- Quick Price Prediction Summary

- Current Market Overview

- What Is Dogecoin (DOGE)?

- Factors Affecting Dogecoin (DOGE) Price

- Dogecoin Price Prediction by Timeframe

- Short-Term Price Prediction (Next 3-6 Months)

- Medium-Term Price Prediction (2026-2027)

- Long-Term Price Prediction (2030 & Beyond)

- Technical Analysis Overview

- Bullish vs Bearish Scenarios

- Is Dogecoin (DOGE) a Good Investment?

- FAQs

- Can Dogecoin reach $1?

- Is Dogecoin safe?

- Where can I buy Dogecoin?

- What affects the price the most?

- Is Dogecoin better than Shiba Inu?

- Final Thoughts

Key Insights

- The launch of the 21Shares Dogecoin ETF (TDOG) on the NASDAQ has officially moved the coin from being a meme into a regulated asset class.

- There are ongoing efforts to integrate DOGE as a native currency on X (formerly Twitter).

- Dogecoin adds 5 billion new tokens annually. While this encourages people to use it as a currency, it still needs new demand to reach the $1 mark.

Dogecoin has grown from being a simple internet joke into being a top-10 cryptocurrency.

So far, the memecoin is now moving beyond social media hype to build a real payment system, and here is an objective look at some of the forces that might affect its future.

Related: Polkadot (DOT) Price Prediction (2026-2030)

Quick Price Prediction Summary

| Period | Estimated Price Range | Market Outlook |

| Current Price (Jan 2026) | $0.12 – $0.15 | Neutral / Volatile |

| Short-Term (3-6 Months) | $0.10 – $0.22 | Trend Consolidation |

| Mid-Term (2026-2027) | $0.28 – $0.65 | Adoption Growth |

| Long-Term (2030+) | $0.80 – $2.10 | Mature Payment Asset |

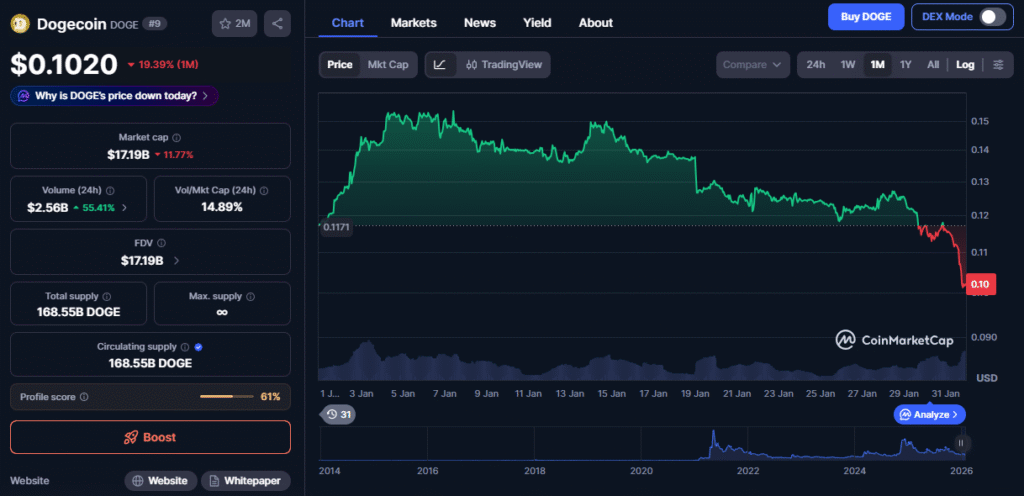

Current Market Overview

As of writing, Dogecoin is showing relative stability after a sudden start-of-year surge.

The token is currently trading at approximately $0.13 and has a total market cap of roughly $21.4 billion. It has a circulating supply of approximately 148 billion DOGE and is the most dominant meme-based asset in the world.

Dogecoin is bullish-neutral over the long term | source: CoinMarketCap

The asset recently got a major boost from the launch of the 21Shares Dogecoin ETF (TDOG) on the NASDAQ. This was a milestone for Dogecoin because this was the first time a meme asset received this kind of recognition.

