We have curated the most harsh realities in the crypto markets. Amid a massive sell-off, you will find most of them to be evergreen truths, like trading with patience, and some of them newly discovered truths, like Bitcoin’s cycle.

- 1. By the Time Retailers Buy, Whales are Ready to Exit

- 2. There is no “Smart Money” in Markets, only Big Money

- 3. “I am Here For Technology” Means “I am Stuck.”

- 4. Crypto Markets are a Zero-Sum Game

- 5. Volatility Loots the Impatient and Rewards the Patient

- 6. Long-term Investment Means Till I Recover My Money

- 7. Bitcoin Doesn’t Move in Cycles Anymore

- 8. Trading Without Data is Pure Gambling

- 9. Markets can remain Irrational Longer than you can remain Solvent

- 10. Loudest People Disappear The Moment Bullish Trends Break

Find out the most relatable ones for you as we keep adding new ones.

1. By the Time Retailers Buy, Whales are Ready to Exit

Retailers only get into markets when the trend is almost over. Most retailers either wait for the trend to build up to a certain extent or wait till the market reaches a FOMO stage.

When the market reaches FOMO, most smart investors, like whales and funds, prepare to exit. They have already ridden the full wave and now can exit with a fat profit. Even those who are not ready to exit take short positions by buying put options or selling call options.

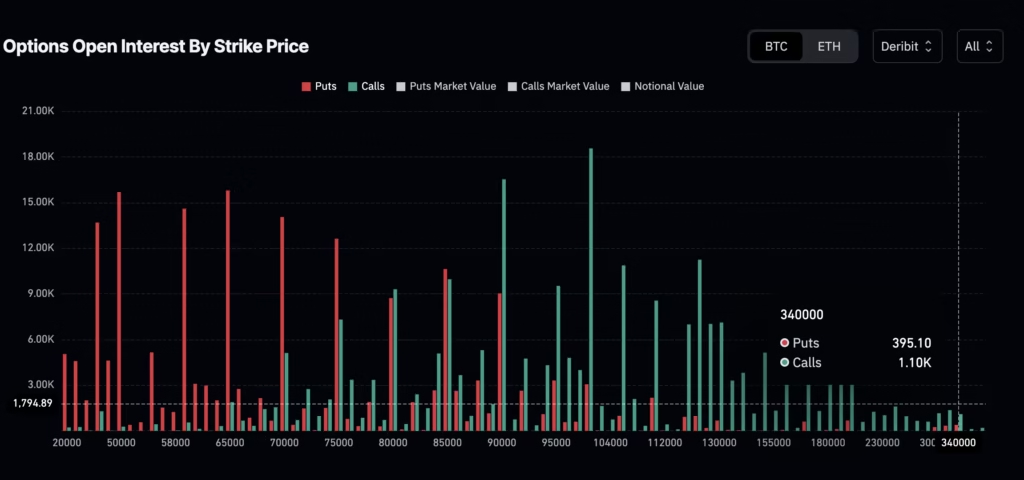

You can see an example in the image below. Here, most of the call options are positions taken by corporations to profit from a sideways market using theta decay or from a falling market with delta changes.

Notice the buildup of call options around $100k. Unless Bitcoin reaches $100k soon, these whales will profit from the premium decay (theta).

2. There is no “Smart Money” in Markets, only Big Money

Over 10 years of trading experience, I have seen people profit from very simple trades. The only difference between them and an ordinary trader is that the profitable ones are more consistent and trade with a very high leverage, either through leveraged trades or via borrowed sums.

The size of these trades is enough to nudge the markets in their direction, and hence they tend to profit easily.

Just a few days earlier, on Jan 20, BlackRock sold $57 million worth of Bitcoin when markets were already weak. The sale negatively impacted markets, triggering more sell-offs.

3. “I am Here For Technology” Means “I am Stuck.”

Most people who say they are there for the technology do not even use Bitcoin to any great extent. Sometimes this is a clever way of saying that I have suffered serious losses and am stuck here until my exit price comes, or I give up hope of recovery.

However, a few serious investors believe in the technology, but most do not complain about the fall.

4. Crypto Markets are a Zero-Sum Game

Unlike traditional businesses, trading as a profession is a zero-sum game, which means that you make a profit when someone makes a loss. There is no perpetual growth for everyone. We all incur losses from time to time.

The novice investors of each cycle become the exit liquidity for the pros from the previous cycle, and this repeats forever.

5. Volatility Loots the Impatient and Rewards the Patient

Market volatility is a confusing situation where novice traders are lost, moderately experienced traders scramble to trade, and experienced traders stay calm.

The top experienced ones

6. Long-term Investment Means Till I Recover My Money

Most long-term investors in retail markets are either people who bought at ultra-low prices and forgot, or those who got stuck in bull traps. The second set of users is those who are stuck and desperately waiting for a break-even.

7. Bitcoin Doesn’t Move in Cycles Anymore

Bitcoin’s price used to move in cycles from its launch in 2009 to 2024, when ETFs were launched. After 2024, when corporate money flowed into crypto markets, the cycle broke.

From 2024 onwards, ETFs, Treasuries, and other institutions like Goldman Sachs have broken Bitcoin out of the market cycle, and therefore, the same impact has been felt in the crypto markets.

8. Trading Without Data is Pure Gambling

Conviction, fear of missing out, fear of loss-making, and other similar emotions are the worst enemies for your trading. These make you judge situations with ungrounded emotions, which traders later regret.

An easy way to avoid these is to trade with charts, indicators, and pre-planned strategies. Unless you know how to make them, there is a very high risk of loss in trading.

9. Markets can remain Irrational Longer than you can remain Solvent

Crypto markets can often remain irrationally bullish or bearish for a long time. A similar situation is the crypto market crash in Jan and Feb 2026. Real reasons for the unexpected trend will only become clear in retrospect, after everything has ended.

Till then, it is best to trade with the market, especially avoid bottom fishing.

10. Loudest People Disappear The Moment Bullish Trends Break

It’s often the most ignorant and the least knowledgeable who trade with the largest noise. As soon as market trends break, these people turn into the most vocal critics of crypto and doubt everything from the earth to the sky.

Disclaimer: BFM Times acts as a source of information for knowledge purposes and does not claim to be a financial advisor. Kindly consult your financial advisor before investing.