- Solana price is down nearly 35% since January and is now trading just above a key support area near $94.

- Rising exchange outflows show some investors are quietly accumulating Solana.

- SOL needs to reclaim $104 and $120 to confirm any meaningful recovery.

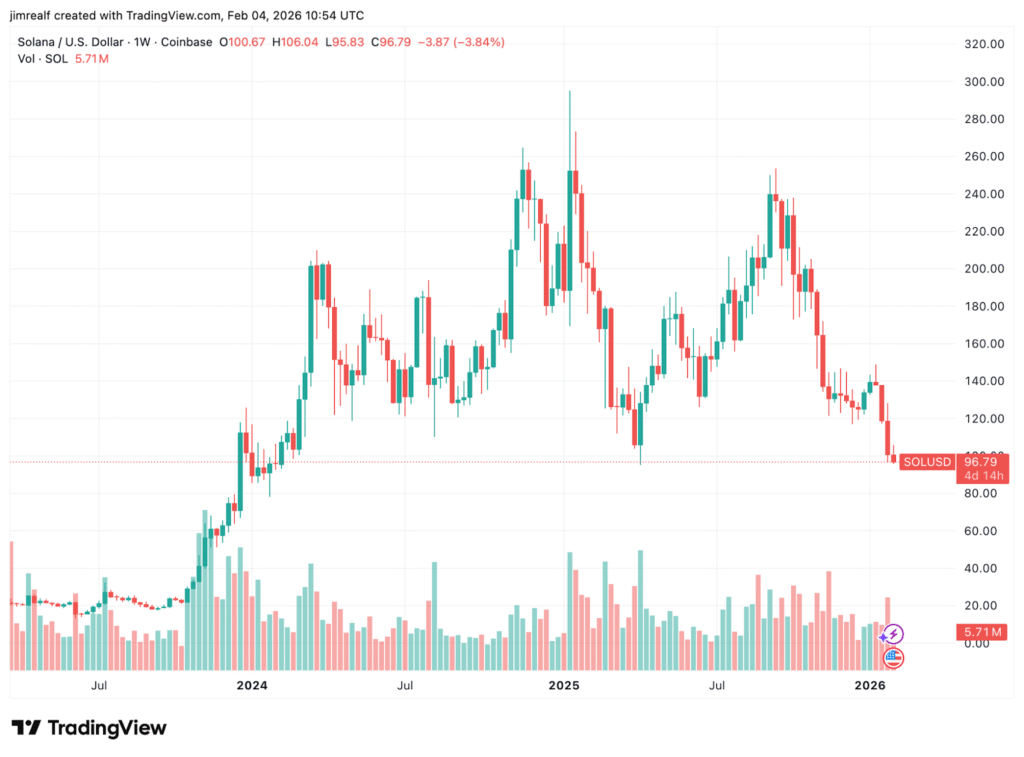

If you have been tracking Solana’s price for a while, it is worth noting that SOL has corrected by over 30% since mid‑January 2026, when it was trading near $ 147. The current price stands under $100, a level SOL hasn’t visited for quite some time now.

Also Read: Solana (SOL) Price Prediction (2026-2030)

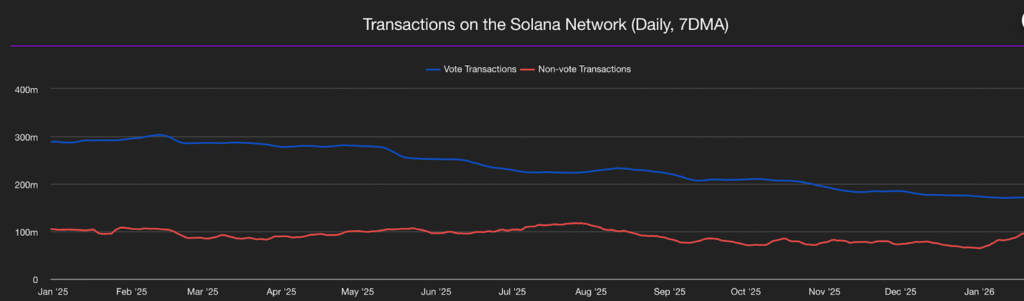

While price action looks heavy, Solana’s underlying network has rarely been more active. On‑chain data shows that active Solana addresses doubled to over 5 million in the first 30 days of 2026, while daily transactions jumped from around 52 million to roughly 87 million, pushing daily fee revenue above 1.1 million dollars. At the same time, Solana recently set a new record by processing about 148 million non‑vote transactions in a single day, with nearly 1 billion transactions settled over the past week alone.

It would be interesting to see if the price keeps dipping or if there are signs showing that a possible rebound might be waiting for the optimistic traders.

Solana Price Fell More Than 35% Since January

The weakness in Solana did not start in February. It began much earlier, around mid‑January, when the price was still trading in the mid‑140s. From that point, selling pressure slowly increased, even when the broader market looked stable.

On the chart, a warning sign had already appeared. Between October and mid-January, the price made higher highs, but the RSI kept rising faster. This created a hidden bearish divergence. In simple terms, momentum was weakening even as the price looked strong.

After that, the broader crypto market turned shaky. Liquidations, weak sentiment, and falling risk appetite made things worse. Solana started falling faster than many other large tokens.