However, the market has cooled off, and investors now seem to be balancing the excitement of regulated funds against the lack of immediate new price boosts.

The highly anticipated DOGE-1 Lunar Mission has also recently faced new scheduling delays and is expected to launch later this year. This has forced some retail traders to wait on the sidelines while institutional accumulation begins.

What Is Dogecoin (DOGE)?

Dogecoin is a peer-to-peer, open-source cryptocurrency created in 2013 by Billy Markus and Jackson Palmer. It started as a parody of Bitcoin but quickly generated a massive following.

Unlike Bitcoin, which acts like “digital gold,” Dogecoin works mostly as a digital currency for everyday use, and some of its use cases include micro payments, because its low fees and fast block times make it perfect for tipping creators.

Other use cases include mainstream commerce, especially with the launch of the “House of Doge” rewards card, which allows users to spend DOGE at millions of merchants worldwide.

Dogecoin has become so popular because it is a friendly entry point for new investors. It also has a focus on being “the people’s currency,” and has even created a niche of its own.

Factors Affecting Dogecoin (DOGE) Price

Dogecoin’s performance between now and 2030 depends on how well it grows into a mature financial tool.

For this to happen, however, institutional adoption needs to grow, and the success of the TDOG ETF already provides a price floor.

Other major drivers of price include Elon Musk and the social media integration on X. Musk’s plan to include DOGE in X payment systems has been a major source of internet speculation, and if X officially adopts the token for creator rewards or advertising, the utility could skyrocket.

This would also provide a stream of buying pressure that the asset currently lacks.

Finally, investors watch supply mechanics when it comes to predicting the meemcoin’s price. Dogecoin is inflationary, and approximately 5 billion new tokens enter the supply every year.

This prevents people from hoarding the coin like they do with Bitcoin. However, it means that the network needs to attract new users to stay afloat.

Dogecoin Price Prediction by Timeframe

Short-Term Price Prediction (Next 3-6 Months)

Technical sentiment is currently neutral after the excitement of the ETF launch. Analysts expect a consolidation range between $0.10 and $0.22.

While speculators wait for this to happen, a move above the $0.165 resistance level could indicate a new bullish trend. On the other hand, falling below $0.11 could see the price test psychological support at $0.09.

In all, traders are currently looking for signs of a post-ETF “accumulation phase” before the next big move.

Medium-Term Price Prediction (2026-2027)

Before the end of the year, the launch of the DOGE-1 mission and the rollout of native debit cards should provide a boost. If the general crypto market enters an expansion phase after the next halving cycles, DOGE could realistically trade between $0.28 and $0.65.

This period will likely focus on “Real-World Utility” as more merchants around the world start to accept the token directly.

Long-Term Price Prediction (2030 & Beyond)

By 2030, Dogecoin could even have been promoted to being a “legacy” altcoin.

If it secures its place as the main tipping layer for the internet, prices in the $0.80 to $2.10 range are possible. However, reaching the $1.00 mark would require a market cap of roughly $165 billion.

This is a high target, but it might be feasible if crypto adoption receives more global hype than it already has.

