution price is better.

Pro tip:

When you trade often, give priority to:

- Deep order books

- Tight spreads

- Stable performance during volatility.

Fiat on-ramps & off-ramps: the hidden friction

Fiat rails are considered to be not as important as many traders think they are. The most appropriate cryptocurrency exchanges allow transferring funds in and out without any huddles.

What to check before choosing a fiat-friendly exchange

- Local bank support (UPI/IMPS in India, ACH in the US, and SEPA in the EU).

- Speed of deposit: Instant or 1-3 business days.

- Withdrawal limits: Daily/monthly limits depending on KYC level.

- Third-party processors: Payments of higher cost, failed payments.

- Compliance stability: Rails may be frozen due to abrupt changes in banking partners.

Fiat on-ramps shift regularly even within secure crypto exchanges as a result of regulatory pressure. Always maintain:

- At least two fiat gateways

- One international exchange account and one region-friendly platform.

Custody models explained (custodial vs self-custody)

When considering crypto exchange platforms, it is necessary to understand the concept of custody.

Custodial exchanges (most centralized platforms).

- The private keys are in the exchange.

- Faster recovery in the event of loss.

- Subject to freeze of accounts or compliance measures.

Self-custody (wallet-first approach)

- You control private keys

- No recovery of accounts in case of loss of keys.

- Increased accountability of backups and security.

Best practice for retail users

- Trade on exchanges

- Keep long-term holdings in wallets of self-custody.

- Keep only active trading balances on exchanges

This will minimize the exposure to the custodial risks but enjoy the exchange liquidity.

Security best practices for Exchange users (practical checklist)

Most of the accounts are lost even when secure crypto exchanges are used, but most of them occur as a result of errors on the part of users.

Personal security checklist

- Turn on 2FA using hardware (YubiKey is recommended)

- Send email alias and individual password per exchange.

- Activate whitelisting of withdrawal addresses.

- Enable anti-phishing codes

- Storing API keys with withdrawal permissions should not occur.

- Distinct trading email and personal email.

- Add official exchange URLs (do not use Google Ads phishing)

Operational security for businesses & power users

- Apply read-only APIs to analytics.

- Whitelisting IPs for API trading.

- Introduce approval processes for large withdrawals.

- Keep access logs within the company.

- Regularly audit account permissions

Such measures will have a significant effect on mitigating real-world risk in the top crypto trading platforms.

Advanced trading tools explained (for serious traders)

Crypto exchange platforms are selected by many users for characteristics that they do not use. The following is what really counts for the advanced users:

Order types

- Limit: Control price (optimal in terms of fees and slippage)

- Market: Speed over price (use sparingly).

- Stop-limit/stop-market: Risk management.

- OCO: Sophisticated trade management.

Derivatives trading

- Futures and perpetuals give leverage.

- There is a greater risk: liquidation risk.

- Needs effective risk controls.

API trading

- Allows market-making, bots, and automation.

- The API permission should be stringent.

- Rate limits and uptime are a concern.

OTC desks

- For large block trades

- Reduces slippage

- Many are listed on large cryptocurrency exchanges such as Kraken and Binance.

Staking, Earn & yield products: risks vs rewards

A good number of crypto exchange platforms have introduced staking and earn programs. They are not risk-free but convenient.

Benefits

- Passive yield

- Easy access

- No wallet management

Risks

- Custodial risk

- Lock-up periods

- Treatment is regulated differently.

- Rates of yield fluctuate without prior awareness.

Safer approach

- Short-term yield: Use exchange staking.

- Transfarm long-term holdings to self-custody staking where feasible.

- Do not run after abnormally high APY without knowing about counterparty risk.

Regional availability matrix (who can use what in 2026)

Jurisdiction is critical in terms of access to the best crypto exchanges.

United States

- Strong compliance

- Fewer derivatives options

- Reliable fiat rails

- Higher retail fees

European Union & UK

- Good fiat access

- Good consumer laws.

- Certain platforms limit leverage.

India

- KYC/AML required

- Depending on the bank partner, the on-ramps of fiat vary.