By 4 February 2026, Solana price had dropped below $100 and touched levels near $96–98, marking a decline of almost 35% from its January highs. Over the last week, losses have run into double digits, making Solana one of the weakest large‑cap assets in that period.

This long decline shows that the fall was not sudden. It was building up over time, and the market slowly priced in lower expectations.

Buying Pressure is Rising Even as Price Stays Weak

Even though Solana price has been falling, not all signals are negative. Some on-chain data shows that buyers have started stepping in quietly. A recent post from CoinMarketCap highlights that Solana processed a record wave of transactions and user activity, underscoring how the network is still attracting heavy demand despite the drawdown.

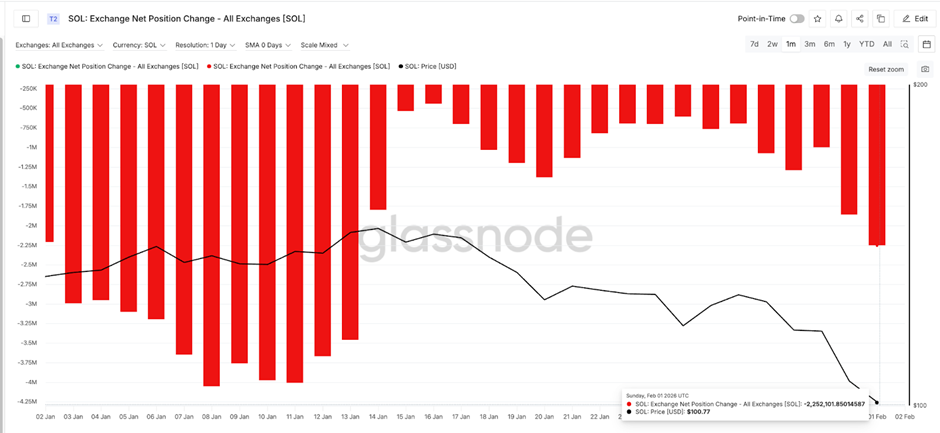

Taken together with record highs in active addresses and daily transactions, these exchange and NUPL readings suggest that speculative leverage is being flushed out while underlying network usage remains strong.

One key metric is exchange net position change. On Jan. 15, net outflows stood near 535,000 SOL. This already suggests some accumulation. When the price dropped close to $100 on Feb. 1, outflows jumped to more than 2.25 million SOL.

SOL Buyers are Back | Source: Glassnode

Outflows mean coins are leaving exchanges, often for long-term holding. This suggests that some investors are using the dip to buy and move tokens into private wallets.

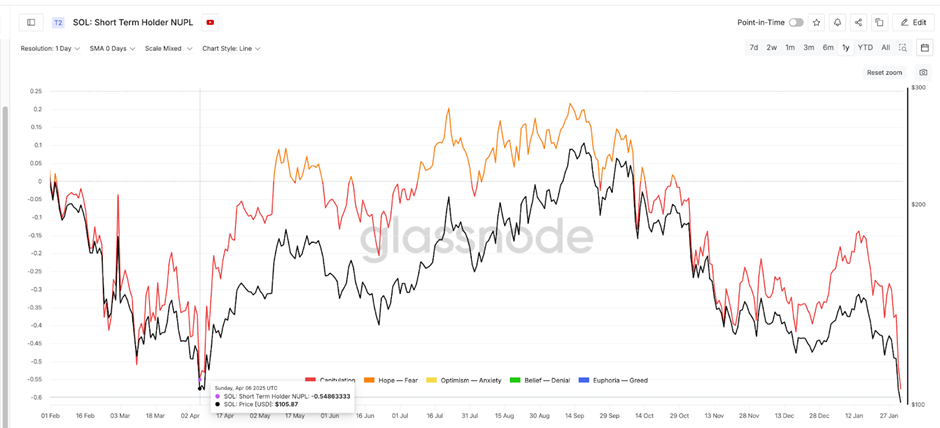

Another important signal comes from short-term holder NUPL. This metric measures whether recent buyers are in profit or loss. Back in April 2025, Solana price was trading near $105.

SOL Bottom in Sight | Source: Glassnode

Back in April, Solana price was trading near $105 when this level appeared. After that, the SOL price started recovering. Seeing the same zone again suggests that many short-term holders are under pressure, which often happens near local bottoms.

The RSI is also near oversold territory. This does not guarantee a rebound, but it shows that selling has been heavy and may be losing strength. Together, these signals show that while price looks weak, some investors are quietly preparing for a possible bounce.

Key SOL Price Levels to Track

From here, Solana’s direction depends on a few clear price levels. The most important support is near $94. This area must hold. If the price closes below it, the next likely zone sits near $79. That would mean another drop of around 18% from current levels.

Such a fall could happen quickly if market sentiment turns negative again. Weak liquidity and fear can speed up declines in this zone.

On the upside, the first Solana price level to watch is $104. A daily close above this level would show that buyers are gaining some control. After that, $120 becomes the next test. This zone acted as support before and could now act as resistance. Clearing it would improve short-term confidence.

For a full trend change, Solana would need to reclaim $148. That was the January high and the start of the long decline. Without crossing this level, the broader structure remains weak. Right now, Solana sits in a difficult position. It is deeply corrected; some buyers are returning, but the trend is still pointing to the downside.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.