- In a tweet, Vitalik Buterin commented on how stablecoins are way too centralized and, therefore, make Ethereum more centralized.

- He further added that these centralized coins now dominate the entire DeFi volume, effectively centralizing the market.

- USDC, USDT, and other stablecoins now have the ability to freeze wallets based on suspicion.

- Vitalik prefers new algorithmic stablecoins backed by a cryptocurrency such as Bitcoin or Ethereum.

- Since 2022, following the Terra USD crash, algorithmic stablecoins have become less popular, with most moving towards an asset-backed model.

Vitalik Buterin Criticizes Centralization of DeFi Through Stablecoins

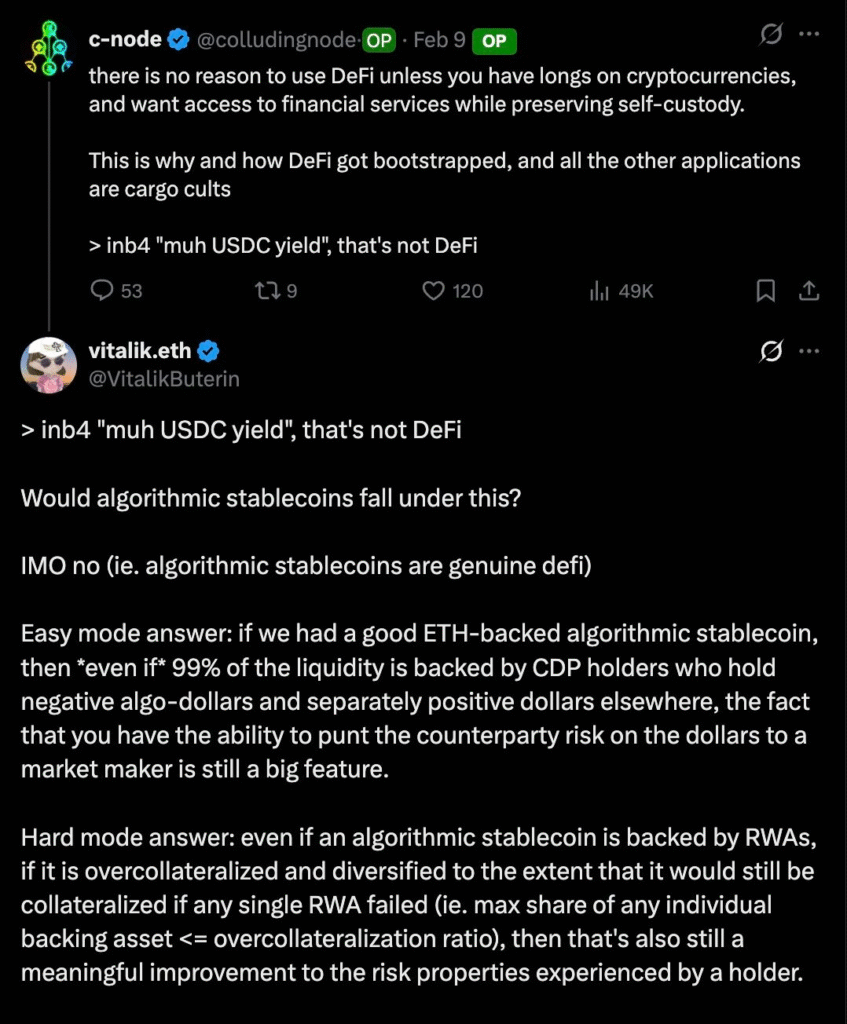

In a reply to a tweet, Vitalik Buterin criticized that Ethereum and its ecosystem were overly dependent on USDC and similar stablecoins, which are totally centralized. His tweets against centralized stablecoins have been quite consistent in the recent past.

He adds that these stablecoins now make upto 90% of the trading volume and liquidity pool of several DEXs and DeFi protocols, essentially making them indirectly centralized.

A few weeks ago, he made a similar tweet on using ETH as the main token in this wallet and paying others with USDC/USDT through real-time swaps. However, it might not be suitable for those like us who have to make a fixed monthly transfer for salaries or fixed expenses.

His other alternative was to use RAI, a lesser-known algorithmic stablecoin with approximately $40k trading volume. He also called for using more algorithmic stablecoins and a pivot away from the US Dollar as the main stablecoin peg.

Voices Support for Algorithmic Stablecoins

Vitalik Buterin, instead, voiced his support for algorithmic stablecoins backed by blue-chip cryptocurrencies like Ethereum.

Doing so, Vitalik claimed that there could be a DeFi world in which centralized entities do not maintain dominant control over the platform.

Although his bias toward ETH is understandable, it could also be a Bitcoin reserve backing the stablecoin.

Calls For Pivoting Away from the US Dollar

Vitalik also called for a pivot away from the US Dollar because it enables centralized control of the stablecoins. Most stablecoins today are USD-based and therefore either back their coins with the dollar or with US Treasuries. This gives authorities the power to dictate operational terms for these stablecoin issuers.

Related: Largest USD Stablecoin Tether Pivots Aways from US Dollar, Buys Record Gold

Why Algo Stablecoins Lost Market?

Algorithmic stablecoins had a major share of the market till early 2022. The dominance ended with the collapse of the Terra Luna ecosystem, which wiped out more than $40 billion worth of assets. The cause of the collapse was the algorithmic stablecoin Terra USD, which was linked to LUNA through an auto-burning mechanism. When Terra USD de-pegged, users went into panic and sold en masse. As a result, it de-pegged more and finally collapsed on May 9, 2022.

The shock of a collapse of one of the largest stablecoins sent users doubting algorithmic stablecoins. Traditional stablecoins were also affected, but they regained user trust with a 100% asset backing.

What are Algorithmic Stablecoins? How do they work?

Suggested Prior Reading: What are Stablecoins?

Algorithmic Stablecoins are cryptocurrencies that maintain a 1:1 peg to their base asset (such as the US Dollar) through complex supply-and-demand algorithms. These coins do not have a 100% asset backing like traditional stablecoins such as USDT or USDC; they have partial asset backing.

They work by either minting or burning tokens when the 1:1 peg becomes loose. If the peg is lower than, say, $1, some coins are burnt to reduce supply, and since the demand is unchanged, the price appreciates. Similarly, when the value of the stablecoin crosses $1, some additional coins are minted, and due to increased supply and unchanged demand, the price slides back to $1.

Almost all algorithmic stablecoins are partially asset-backed, such as DAI. These assets help maintain user trust.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.