- There are international transactions that limit the INR support.

- Regulatory transparency is currently improving.

Actionable advice:

When onboarding, always ensure that you check the country-specific terms page of the exchange. Availability may vary and change without much notice.

Performance during market stress (what breaks first)

Not every leading crypto trading site is the same in terms of high volatility.

Common failure points

- Login outages

- Order matching delays

- Frozen withdrawals

- App crashes

- API throttling

What to prioritize

- Trades of high infrastructure investment.

- Transparent status pages

- Postmortem after incidents in public.

That is where the secure crypto exchanges are more effective than the smaller places.

Real-world selection scenarios

If you are a beginner:

→ Coinbase or Gemini to fiat onboard + security.

If you want low fees + liquidity:

→ Binance/OKX (location allowed)

If you trade derivatives actively:

→ Bybit or OKX

If you want strong EU compliance:

→ Bitstamp or Coinbase

If you want early access to new coins:

→ KuCoin (higher risk)

If you run bots or automated strategies:

→ Kraken or Binance (stability of the API and liquidity)

Future trends shaping crypto exchanges (2026–2027 outlook)

Structural changes are predetermining the best crypto exchanges environment without price forecasts:

- Additional regulation: better compliance requirements.

- Proof of reserves: becoming customary.

- Expansion of institutional custody: regulated custodians working with exchanges.

- Increased transparency dashboards: real-time reporting of reserves.

- Tougher consumer laws: particularly in the EU and the UK.

- Expansion of UX: mobile-first trading.

- Separating brokerage and exchange services: better risk segmentation.

The trends incline towards safe crypto exchanges having good compliance and infrastructure.

FAQ

1. Are centralized exchanges still safe in 2026?

Yes, with controlled platforms with cold storage and audits, but self-custody will be more secure in long-term holding.

2. Which exchange has the lowest fees?

Fee leaders are volume-based. The quality of execution and the spreads are equally important to the maker/taker fees.

3. Can I use one exchange forever?

Not recommended. Hold at least two accounts with various cryptocurrency exchanges to limit the platform’s risks.

4. Is KYC mandatory?

Yes, on the majority of leading crypto trading platforms because of KYC/AML rules.

Fees & limits snapshot

| Exchange | Deposit fees | Withdrawal fees | Typical maker | Typical taker | Minimum deposit |

| Binance | Depends on a fiat partner | Network fee | ~0.10% | ~0.10% | Low |

| Coinbase | Card/bank varies | Network fee | Varies | Varies | Low |

| Kraken | Bank transfer varies | Network fee | ~0.16% | ~0.26% | Low |

| OKX | Partner varies | Network fee | Tiered | Tiered | Low |

| Bybit | Partner varies | Network fee | Low | Low | Low |

| Bitstamp | Bank fee | Network fee | Tiered | Tiered | Low |

| Crypto.com | Card/bank varies | Network fee | Tiered | Tiered | Low |

| Gemini | Bank fee | Network fee | Lower on ActiveTrader | Lower | Low |

| KuCoin | Partner varies | Network fee | Low | Low | Low |

Regulatory notes (US, EU, UK, India)

US: Coinbase, Kraken, and Gemini are registered in the US and comply with US regulations; derivatives are limited.

EU/UK: Bitstamp and Coinbase have good regulatory responsibilities; Binance services by jurisdiction.

India: Fiat ramps require banking partners and subsistence to KYC/AML; availability is subject to change.

Conclusion

The choice of the best suitable crypto exchanges is reduced to the alignment of your preferences, such as security, fees, access to fiat, liquidity, and functionality, with what is legally provided in your country. Novices must focus on compliance, fiat on-ramps, and straightforward user experience; more professional traders need to worry about liquidity, maker/taker charges, and access to derivatives. There is no ideal platform to trade on, and thus, a good number of users have accounts in two exchanges in order to diversify regulatory and liquidity risks. The ideal crypto exchange is one that fulfills your workflow requirements in terms of security, transparency, and usability.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.