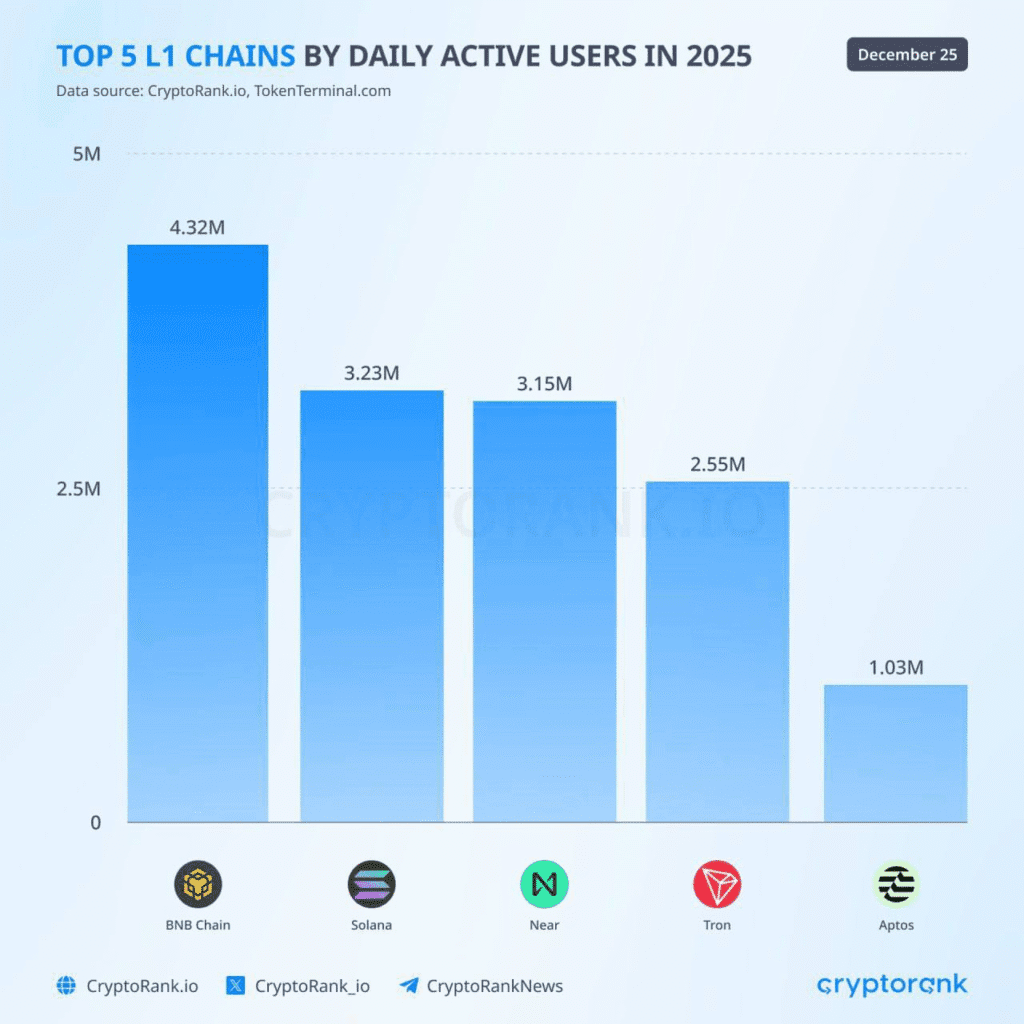

- BNB Chains is the most popular blockchain in 2025, with 4.32 million transactions.

- Solana was a close second winner with 3.23 million transactions, followed by Near (3.15 million).

- Binance’s backing, ultra-low fees, near-instant finality, and a wide range of supported cryptocurrencies help BNB outshine others.

BNB is the Most Visited Chain in 2025

Read More: BNB Explained: History, Working, Significance

Beating Solana (the 2024 winner), BNB was the most visited cryptocurrency in 2025, surpassing all chains. The number of transactions on the BNB chains reached 4.32 million, higher than Solana (3.23 million), Near (3.15 million), Tron (2.55 million), and Apros (1.03 million).

Ethereum did not make the top 5 chains list. However, it might become the most significant revenue earner as has been the case in 2024.

BNB and Solana were the usual winners over the last few years for their own internal reasons. Solana has become a cheap, efficient, and dApp-friendly chain. Similarly, BNB chains has become a ready-to-go chain for Binance users, the world’s largest cryptocurrency exchange. Other reasons contributing to BNB’s growth are listed in the subsequent sections.

The Near blockchain gained significant popularity in 2025, likely due to the AI craze and AI-related projects. The rally in traditional markets for AI projects led to a subsequent rally in AI tokens. Near, being an infra-provider for several AI projects, emerged as a clear winner in the race.

Tron’s presence at the 4th rank was also not unusual because it holds the second-largest on-chain stablecoin supply after Ethereum. Tron primarily holds USDT on its chain. At press time, there were around $80 billion in circulation, second only to Ethereum at $165 billion.

Aptos was an unusual inclusion in the list. Aptos saw its fortunes rise in 2025 due to a host of factors, including rising memecoins, a fast chain, a new upgrade that offered parallel transaction execution, and several others.

What Works for BNB?

BNB has several factors to its advantage. It has been uniquely placed in the market in a way that no other exchange token or exchange-related blockchain can achieve.

Ultra Low Fees

Since Binance backs BNB, it has little regard for earning a fee revenue. As a result, BNB can make fees ultra-low for its users.

Fast Chain

With just 21 validators, BNBchains has achieved almost instant finality. For a transaction done by us using the BNB Chain, we were able to use the received funds within a minute.

Widest Range of Supported Cryptocurrencies

Rather than bridging and relying on wrapped tokens, BNB uses pegged tokens to allow users to transport their tokens from other blockchains to BNB. A pegged token is priced at par with a native token. For example, if I buy 1 ETH on the Ethereum blockchain and transfer it to the BNB chain for a cheap cost of transactions, I can redeem the BNB-pegged ETH to Ethereum at the market price of ETH without any noticeable loss.

Limitations in BNB That Users Must Know

Highly Centralized

BNB is a highly centralized blockchain with just 21 validators, compared to 1 million in Ethereum and over 800 in Solana. The low number of validators also poses a risk of a 51% attack, as happened with the Ronin Bridge in 2022, when $625 million was lost to hackers.

Besides centralization, BNB also relies heavily on Binance for its user base. This reliance provides it an unnatural advantage over others.

Past and Present Legal Troubles

Binance has been in constant legal trouble across the world in the last few years. Just a year ago, it had to pay a whopping $4.3 billion in fines to several US Authorities, including the US Department of Justice.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.