The past few years have seen the rise of Proof of Stake(PoS) blockchains like Ethereum, Cardano, and Solana that turned crypto into a common passive income stream for many indian investors. However, with the introduction of the new tax act that taxes income from crypto, some investors might be wondering if staking income is taxable. To answer this quickly, yes, it is taxable under the new tax framework. Staking is subject to a dual-taxation structure where the tax varies depending on whether you are selling or receiving them.

1. Tax on Receipt of Rewards

Staking rewards are considered Income from Other Sources” by the government under the new tax law. Tokens received as reward in a PoS network are considered income and therefore subject to the 30% flat tax rate under the tax law. The taxable value of this reward is the Fair Market Value (FMV) of the tokens at the specific time they hit your wallet or account.

2. Tax on the Transfer (Sale) of Rewards

There are scenarios where you can trigger a second taxable event on your staking rewards. These scenarios include swapping, selling, and buying tokens with the staking rewards. All these events are also taxable (30% flat tax), and you will be taxed again on your income from these events.

Investors should take note that crypto losses are not offsetable under the new tax laws, so losses from these trades cannot be used to offset the taxes on the earlier gain. Expenses like gas fees, validator costs, etc are also not offsetable under the tax law.

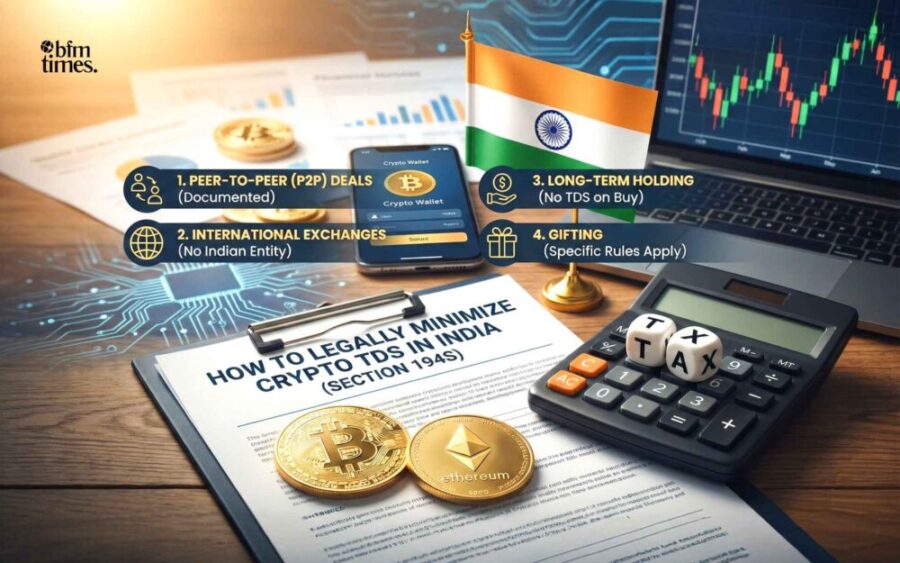

Staking is also subject to the 1% TDS (Tax Deducted at Source) tax under the new law, where every transaction above a certain threshold (₹10,000 or ₹50,000 in a financial year) is taxed by 1% on both ends. This is often handled by centralized exchanges if you are using local ones, but the responsibility is on you if you are using international exchanges or self-custody.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.