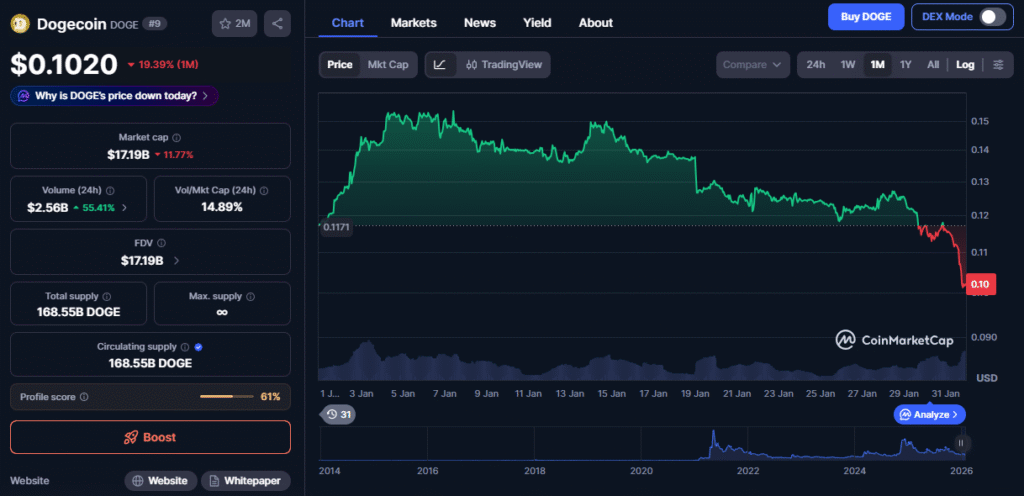

Technical Analysis Overview

Dogecoin’s long-term trend is currently bullish-neutral, mostly because it has established a higher floor throughout 2025.

Currently, the price is now testing the 200-day Moving Average (MA) near $0.125, and this line often acts as a pivot point for major trend changes.

Investors should note that immediate support now sits at $0.11, while $0.1 serves as a strong price floor.

Dogecoin is hovering above a major price floor according to the charts | source: TradingView

Overall, the asset has immediate resistance set around $0.153, and the bulls could be challenged if they attempt to break the $0.22 price level.

On the indicators side, the RSI is currently around 48, which means that the market is neither overbought nor oversold. There is an ongoing “squeeze” in the Bollinger Bands on the weekly chart, which indicates that a major move is coming.

Bullish vs Bearish Scenarios

Bullish Case

On the bullish side, X could officially integrate DOGE as the main currency for creators and tipping.

The TDOG ETF could also see massive institutional interest, which will force large-scale buying of the token. Before the end of the year as well, the DOGE-1 mission is expected to succeed and create a wave of “fear of missing out” (FOMO) among retail buyers.

Bearish Case

On the other hand, new laws could emerge and label meme coins as “high-risk.” This would make it harder for exchanges to list them.

Moreover, the annual 5 billion new tokens could outpace the demand from new users, while the community moves on to newer AI-themed or social tokens.

Finally, public interest in Elon Musk’s endorsements could fail completely and remove a main catalyst for any price jumps.

Is Dogecoin (DOGE) a Good Investment?

Dogecoin continues to be a highly volatile asset. This means that it is most suitable for traders who can handle 50% price swings in a single afternoon.

Long-term “believers” currently see it as the future of digital social currency. However, it is not a traditional “safe” asset for retirement portfolios, for example.

Finally, investors should note that it is inflationary, which means that it must be used as a currency to maintain its value over time.

FAQs

Can Dogecoin reach $1?

Yes, it is possible by 2030. However, to reach $1, Dogecoin would need a market cap of roughly $160 billion. Considering the historical growth of the crypto market, this target is achievable during a major bull cycle.

Is Dogecoin safe?

Dogecoin is a secure network because it is based on the Litecoin codebase. However, if it is to be used as an investment, analysts generally consider it “unsafe” due to its extreme price volatility.

Where can I buy Dogecoin?

You can buy DOGE on any major exchange like MEXC, Binance, Coinbase, and Kraken. Lately, it is even available through stock brokerages via the TDOG ETF on the NASDAQ.

What affects the price the most?

Some of Dogecoin’s biggest drivers are social media sentiment and mentions by influential figures. The memecoin also tends to benefit from the general “risk-on” appetite in the general markets.

Is Dogecoin better than Shiba Inu?

This is a matter of choice. Dogecoin has its own blockchain and a fixed annual inflation rate. Shiba Inu, on the other hand, is an Ethereum-based token with a different ecosystem of apps.

Final Thoughts

One major takeaway from all of this is that Dogecoin’s journey toward 2030 is about finding legitimacy.

While it will always be a memecoin, its survival as a top asset proves that it has staying power. The next five years will determine if the so-called “Do Only Good Everyday” token can turn into a globally recognised form of money.

In the end, investors should always research tokens independently before making any financial decisions.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.